NYISO Installed Capacity/Market Issues Working Group (ICAP-MIWG)

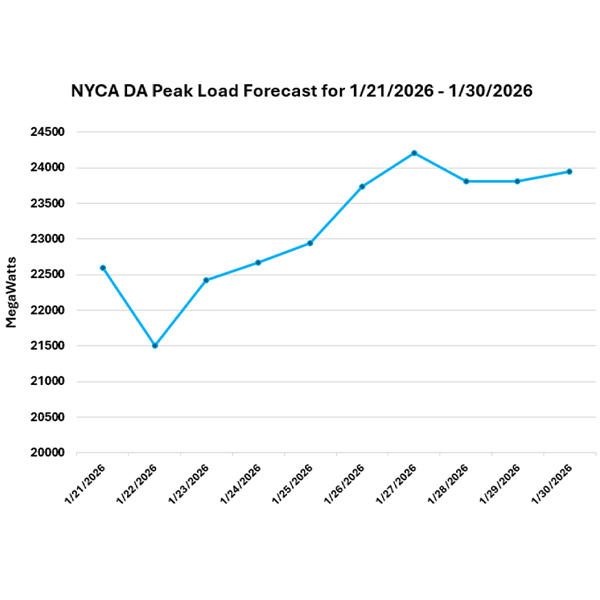

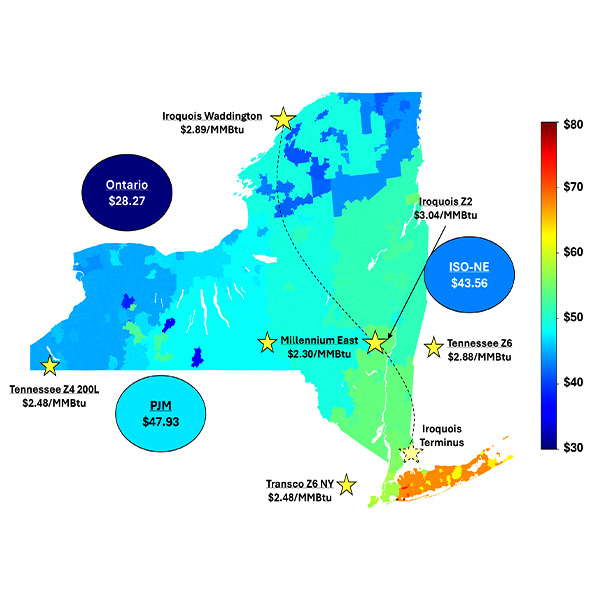

New York generators had to rely on oil as gas was scarce throughout the Eastern Interconnection during the Jan. 25-27 winter storm, NYISO said in a preliminary analysis.

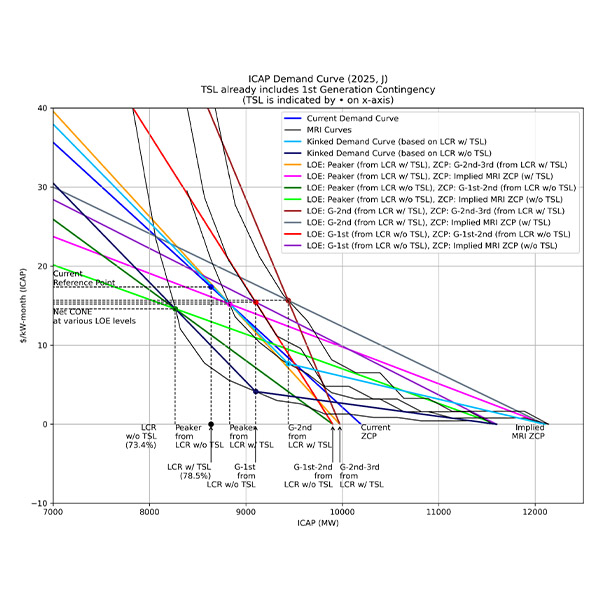

NYISO staff presented more of their initial ideas for improving the Demand Curve Reset process, centered on alternative shapes, slopes and points of the curve.

NYISO kicked off the demand curve reset reform process with a discussion of how to improve the overall process and what could be done to strengthen the definition of the proxy unit.

If the Champlain Hudson Power Express comes in as expected, it will have an impact on both LCR and CAFs downstate.

NYISO's Installed Capacity Working Group's final meeting of 2025 focused on proposed manual changes for several projects.

The NYISO Market Monitoring Unit told the Installed Capacity Working Group that more data is necessary to verify the need for out-of-market actions on the part of transmission owners for reliability.

Discussion about potential changes to the NYISO demand curve reset process dominated a recent Installed Capacity Working Group meeting and will likely take up more oxygen in stakeholder meetings throughout the coming year.

NYISO presented the results of Phase 1 of the 2024 Cluster Study process at a special Operating Committee meeting.

NYISO’s consumer impact analysis for the Winter Reliability Capacity Enhancements project found that under the scenarios it considered, installed capacity procurement costs would drop by 15 to 45% depending on locality

As NYISO continues its Capacity Market Structure Review, the Market Monitoring Unit used its second-quarter State of the Market report to highlight potential issues with how the ISO forecasts resource availability.

Want more? Advanced Search