Nuclear

Arizona Public Service, Salt River Project and Tucson Electric Power announced they are jointly exploring the possibility of adding nuclear generation.

A North American trade war was delayed for a month at least as Canada and Mexico struck deals with President Trump that delayed potential tariffs for a month.

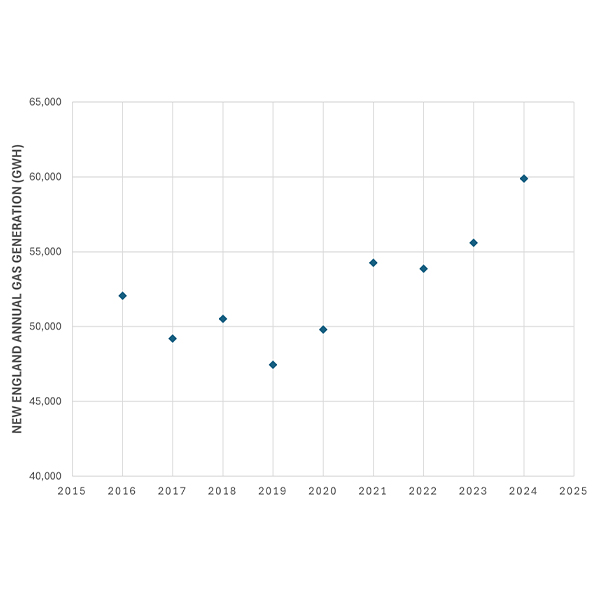

As overall power production ticked up in New England in 2024, natural gas generation reached its highest annual total in the region’s history, accounting for over 55% of all generation and 51% of net energy for load, according to new data from ISO-NE.

Participants at the United States Energy Association’s 2025 State of the Energy Industry Forum discussed topics such as demand growth, nuclear fusion and energy efficiency.

The Energy Association's 21st Annual State of the Energy Industry Forum reflected the quickly shifting landscape of national energy policy and the resulting shift in industry priorities and narratives.

NextEra Energy is collaborating with GE Vernova on development of natural gas-fired power generation and is taking further steps toward restarting an idled nuclear plant.

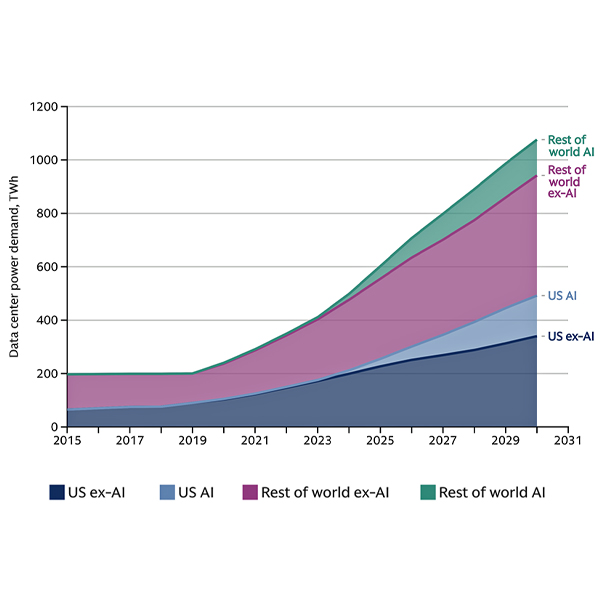

President Donald Trump presented the World Economic Forum with his desire to power the U.S. AI revolution: behind-the-meter generation co-located with data centers and built rapidly under his National Energy Emergency executive order.

Spurred by the recent wave of interest in new nuclear generation, Santee Cooper is seeking a buyer to take over an expansion project halted in 2017 amid extensive cost overruns and delays.

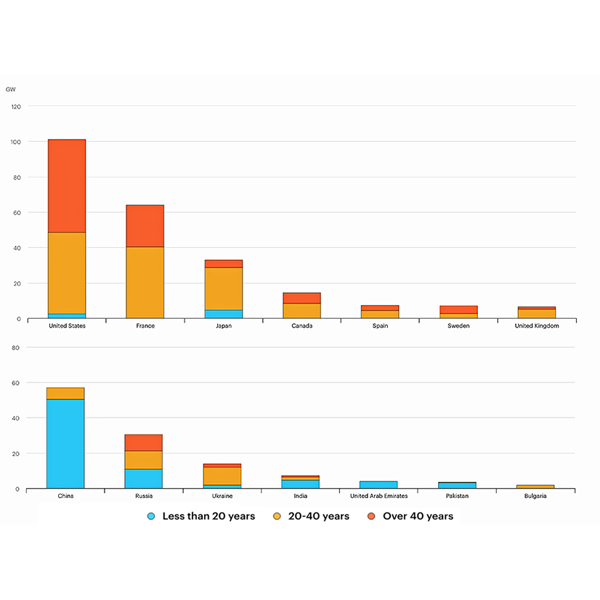

The International Energy Agency concludes in a new global review that high cost, long delays and other challenges must be addressed before nuclear power can experience sustained growth.

Chris Wright, President-elect Donald Trump’s nominee to head the Department of Energy, positioned himself as a supporter of an all-of-the-above approach to developing generation and transmission before the Senate Energy and Natural Resources Committee.

Want more? Advanced Search