Policymakers and advocates often hail solar energy as the future of electricity generation. Yet behind the glowing headlines and government incentives lies an overlooked economic risk — one that threatens both grid stability and long-term affordability.

If one were to assess solar power’s true cost, a simple thought experiment proves instructive. Imagine a U.S. region rich in both natural gas and sunlight, where a hypothetical grid relies entirely on newly built generation. Based on 2024 gas prices and capital costs, at a baseline, a 100% gas-fired system would break even at approximately $50 to $55/MWh.

However, as solar capacity is added, the system’s breakeven cost of generation rises by $3.25 to $3.50/MWh for every 10 percentage points of demand captured by solar. At 50% solar penetration, system generation costs would rise to $65 to $73/MWh. This is before considering the costs of additional large-scale battery storage, system balancing and monitoring, and transmission assets inevitably needed to make solar work well enough to achieve and maintain such a market share.

Yet the situation on today’s real-world grids is even more precarious. In many cases, new solar farms are being added to systems otherwise dominated by legacy gas-fired power plants. These assets were built under the assumption they would have a fair opportunity to generate returns over their lifespan. Instead, heavily subsidized solar generation — boosted further by both national and state regulatory favoritism — is driving wholesale electricity prices down while pushing older, gas-fired plants to the financial brink.

For many power producers, this shift has created a brutal economic reality — legacy gas-fired plants being forced into an uneconomical position, unable to justify reinvestment or sustain profitability. This dynamic keeps power prices artificially low in the short term but lays the groundwork for rising costs over time — as dispatchable gas-fired units retire and grids become dangerously reliant on intermittent solar.

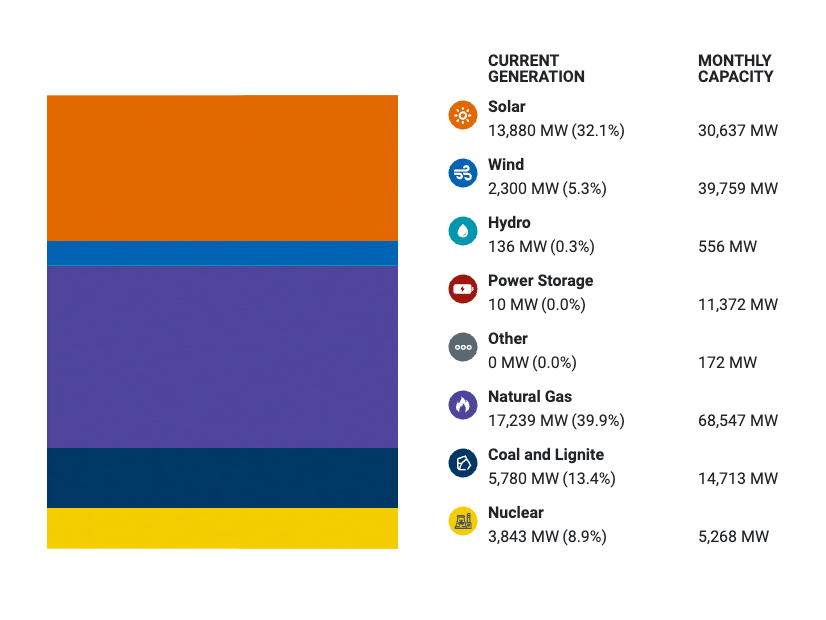

No grid exemplifies this trend more starkly than ERCOT, which supplies power to millions of people across the state. Rapidly growing solar penetration has eroded developer confidence in the profitability of gas-fired projects on the system — as evidenced by the lukewarm enthusiasm for the $5 billion Texas Energy Fund designed to incentivize new gas-fired capacity. (See 2 More Projects Fall out of TEF Loan Program.) Developers continue to refuse its offers, no doubt concerned over the lack of regulatory and economic safeguards against the eroding effects of subsidized renewables.

Texas is at an inflection point. The systematic erosion of its time-tested dispatchable gas-fired generation threatens grid reliability, while the economic uncertainty deters investors from stepping in to stabilize the system.

If history is any indication, officials may attempt to downplay the consequences of solar’s effects on the system or blame external factors like rising demand. But in reality, Texas — and states following similar paths — are setting themselves up for long-term risks in both pricing and power security. The risk of higher residential rates and more frequent blackouts cannot be ignored.

Subsidized solar may look economically attractive today, but its distortive impacts on energy markets tell a different story. Without course correction, states like Texas risk facing an electricity crisis not in spite of solar’s success — but because of it.

Doug Sheridan is president of EnergyPoint Research in Houston.

See Stakeholder Soapbox guidelines to learn how to make a submission for publication.