Securities and Exchange Commission (SEC)

Under the finalized rules, the SEC estimates only 40% of U.S. firms and 60% of foreign companies will have to report their emissions.

One of the Senate’s strong liberal voices on climate change, Sen. Sheldon Whitehouse slammed the fossil fuel industry for its campaign of “climate denial and propaganda.”

California’s new climate reporting requirements are being carefully designed to minimize duplication of efforts once the SEC catches up.

American Electric Power says it's been issued two SEC subpoenas in an investigation into the company’s involvement in controversial Ohio legislation.

JPxG, CC BY-SA 4.0, via Wikimedia Commons

PG&E asked the CPUC to approve a plan that would allow it to sell a stake in a new generation subsidiary, with proceeds to be used to fund capital investment.

DangApricot, CC BY-SA-3.0, via Wikimedia

The FirstEnergy board of directors told the SEC that it had formed a “special review committee” to assess the performance of current top executives.

Attorneys general from 19 states and D.C. voiced support for a plan to require companies to include climate change risk assessments in their SEC reports.

SEC Chair Gary Gensler and officials of large investment funds defended the SEC’s proposed climate rule, saying it will bring consistency and transparency.

The SEC's proposal to require companies to disclose their climate-related impacts raises the question of "materiality" — that is, what exactly to report.

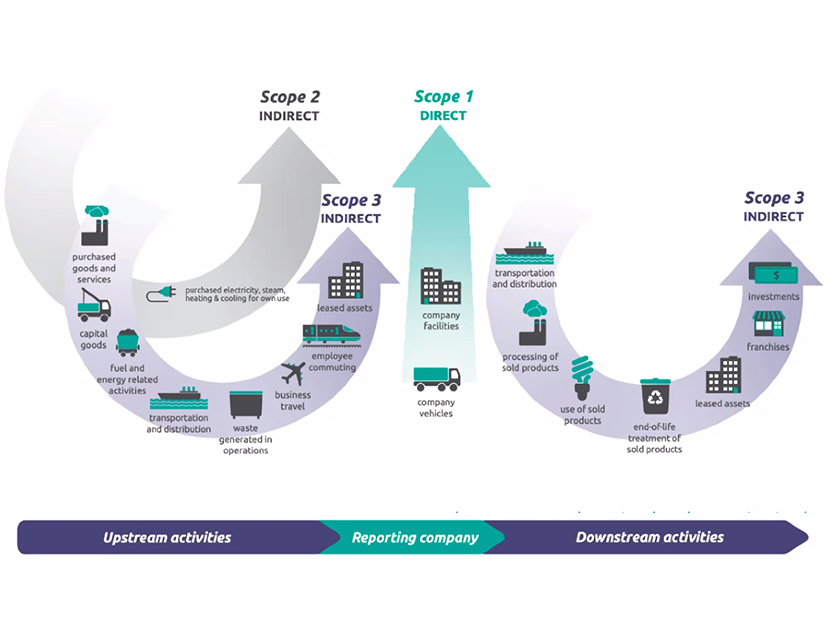

The SEC has issued a proposed rule that would require public companies to file GHG emissions data and information related to impacts of climate risks.

Want more? Advanced Search