Financial Transmission Rights (FTR)

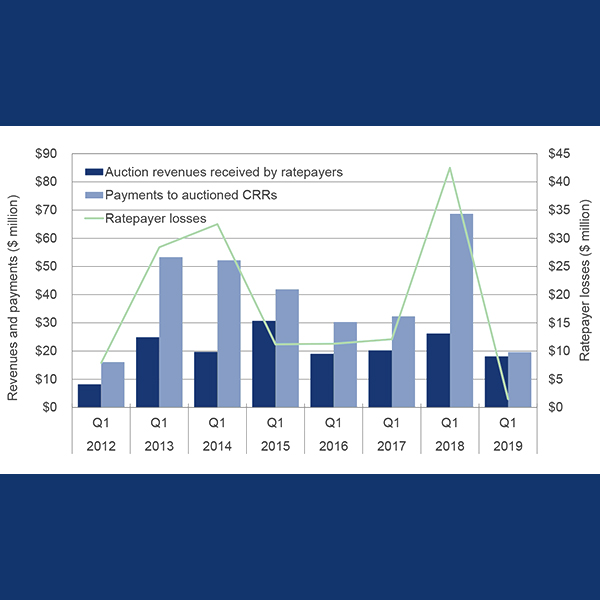

A spike in natural gas prices drove up the cost of wholesale electricity in CAISO in Q1 2019, but changes to CRR Auctions appears to be working .

A summary of the issues scheduled to be brought to a vote at the PJM Markets and Reliability and Members committees on June 27, 2019.

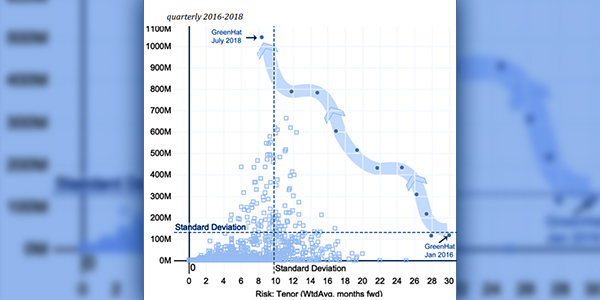

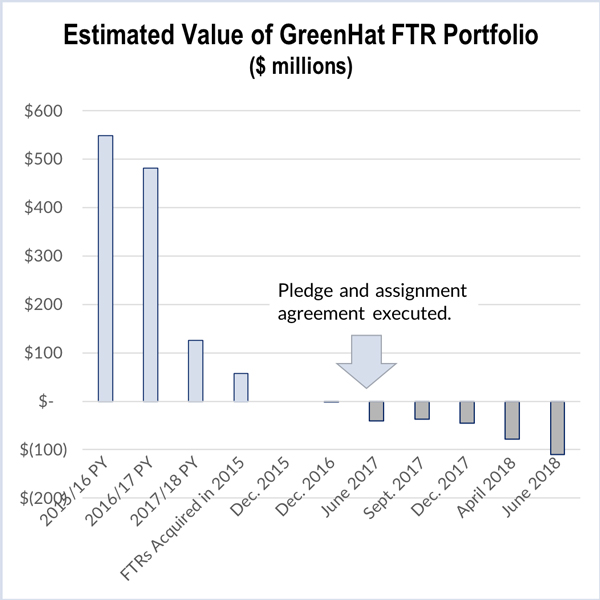

A battle over the future of the financial transmission rights market looms for PJM as stakeholders dig into the causes behind the GreenHat Energy default.

PJM stakeholders were reminded that the clock will soon start ticking on the 90-day settlement period for working out how to unwind the GreenHat default.

MISO proposed a set of changes to buttress its FTR market and said it will convene a new task team to work out the details of the fledging proposal.

FERC gave PJM stakeholders just 90 days to settle all disputes about how to best liquidate FTRs left over from the GreenHat default.

The PJM MRC heard a first read of manual changes and approved several others at what may have been its shortest meeting ever.

Most of PJM’s recent market rule changes went too quickly for advocate groups, though their desire for deceleration stops at financial transmission rights.

PJM stakeholders gathered for a special Members Committee meeting in Cambridge, Md., as part of the RTO’s Annual Meeting.

PJM will assemble a task force dedicated to studying the impacts of carbon pricing throughout the RTO’s footprint under a problem statement and issue charge approved by the MRC.

Want more? Advanced Search