market manipulation

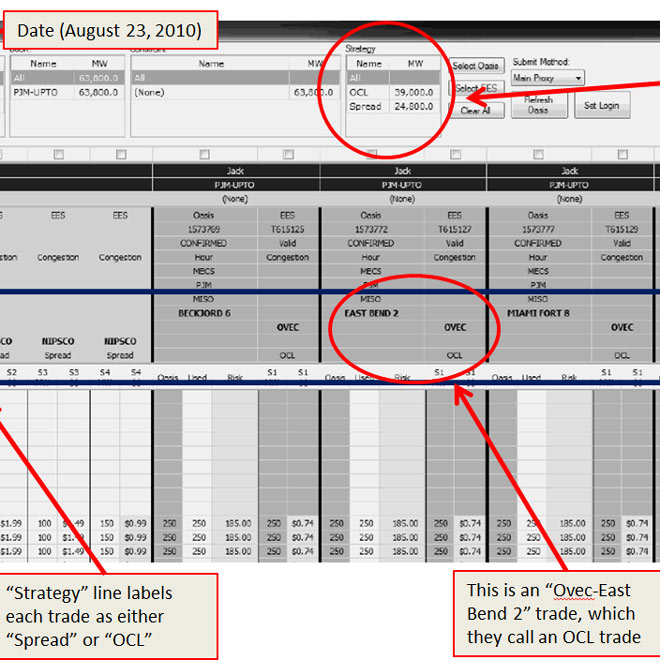

PJM has received FERC approval to divide $40.8 million from an enforcement settlement with GDF SUEZ among implicated market participants.

In a settlement approved by FERC's Office of Enforcement, GDF SUEZ will will pay almost $82 million to PJM to settle market manipulation charges.

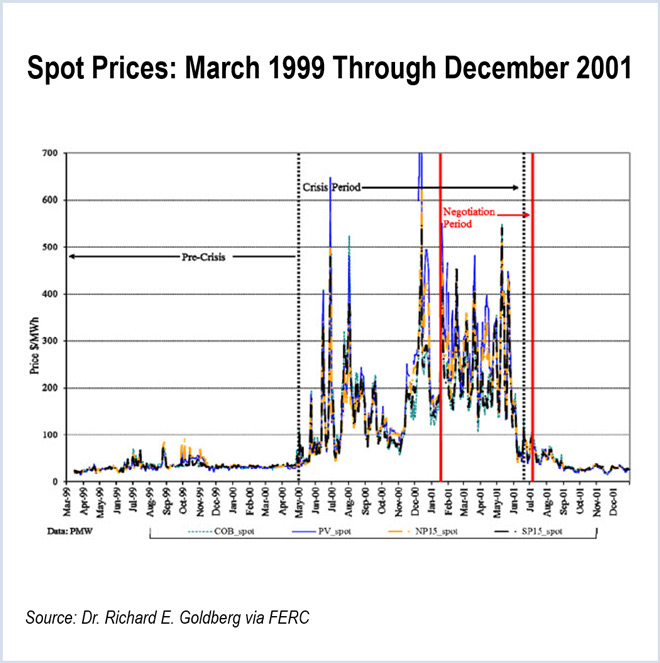

FERC ruled that Shell and Hafslund can not use the costs associated with illegal trading activity during the Western Energy Crisis to offset their refund.

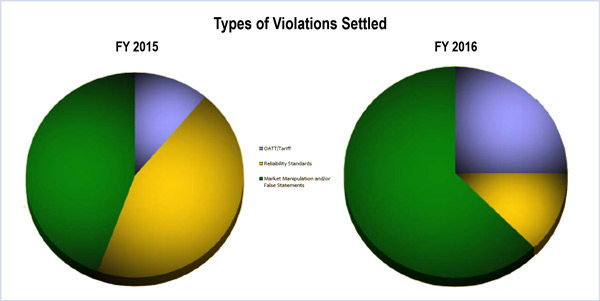

Market manipulation cases dominated FERC enforcement efforts in fiscal 2016, according to the Office of Enforcement’s 10th annual report.

Maxim Power will pay $8 million to settle a FERC complaint that it manipulated the New England power market in a fuel-switching scheme.

FERC revised its proposed rules for connected entity data collection from market-based rate traders to monitor against market manipulation.

A FERC judge ruled that Shell and Iberdrola saddled California consumers with $1.1 billion in excess energy costs at the height of the Western Energy Crisis.

The FERC Office of Enforcement said that the presence of flaws in the CAISO market is irrelevant to their market manipulation case against ETRACOM.

Coaltrain Energy said that it didn’t manipulate the market, that its trading strategy wasn’t deceptive and that it didn’t engage in wash trades.

FERC approved a request by CAISO to eliminate from its Tariff a provision establishing convergence bidding at scheduling points on the interties into Ca.

Want more? Advanced Search