Financial Transmission Rights (FTR)

PJM Board of Managers Chairman Ake Almgren recognized interim CEO Susan Riley for her efforts to lead the RTO during a “challenging” season.

MISO is moving ahead with a proposal to bring solar generation into market dispatch, reusing many rules that brought dispatchable wind generation.

PJM staff and stakeholders kicked off the Markets and Reliability Committee meeting with an homage to Denise Foster on her last day with the organization.

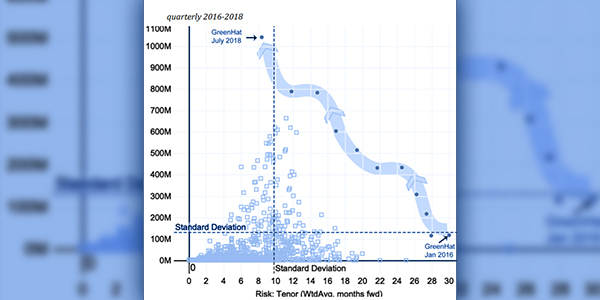

Shell Energy asked the D.C. Circuit to review two FERC rulings in the GreenHat default case it denied the company a role in settlement negotiations.

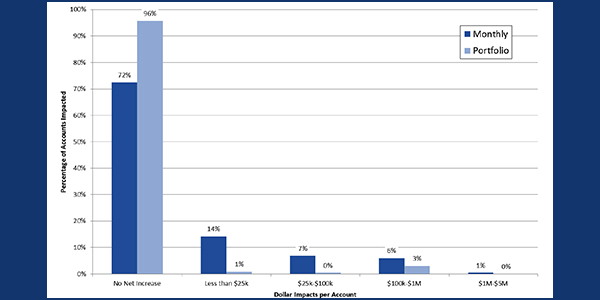

PJM’s concerns over FTR underfunding on projects with incremental auction revenue rights won’t be addressed through any Operating Agreement revisions.

FERC denied a rehearing request of PJM’s mark-to-auction provision, which gives PJM leverage to secure collateral for declining portfolios in its FTR market.

PJM’s conference to discuss its $12.5 million settlement with two FTR firms produced neither protest nor complaint from any of the many stakeholders.

PJM will pay two trading firms $12.5 million to end a dispute over the 890 million MWh GreenHat Energy default under a settlement agreement filed with FERC.

After a one-month delay, the PJM Market Implementation Committee endorsed two packages to update the RTO’s opportunity cost calculator.

PJM told their MIC that they anticipate submitting to FERC a settlement with its members on Oct. 9 over GreenHat Energy’s massive default.

Want more? Advanced Search