Portland General Electric (PGE)

Utilities at a customer-led workshop voiced support for Bonneville Power Administration’s shift toward proactive transmission planning, though some expressed reservations about the agency’s proposed commercial readiness criteria.

Coordination between the gas and electric industries is becoming increasingly crucial to meet demand and to tackle extreme weather events, panelists participating in a WECC webinar argued.

Four Western utility executives participating in an Energy Bar Association webinar presented their reasoning for why they ultimately chose either SPP’s Markets+ or CAISO’s EDAM, with some eyeing the creation of a full regional transmission organization in the future.

CAISO’s EDAM clinched a set of wins when FERC approved the market’s revised congestion revenue allocation model and authorized participation for the EDAM’s first two members — PacifiCorp and Portland General Electric.

CAISO’s Western Energy Imbalance Market provided participants with $422.44 million in economic benefits during the second quarter of 2025, up 15% compared with the same period year earlier despite no change in membership.

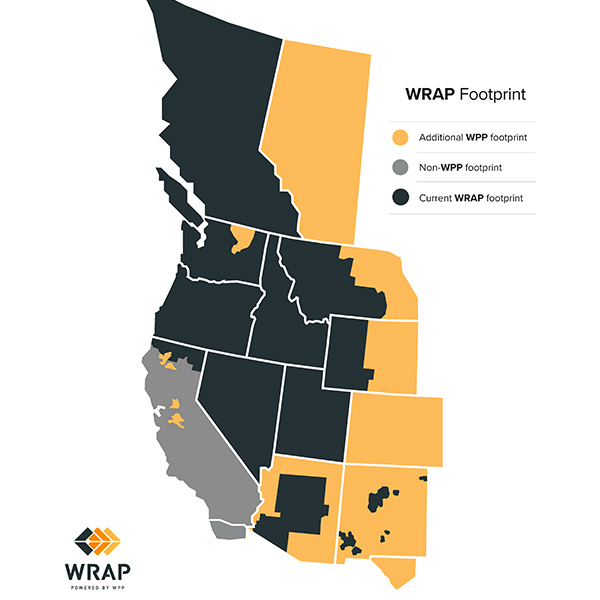

A new task force will examine how the WPP’s WRAP can continue to operate efficiently under the new multimarket environment emerging in the West.

The author behind the bill that would allow CAISO to relinquish market governance to an independent RO has delayed a hearing after several organizations withdrew support for the proposed legislation.

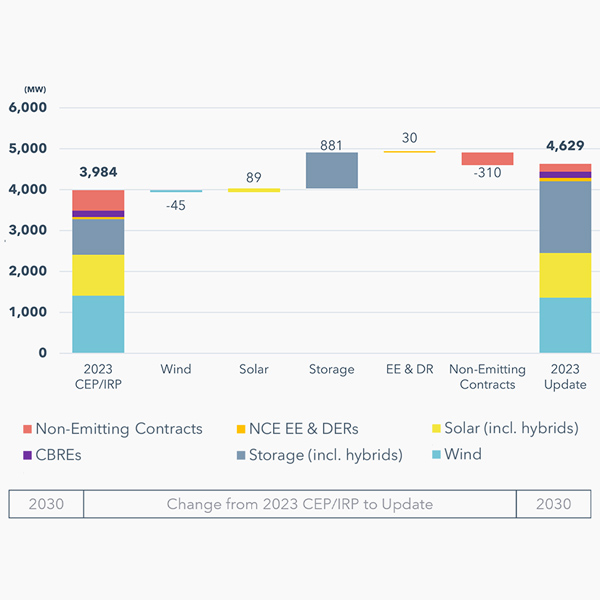

Portland General Electric’s need for new resources by 2030 has grown by 16%, largely because of a decreased capacity contribution from batteries, particularly in winter.

Even in its nonbinding phase, the Western Power Pool’s Western Resource Adequacy Program has been a valuable tool for working toward resource adequacy goals, program participants said.

Although one of the aims of day-ahead markets in the West is to fix a fragmented transmission landscape, some islanded entities will have a tough time navigating seams issues likely to arise as markets take shape, analysts at Aurora Energy Research said during a webinar.

Want more? Advanced Search