MISO Resource Adequacy Subcommittee (RASC)

MISO is registering and accrediting resources to meet a roughly 2-GW uptick in load for the 2026/27 planning year.

MISO signaled an openness to alter its 31-day planned outage rule for units that signed up to be capacity resources.

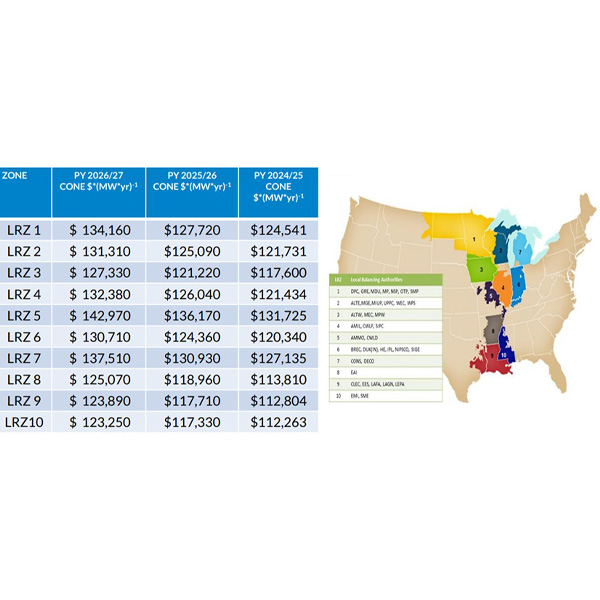

Inflation and higher borrowing costs pushed MISO’s cost of new entry up by about 5% heading into the 2026/27 planning year, but stakeholders are questioning MISO’s use of 2020 data in calculations in order to keep prices lower.

Stakeholders told MISO they need a better explanation of the every-other-day capacity advisories issued for MISO South, which have become customary since the beginning of summer.

MISO has filed with FERC to impose more exacting testing on its demand response resources in an effort to deflect fraud.

MISO stakeholders are skeptical of the RTO’s proposed new approach to divvying up reliability obligations among load-serving entities based on evolving system risk.

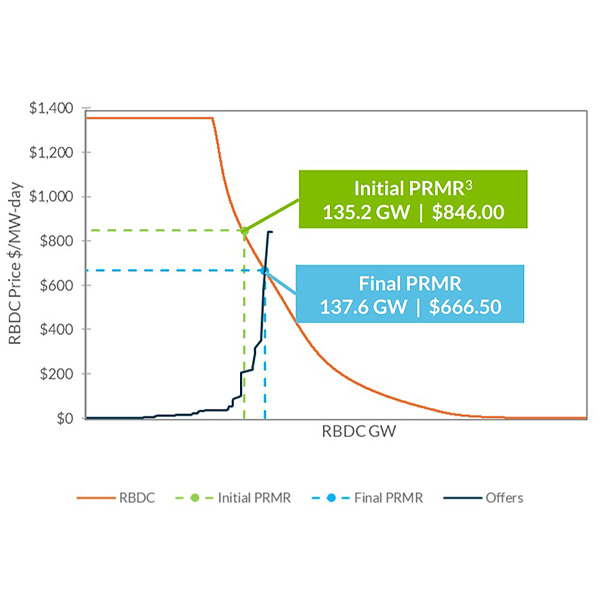

Stakeholders continue to ask MISO to crunch hypothetical auction clearing prices absent the RTO’s new sloped demand curve that sent prices past $660/MW-day for summer.

MISO is nearing an overhaul of its capacity accreditation methods for load-modifying resources and demand response that would be based on whether they can assist during periods of high system risk.

Voltus filed a complaint with FERC against MISO, alleging the RTO’s “11th-hour” changes in testing and contract proof requirements ahead of the spring capacity auctions will harm demand response resources and affect rates.

Load-serving entities that decide against participating in MISO’s capacity auction must secure anywhere from 1.5% to 4.2% beyond their reserve margin requirements in the 2025/26 planning year.

Want more? Advanced Search