Midcontinent Independent System Operator (MISO)

Members of the Organization of MISO States sent a letter to contradict aspects of NERC’s Long-Term Reliability Assessment, disputing the ERO’s label of MISO as being at “high risk.”

MISO membership called for modernized market rules for energy storage that can capture its chameleon-like roles.

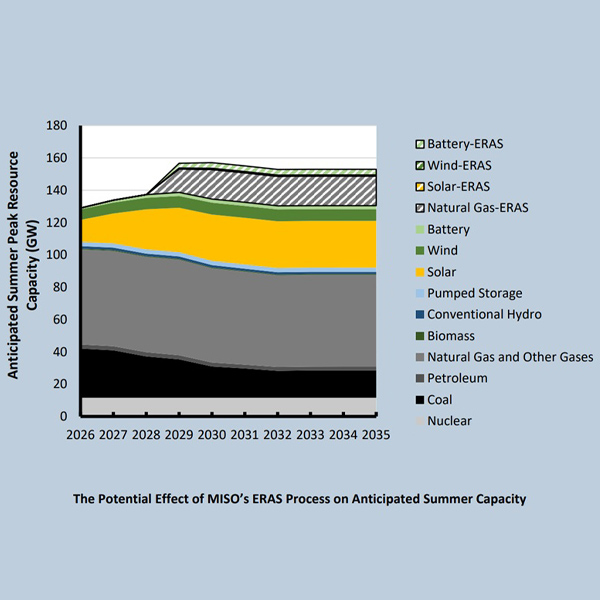

The new ERAS processes in MISO and SPP allow certain power plants to effectively jump the interconnection line, skipping ahead of hundreds of other projects already waiting their turn, writes Southern Renewable Energy Association Executive Director Simon Mahan.

MISO said it likely will create interconnection reliability requirements and explore new rules that could bring large customers online in stages, as capacity becomes available, to get a handle on large loads eyeing MISO locales.

MISO has deferred plans for an all-encompassing future-looking assessment that relies on member data after state regulators appeared hesitant about the move.

Some MISO stakeholders said an extreme events analysis from 2025’s transmission planning cycle potentially raises a red flag and deserves more attention.

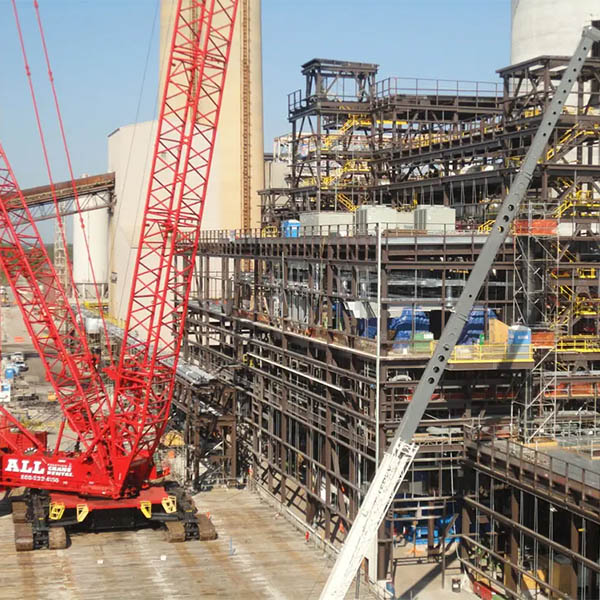

State regulators in MISO asked FERC to let power industry stakeholders determine how to allocate the costs for an Indiana coal plant forced to stay online by the Trump administration’s Department of Energy.

MISO announced further delays in its generator interconnection queue for the cycles of projects that entered in 2022, 2023 and 2025.

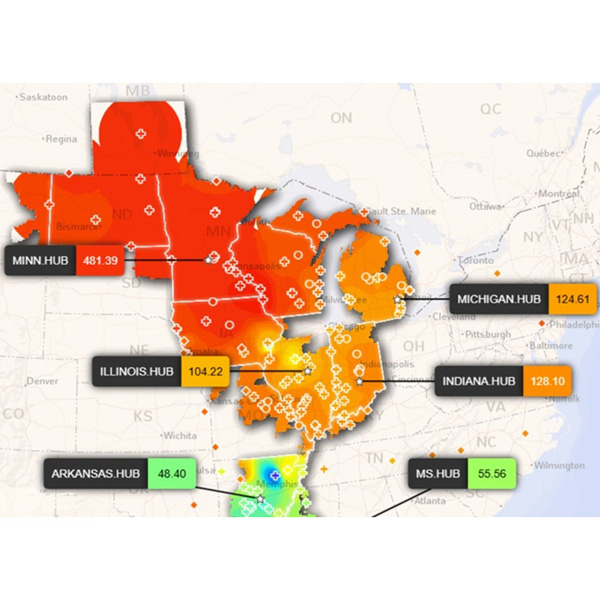

MISO declared a maximum generation emergency for its Midwest region just after midnight on Jan. 24 as the northern portions of the footprint rode out double-digit negative temperatures.

FERC ruled that MISO is free to continue using its interconnection queue fast lane, shutting down rehearing requests from several clean energy organizations.

Want more? Advanced Search