congestion revenue rights (CRRs)

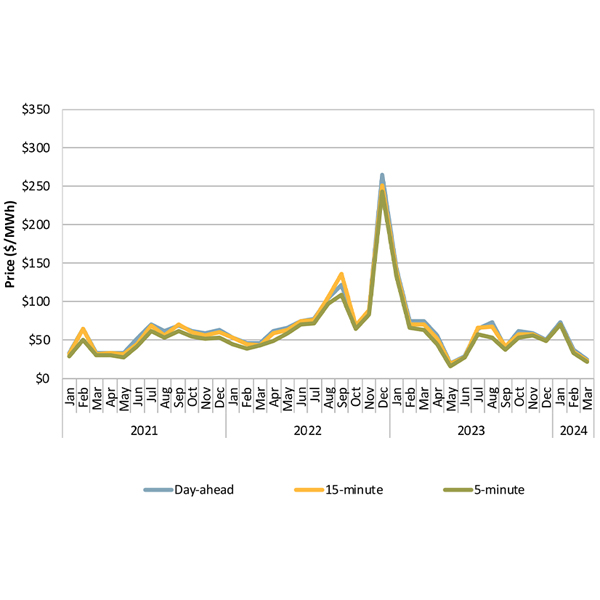

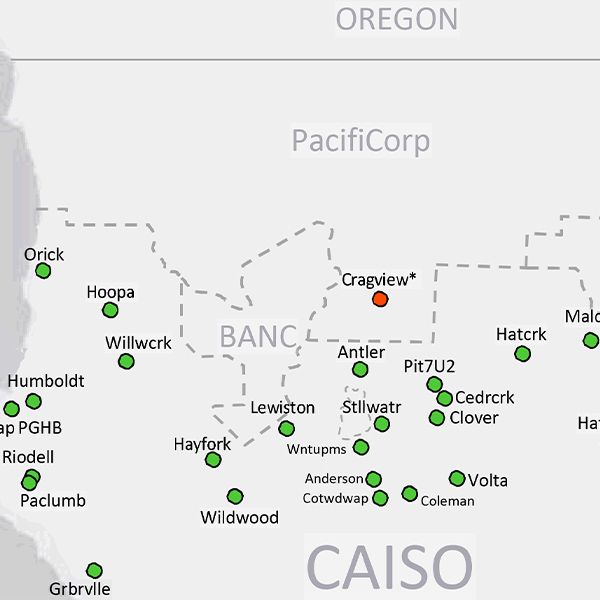

First-quarter electricity prices in CAISO markets were down sharply from the same period in 2023, despite sharp spikes during the January cold snap in the Pacific Northwest, the ISO’s Department of Market Monitoring said.

The white paper by The Brattle Group offers a point-by-point comparison of CAISO’s Extended Day-Ahead Market and SPP’s Markets+ that leans in favor of EDAM but stops short of endorsing either market.

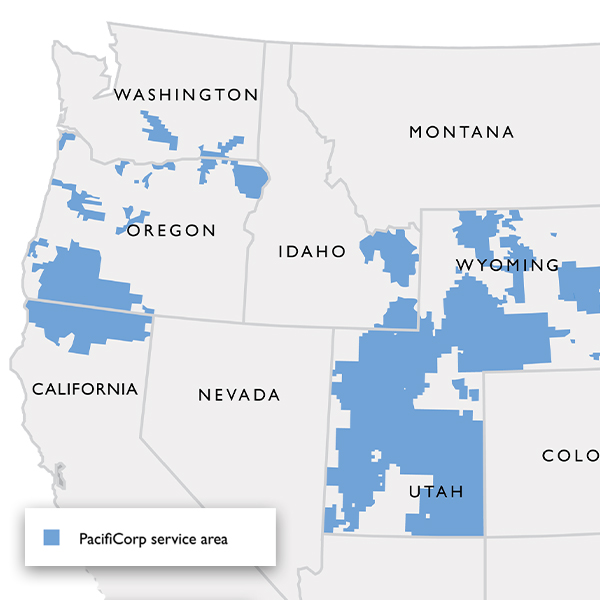

CAISO focused on CRRs when it served up the latest volley in the ongoing dispute over what played out on the Western grid during the January cold snap that forced Northwest utilities to import high volumes of energy to avoid blackouts.

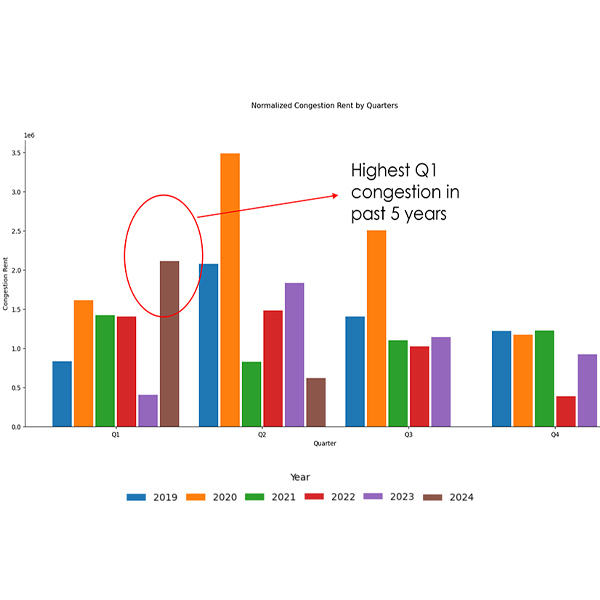

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

FERC approved $2.3 million in penalties against Vitol and one of its traders for manipulating CAISO's market in 2013 to limit losses stemming from the firm's congestion revenue rights position.

FERC proposed allowing RTOs to share credit information about market participants, fulfilling a request the grid operators made at a 2021 technical conference.

ERCOT stakeholders are waiting on final direction from Texas officials as they tackle issues arising out of February’s disastrous winter storm.

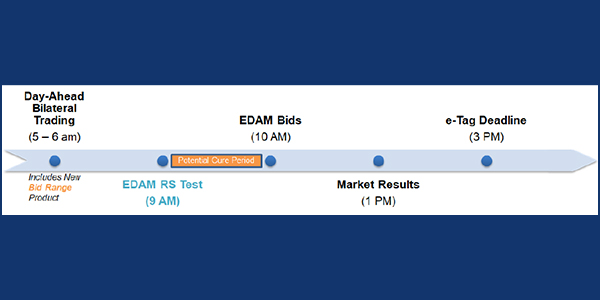

CAISO issued a proposal outlining the leading edge of its plan to bring day-ahead trading to the Western Energy Imbalance Market.

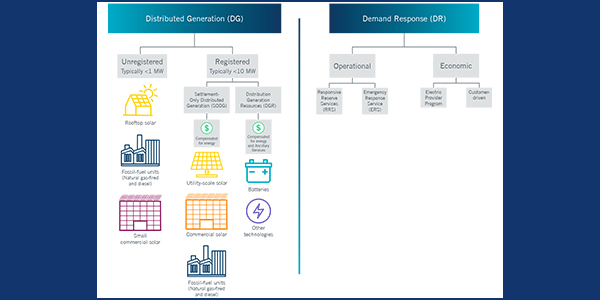

The ERCOT Technical Advisory Committee unanimously approved a change to how emergency response service resources return following recall.

The ERCOT Technical Advisory Committee approved the Corpus Christi North Shore transmission project to address more than 1 GW of industrial load growth.

Want more? Advanced Search