Consolidated Edison (Con Ed)

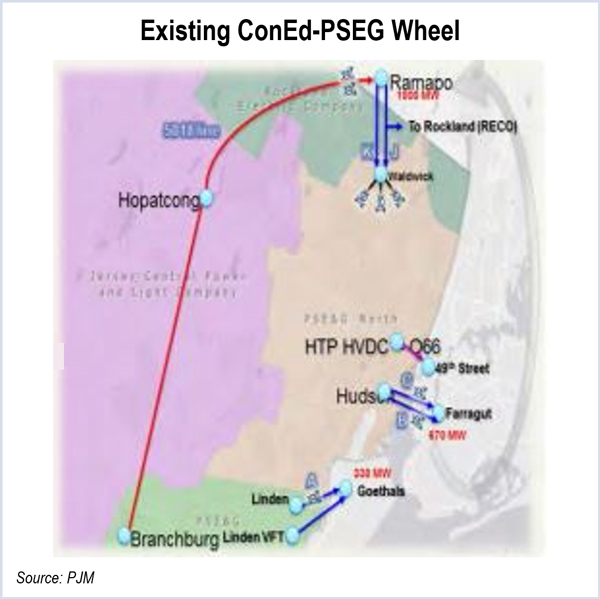

PJM will hold a meeting Monday to seek stakeholder input on options for replacing the Con Ed-PSEG “wheel.” NYISO meeting in September.

Exelon is buying the Consolidated Edison (Con Ed) retail energy business as it continues its efforts to hedge against falling wholesale power prices.

PJM is using a three-pronged approach to prepare for next year’s termination of the Con Ed-PSEG wheel.

Stakeholders ask FERC to revisit its ruling approving solution-based DFAX cost allocation for the Artificial Island and Bergen-Linden Corridor projects.

Con Ed will stop using the “PSEG wheel” next April, following through on a promise it made late last year in a dispute with PJM.

We are proud to announce the initiation of the RTO Insider Top 30, the first in what will be a quarterly review of the top publicly traded companies.

FERC approved the controversial cost allocation of two PJM projects: a stability fix for Artificial Island and the Bergen-Linden Corridor upgrade.

The FERC proposal to apply a new offer cap construct uniformly across the markets is a good and fair solution, ConEdison argues.

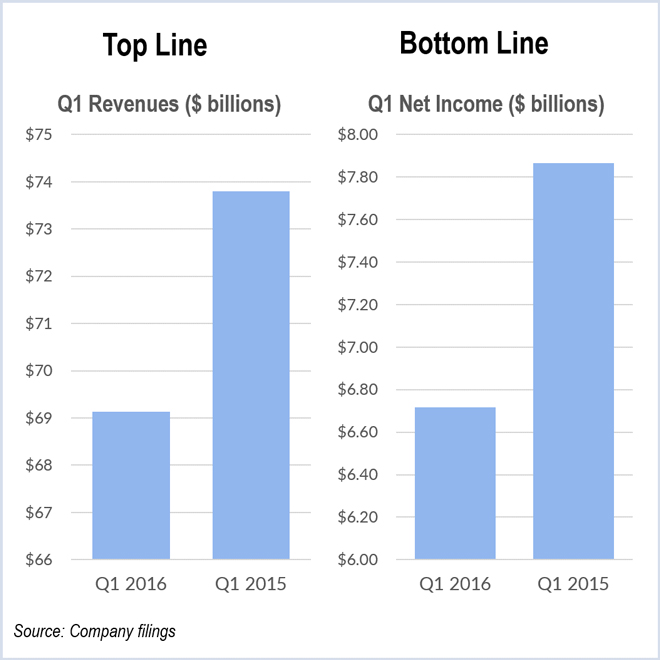

Con Ed reported 2015 net income of $1.19 billion compared with $1.09 billion in 2014.

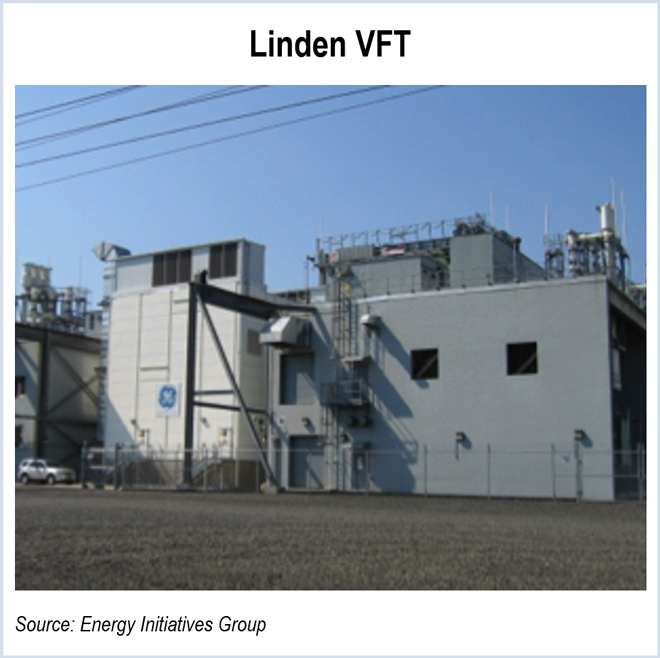

A transmission developer asked PJM to determine if four projects in the PSE&G territory are still necessary if Con Edison makes good on its threat to terminate the “PSEG wheel” to route power into New York City.

Want more? Advanced Search