investment tax credit (ITC)

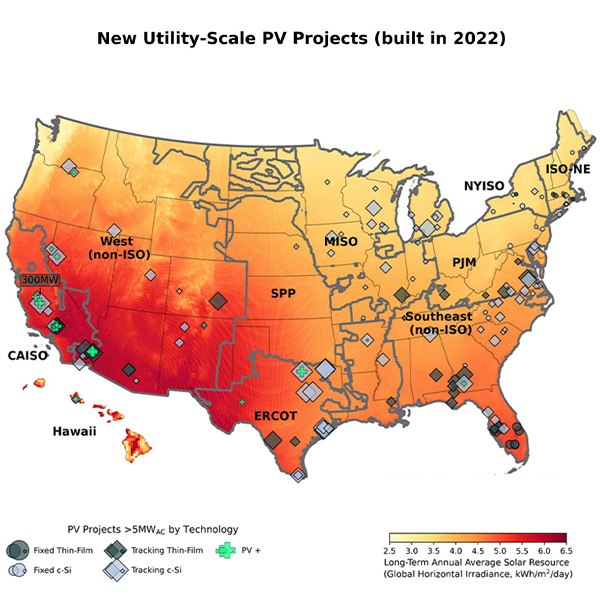

After a down year, the Berkeley Lab sees new utility-scale solar capacity increasing more than fourfold by the mid-2030s to over 50 GW per year.

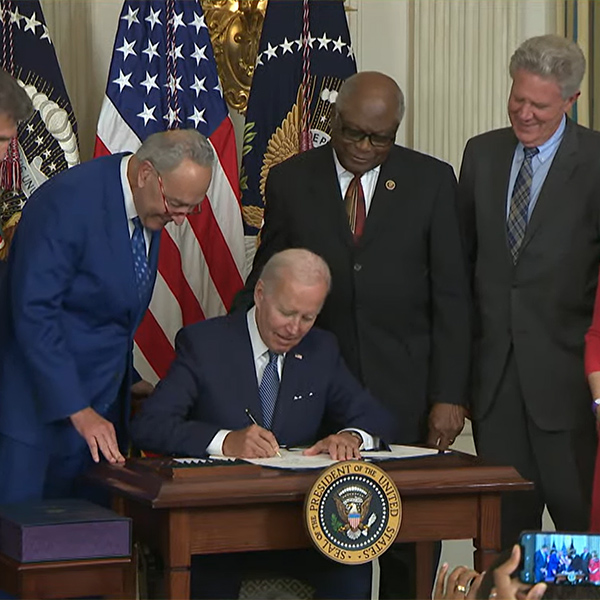

One year on, implementation of the IRA has not been smooth or easy, and four out of 10 registered voters say they know nothing about the law.

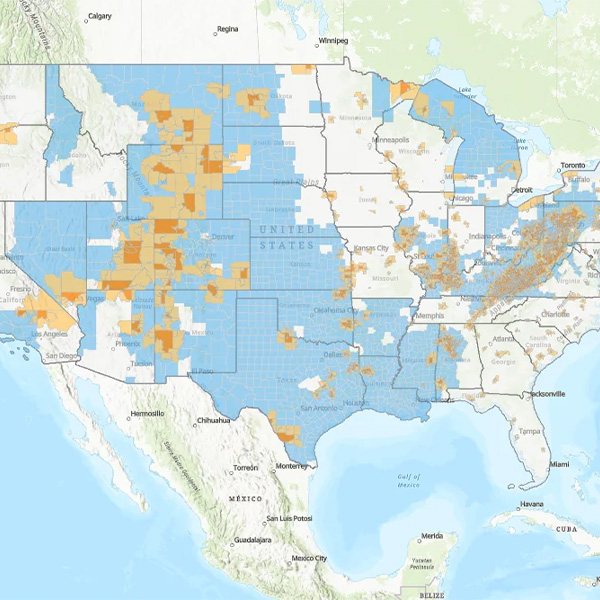

Millions in new funding and bonus tax credits are heading to new clean energy projects in communities impacted by the closure of fossil fuel-based industries.

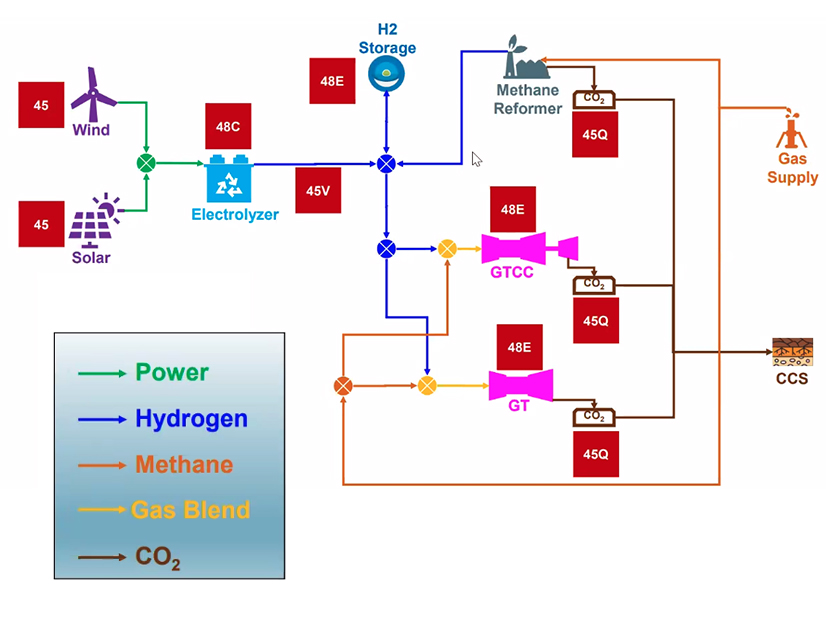

The tax credits provided by the IRA are key to the development of major clean hydrogen projects and seasonal hydrogen storage, Mitsubishi Power Americas said.

PJM's MIC deferred a vote on adopting a problem statement and issue charge to discuss combined cycle modeling in the market clearing engine.

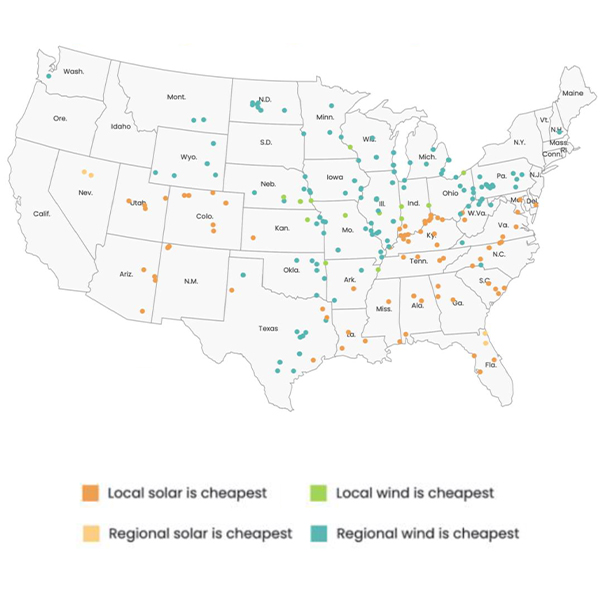

A new report found that nearly all coal plants studied “are more expensive to run than replacing their generation capacity with either new solar or wind.”

The U.S. economy is experiencing its first taste of high inflation in decades, and that is contributing to delays in new renewable power projects, experts say.

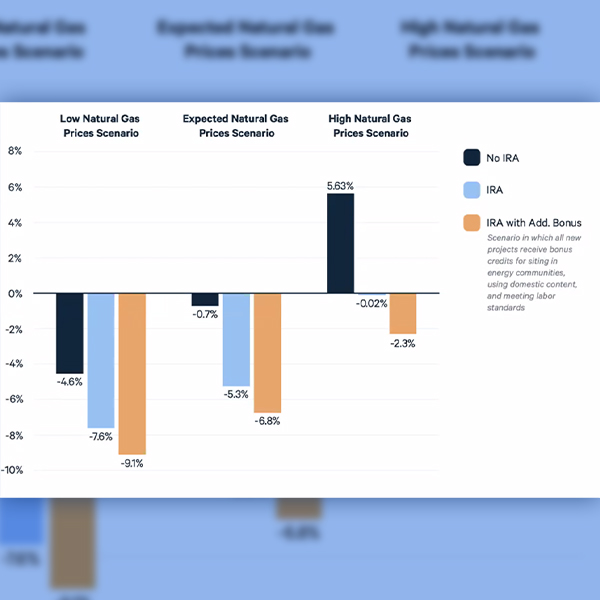

A panel of industry analysts presented their estimates of how much the Inflation Reduction Act would reduce emissions and its impact on household energy costs.

Exelon said the proposed 15% minimum corporate income tax in the Democrats’ energy and climate bill could impinge its cash flow, slow infrastructure investment.

The Inflation Reduction Act carries the same number as the Build Back Better Act, but its $670 billion falls far short of the original $2.2 trillion.

Want more? Advanced Search