sloped demand curve

The Sierra Club, Natural Resources Defense Council and the Sustainable FERC Project are seeking a rehearing of MISO’s sloped demand curve in its capacity auction.

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

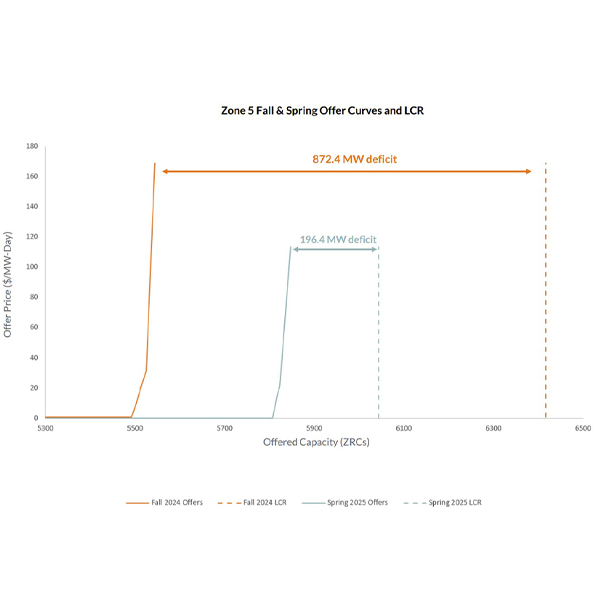

As it gears up to run its first auctions using sloped demand curves, MISO said prices and procurement would have risen had it used them in this year’s auctions.

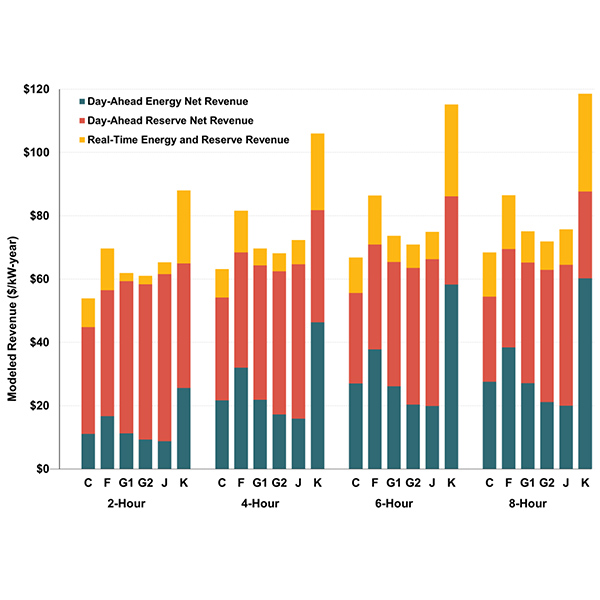

NYISO stakeholders are divided over consultants’ proposal to use a two-hour battery as the peaking plant in the ISO’s capacity market demand curve, as part of its quadrennial demand curve reset for 2025-2029.

After two requests for more information and nine months, FERC has greenlit MISO’s plan to exchange its current, vertical curve for sloped demand curves in its seasonal capacity auctions.

FERC once again said it needs more information on clearing price caps before MISO can proceed with sloped demand curves in its capacity auctions.

MISO juggled several projects over 2023 designed to fend off imminent reliability problems and will keep up the multitasking in 2024.

FERC wants more description behind MISO’s plan to adopt sloped demand curves for its capacity auctions before it decides the matter.

Stakeholders appear divided over MISO’s proposal to use a downward sloping demand curve in its capacity auction, with criticisms mostly aimed at a provision to allow utilities to opt out of the auction for three years at a time.

OMS took time to celebrate its 20-year anniversary at its annual meeting while exploring familiar themes of restructuring resource adequacy and barriers to large transmission buildout.

Want more? Advanced Search