Forward Capacity Market (FCM)

Panelists at a recent NECA webinar discussed the highs and lows of working to refine offer review trigger prices for offshore wind and storage resources.

ISO-NE presented its revised Order 2222 compliance proposal to the NEPOOL Markets Committee, including changes to EAS market participation and more.

ISO-NE and NEPOOL kicked off a two-day meeting with a session strictly devoted to discussing removing the MOPR from the capacity market.

ISO-NE and stakeholders formally started work on eliminating the minimum offer price rule at a two-day meeting of the NEPOOL Market Committee.

FERC accepted parts of the ISO-NE and NEPOOL “jump ball” filing on offer review trigger price values in a ruling issued late Monday.

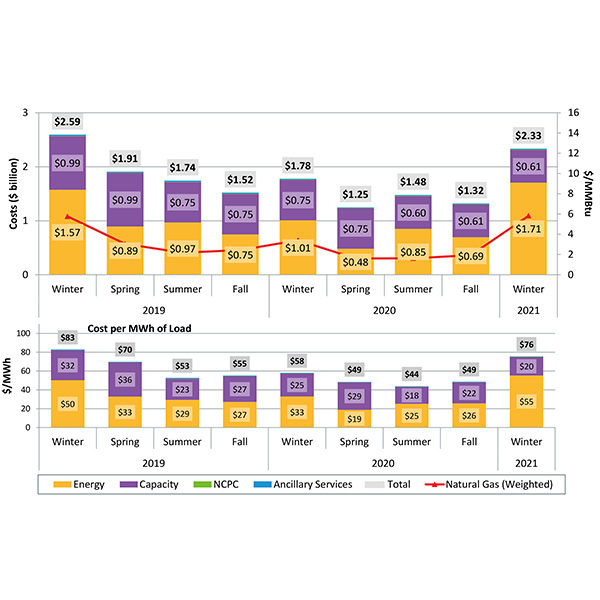

ISO-NE’s winter wholesale market costs totaled $2.33 billion, a 31% increase from the previous winter driven by higher energy costs.

ISO-NE briefed the NEPOOL Participants Committee on a project to address the removal of the minimum offer price rule from the capacity market.

ISO-NE and NEPOOL jointly filed updated offer review trigger price values with FERC under their “jump ball” provision.

FERC approved changes to ISO-NE’s tariff eliminating capacity performance payments for energy efficiency resources.

NEPOOL's Participants Committee acted on modified proposals for ORTPs used for Forward Capacity Market parameters in the 2025/26 capacity commitment period.

Want more? Advanced Search