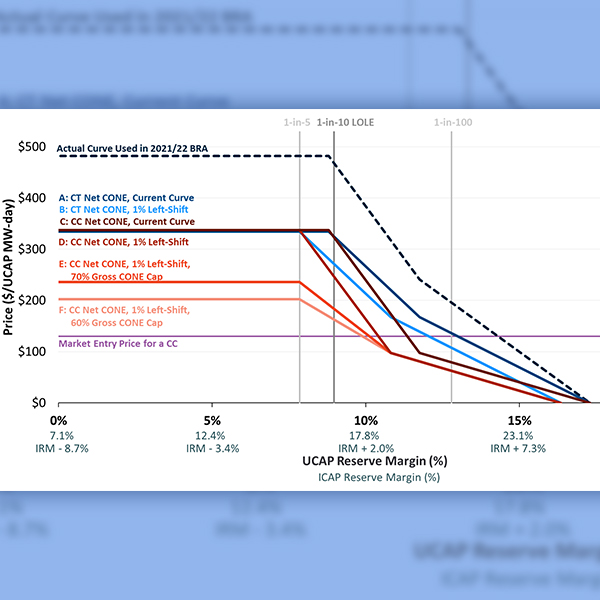

cost of new entry (CONE)

MISO's board may be coming around to the idea of using a sloped demand curve to price capacity as the RTO confronts the possibility of resource shortages.

FERC accepted PJM’s compliance filing restoring the historical energy and ancillary services revenue offset used in the RTO’s capacity market.

The NEPOOL MC discussed changes to the frequency of FCM parameter recalculations, the continuous storage facility model and cybersecurity reporting.

MISO officials answered questions about the capacity shortfalls and expensive prices in the 2022/23 auction while stakeholders asked for more supply data.

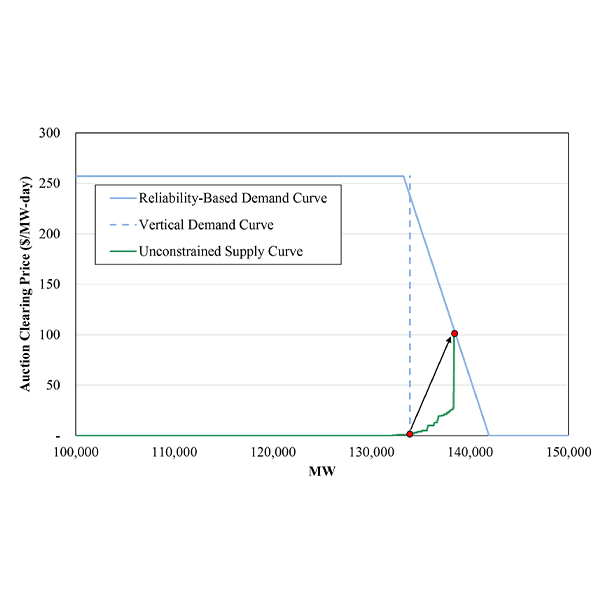

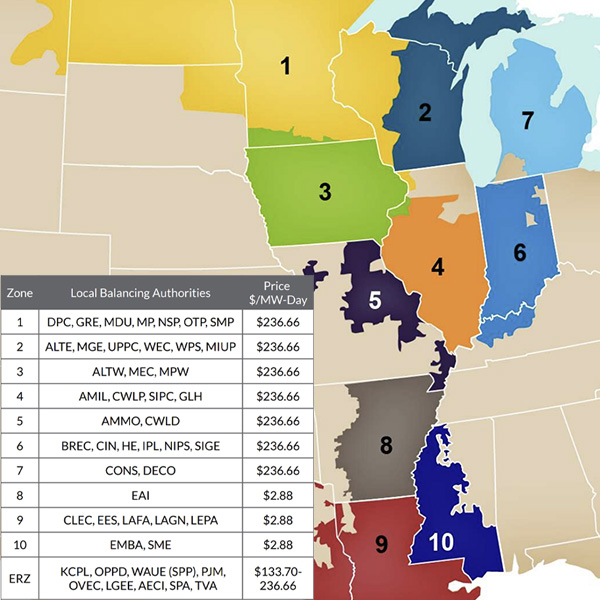

MISO’s 2022/23 capacity auction saw all its Midwest zones clearing at the nearly $240/MW-day cost of new entry, signaling a need for additional generation.

FERC ordered PJM to remove the 10% cost adder for the reference resource used to establish the VRR curve in the RTO’s capacity market.

PJM's upcoming 2023/24 BRA is set to be delayed again after FERC partially reversed its 2020 decision on the RTO’s energy price formation revisions.

Many stakeholders are uneasy with MISO's plan for a seasonal capacity accreditation based on a generating unit’s past performance during tight conditions.

FERC denied a rehearing request by EPSA and NEPGA related to the recalculated values used in ISO-NE’s Forward Capacity Market.

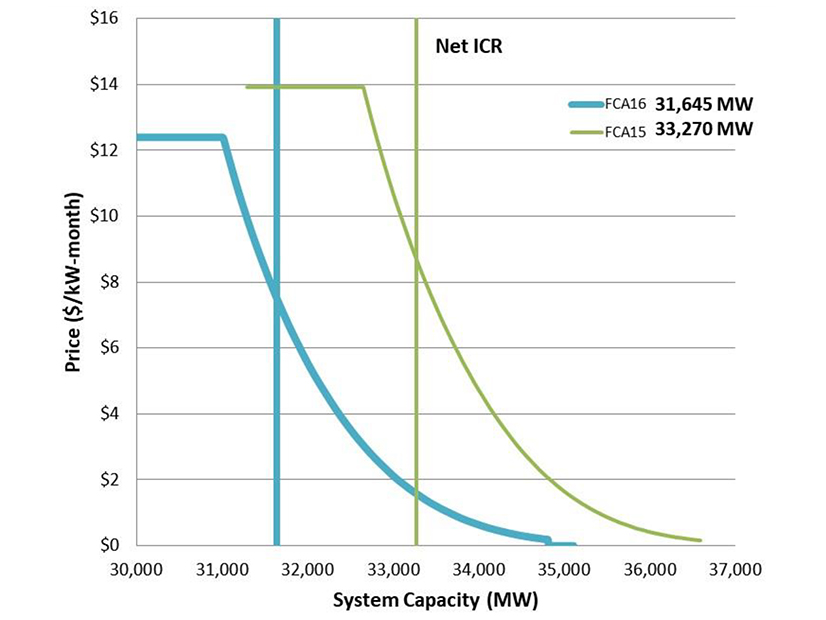

ISO-NE proposed an installed capacity requirement of 32,568 MW for FCA 16, a 1,585-MW decrease from FCA 15, at the NEPOOL Reliability Committee meeting.

Want more? Advanced Search