NEPOOL Participants Committee

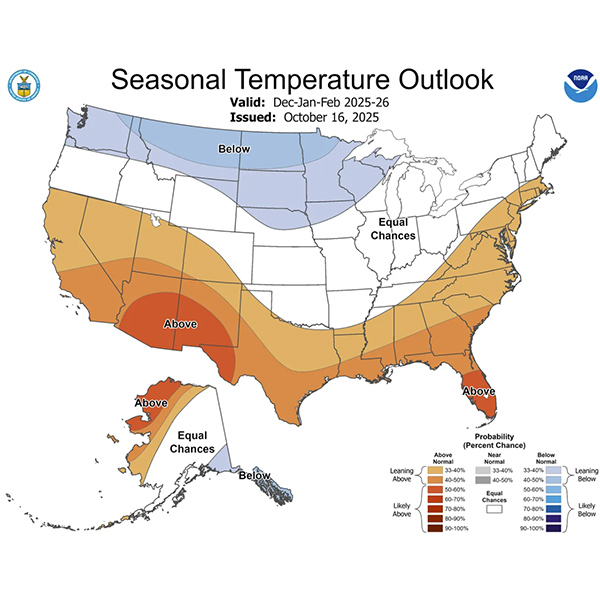

The winter of 2025/26 was the most expensive winter in the history of ISO-NE’s wholesale markets, driven by the lowest average temperatures in 20 years.

New England experienced record high energy costs in the month of January amid cold weather, high gas prices and a heavy reliance on oil-fired generation.

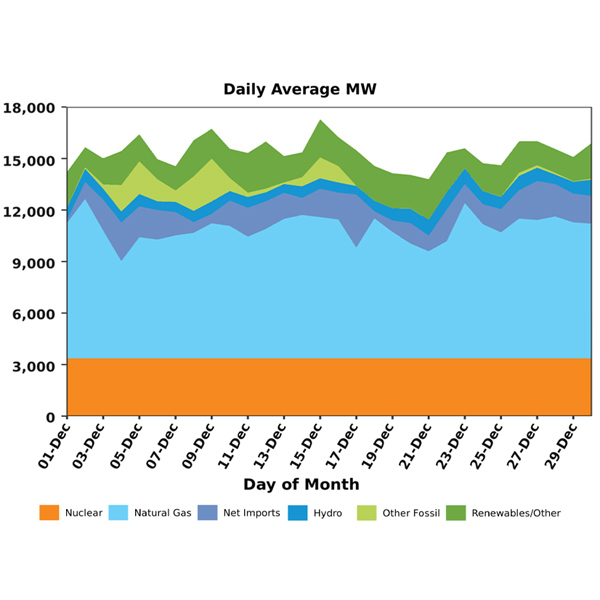

Consistently cold weather drove record-high December energy market costs for ISO-NE and caused the region to rely heavily on stored oil and LNG injections.

The NEPOOL Participants Committee voted nearly unanimously to support the first phase of ISO-NE’s capacity auction reform project.

ISO-NE’s probabilistic modeling indicates there is minimal risk of shortfall in the upcoming winter, COO Vamsi Chadalavada told the NEPOOL Participants Committee.

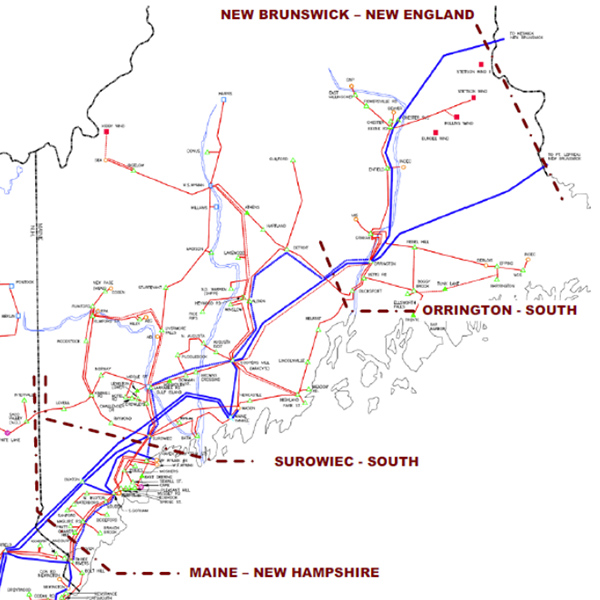

ISO-NE received six proposals from four different companies in response to its request for proposals to address transmission constraints and interconnect onshore wind in Maine.

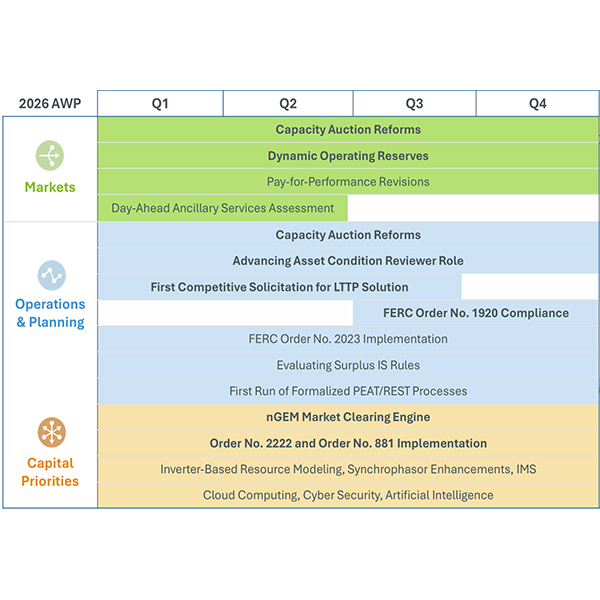

Capacity auction reforms, a new asset condition reviewer role, parallel transmission planning efforts, new reserve products, Pay-for-Performance changes and interconnection modifications are likely to be on the docket for ISO-NE in 2026.

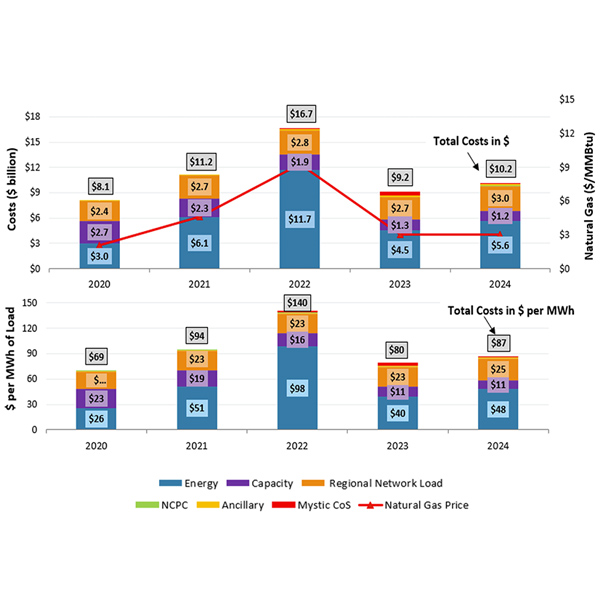

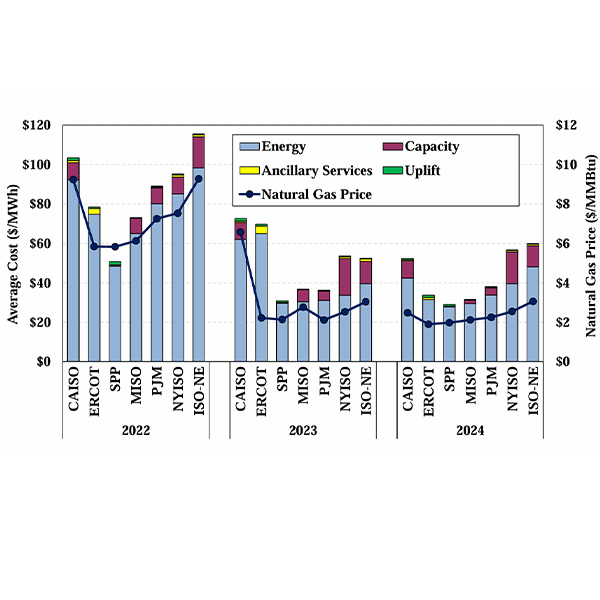

The New England wholesale electricity markets performed competitively in 2024, while decreased imports and higher emissions compliance rates increased overall market costs, the ISO-NE Internal Market Monitor told the NEPOOL Participants Committee.

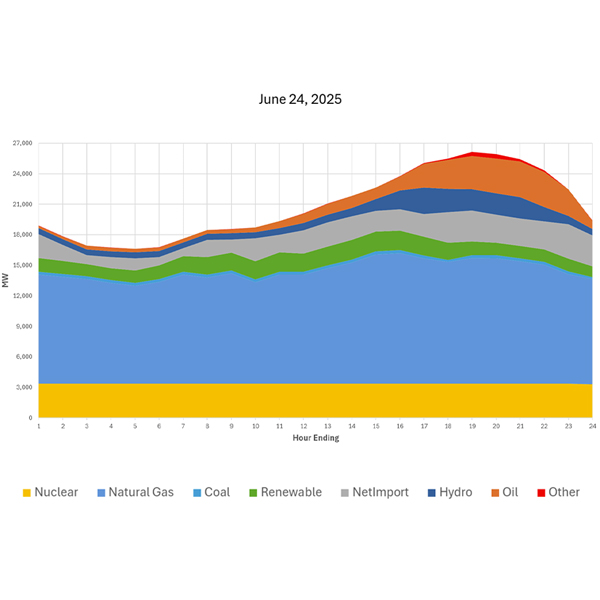

Pay-for-Performance credits accumulated during capacity scarcity conditions June 24 totaled about $114 million, ISO-NE's COO told the NEPOOL Participants Committee.

ISO-NE and stakeholders discussed market performance, capacity auction reforms, the RTO’s 2026 budget and asset condition spending at the summer meeting of the NEPOOL Participants Committee.

Want more? Advanced Search