Energy Market

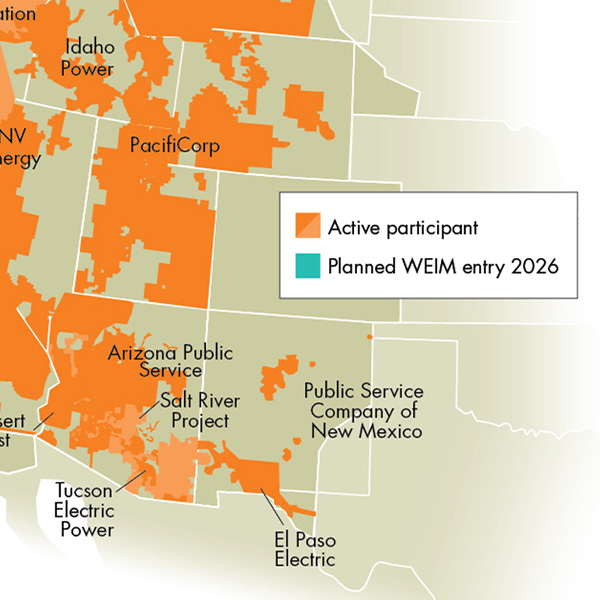

CAISO notched another victory in the competition to bring organized markets to the West when the Los Angeles Department of Water and Power’s oversight board authorized the utility to prepare to join EDAM.

PJM spent $53.5 million on conservative, out-of-market dispatch procedures to maintain reliability during the January 2024 Winter Storm Gerri.

The PJM Market Implementation Committee endorsed manual revisions codifying the real-time temporary exceptions process for generators to report any issues that may prevent them from operating to their unit-specific parameters.

MISO’s Market Subcommittee likely will discuss either a multiday gas purchase requirement or a multiday gas unit commitment process for use during extreme cold.

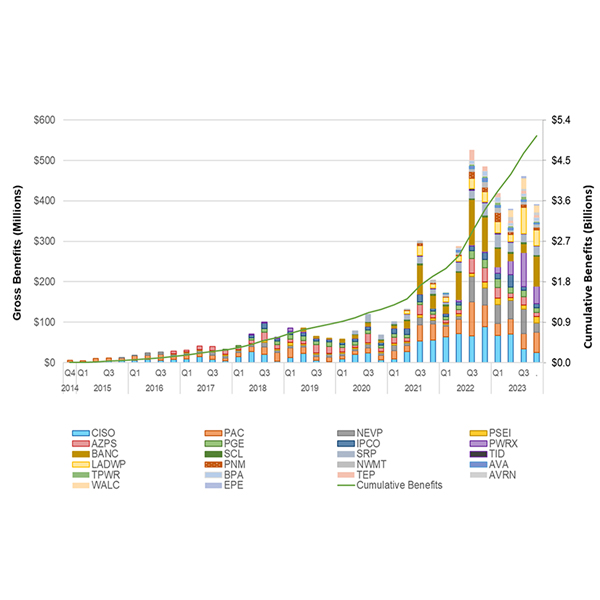

CAISO’s WEIM last year hit $5.05 billion in benefits for its members since its inception in 2014, continuing the positive trend of growth tied to an expanding Western footprint.

A joint package brought forward by PJM, Dominion Energy and Gabel Associates would add intraday real-time commitment runs to the day-ahead market ahead of the three gas nomination cycle deadlines

The Bonneville Power Administration plans to issue a draft decision on its day-ahead market participation in August, followed by a final decision in November.

NYISO CEO Rich Dewey highlighted efficiency improvements and the challenges of the continued electrification at the Jan. 31 MC meeting.

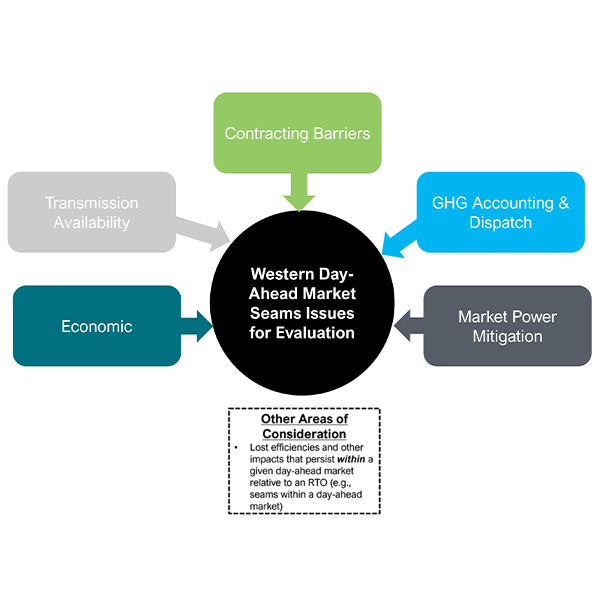

Despite the recent release of results from a study on the two competing day-ahead markets in the West, two New Mexico utilities said they need to conduct more analysis before they make a choice.

The study finds dividing CAISO’s EDAM from SPP’s Markets+ would create seams that pose a different set of problems than challenges seen at the boundaries of full RTOs in other parts of the U.S.

Want more? Advanced Search