Financial Transmission Rights (FTR)

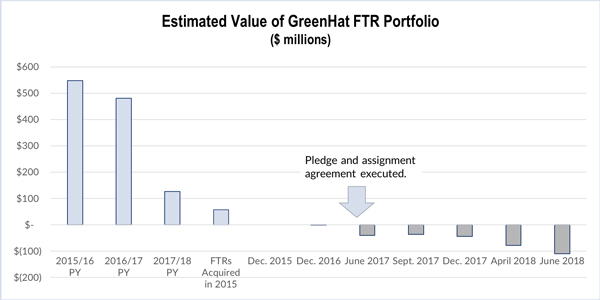

FERC approved some of the flexibility PJM has sought to address after the historic GreenHat Energy financial transmission rights portfolio default.

Public Citizen is urging the Commodity Futures Trading Commission to start overseeing PJM’s embattled financial transmission rights market.

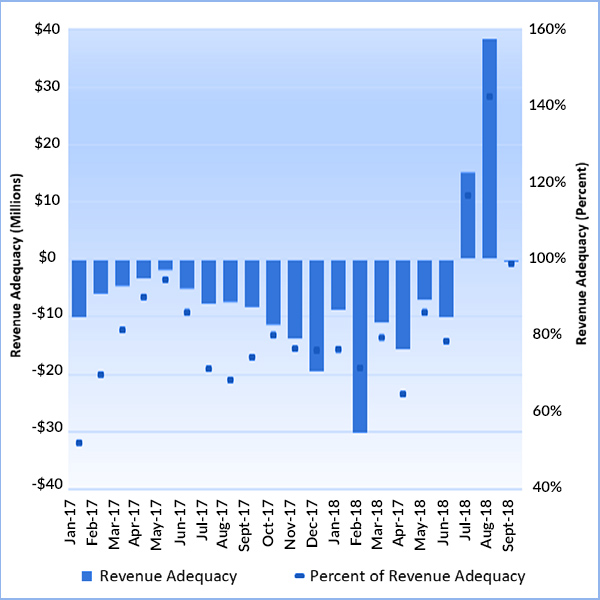

FERC has accepted CAISO’s revised proposal to protect electricity ratepayers from funding shortfalls in the ISO’s congestion revenue rights market.

The PJM Monitor remains unconvinced that performance metrics during localized load sheds should be used to calculate capacity market default offer caps.

PJM told the Market Implementation Committee that the Board of Managers’ investigation of the GreenHat Energy FTR default will run through the new year.

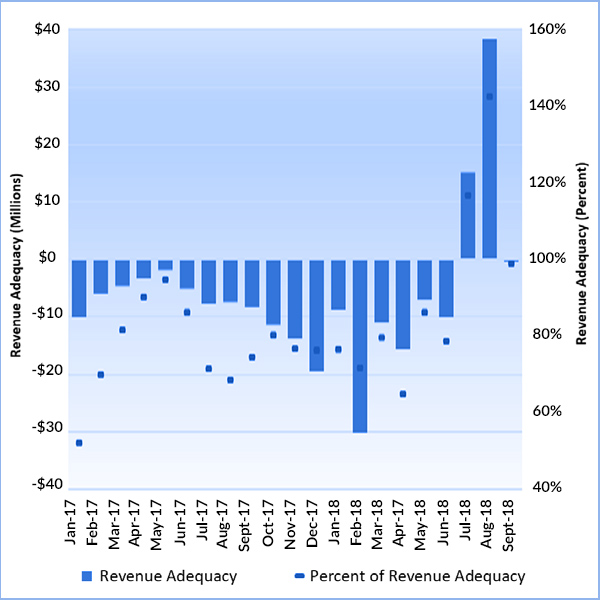

CAISO’s congestion revenue rights market showed unusual surpluses this summer because of higher congestion rents on Path 26.

PJM's Board said it will conduct an "independent review" into GreenHat Energy’s massive default in the RTO’s financial transmission rights market.

A proposal to revise PJM’s credit requirements for financial transmission rights in response to the historic GreenHat Energy default will be delayed.

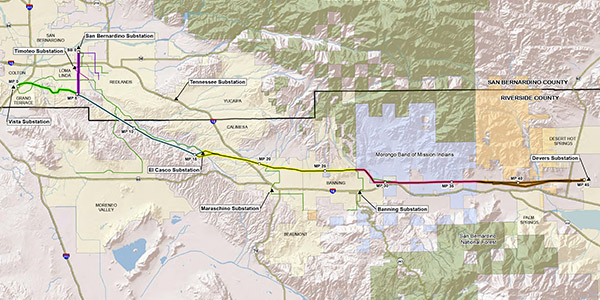

FERC approved a settlement that will grant a NextEra Energy subsidiary congestion revenue rights that CAISO denied the company in 2015.

CAISO is asking FERC for expedited review of a revised proposal to protect electricity ratepayers from funding shortfalls in its CRR market.

Want more? Advanced Search