Nevada

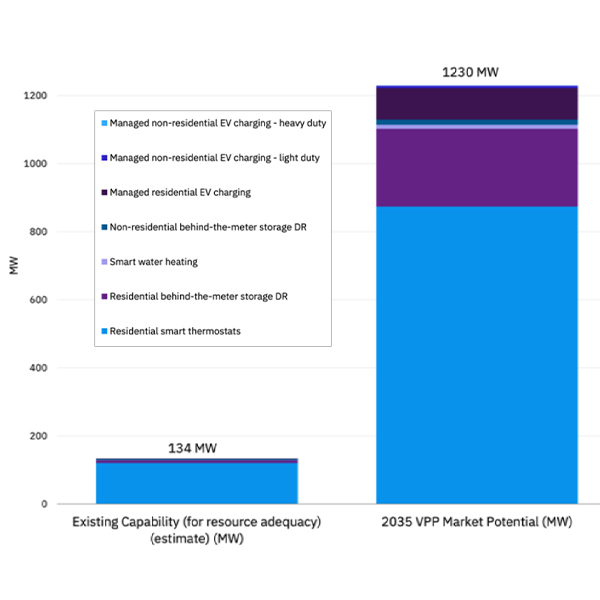

NV Energy's virtual power plant market potential could grow from an estimated 134 MW this year to 1,230 MW in 2035, according to a new analysis.

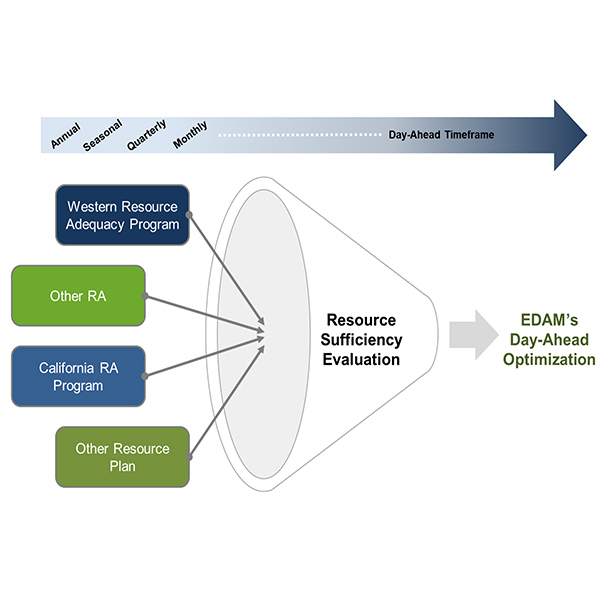

As NV Energy moves forward with plans to join CAISO’s Extended Day-Ahead Market, Nevada regulators have laid out a framework for how the company can seek approval for EDAM participation.

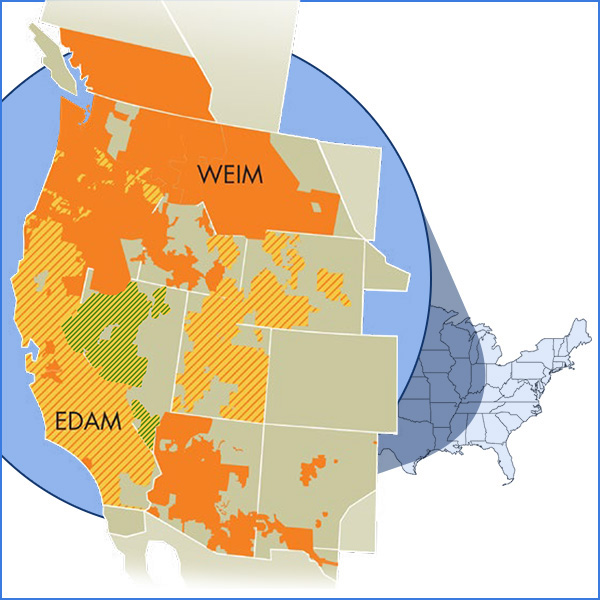

The growing footprint of CAISO’s Extended Day-Ahead Market was a critical factor in NV Energy’s decision to join it rather than the competing Markets+ offering from SPP, the utility said in a regulatory filing.

NV Energy plans to make its intention to join the CAISO EDAM public on May 31 when it files an integrated resource plan with the Public Utilities Commission of Nevada.

Two competing day-ahead markets from CAISO and SPP are taking different approaches to resource sufficiency and adequacy, according to presenters at a workshop included in a regulatory effort to help inform NV Energy’s decision on which market to join.

A key factor in the CAISO EDAM advantage is the benefits the utility would lose by leaving the Western Energy Imbalance Market, a Brattle Group consultant said.

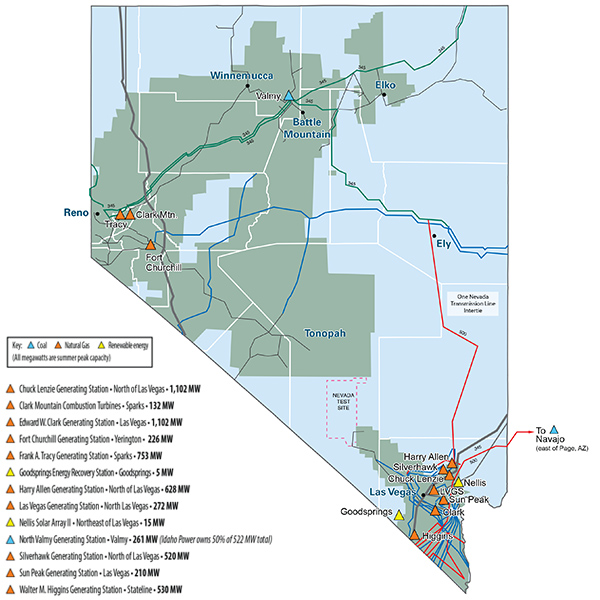

Nevada regulators approved NV Energy’s plan to convert its last coal-fired power plant to natural gas, while also allowing the company to move forward with a $1.5 billion, 400-MW solar-plus-storage project.

NV Energy is aiming to bring a proposal to Nevada regulators by the end of the year for joining a day-ahead market, but what process regulators will use to evaluate that request is still very much up in the air.

NV Energy and several stakeholder groups have weighed in on how Nevada regulators should evaluate a request from the utility to join a day-ahead market or RTO.

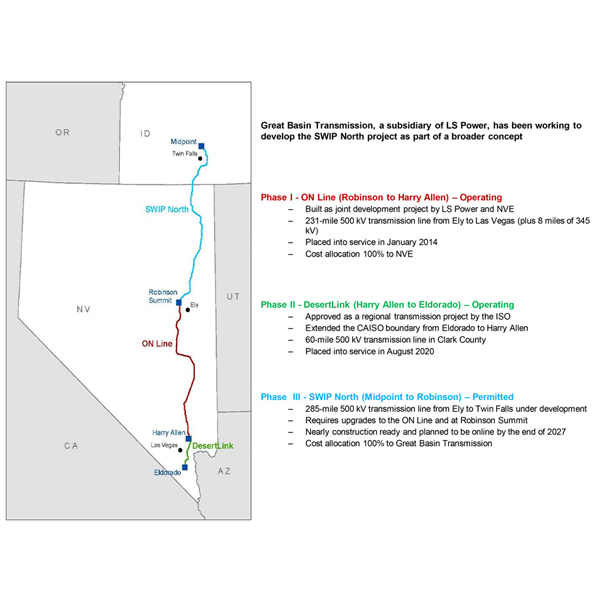

CAISO’s Board of Governors approved the inclusion of the Southwest Intertie Project-North in to the ISO’s 2022-2023 transmission portfolio.

Want more? Advanced Search