Western Energy Imbalance Market (WEIM)

The West-Wide Governance Pathways Initiative soon will begin the nomination process to select the initial board of the independent regional organization that will govern CAISO’s energy markets.

With California passing the bill designed to transition the governance of CAISO’s markets to an independent regional organization, new challenges await the West-Wide Governance Pathways Initiative as the coalition seeks to turn a once-elusive goal into reality.

Western Energy Imbalance Market prices increased sharply in the second quarter of 2025 compared with the same period in 2024, mostly due to higher natural gas prices at Western hubs.

After years in the making, CAISO released a price formation proposal intended to reduce “unnecessary” market power mitigation, strengthen reliability and provide consistent pricing incentives in the WEIM and future EDAM.

Washington’s Ecology Department clarified that cap-and-invest rules that apply to CAISO’s Western Energy Imbalance Market also will cover the ISO’s Extended Day-Ahead Market when it begins operations in 2026.

The West-Wide Governance Pathways Initiative is preparing to file the incorporation documents for the independent RO that will govern CAISO’s energy markets, while funding challenges remain.

FERC approved CAISO's Western Energy Imbalance Market implementation agreement with Imperial Irrigation District.

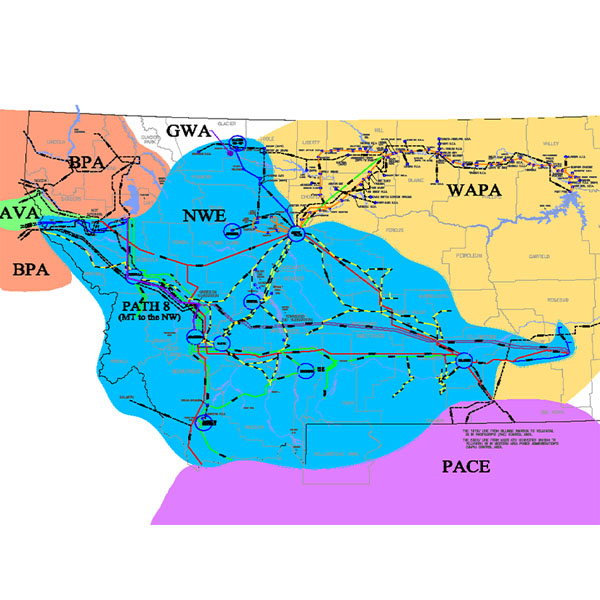

The proposed merger between Black Hills Corp. and NorthWestern Energy likely will reshape the map in the competition between CAISO’s Extended Day-Ahead Market and SPP’s Markets+ — but it’s still too early to know where new boundaries will be drawn.

The Oregon Department of Energy’s new draft energy strategy points to the importance of new transmission development and expanding electricity markets for meeting the state's energy goals.

California Gov. Gavin Newsom again appeared to voice support for the proposed bill that would allow CAISO to relinquish market governance to an independent regional organization, saying the legislation can reduce electricity costs and improve reliability.

Want more? Advanced Search