Wood Mackenzie

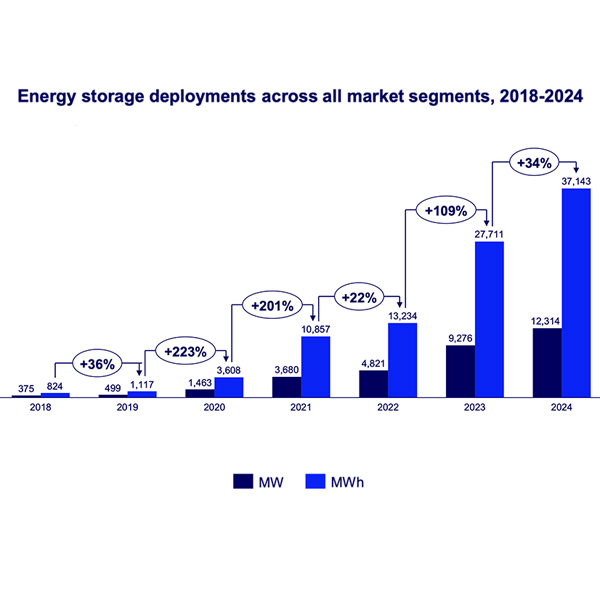

In 2026, utility-scale energy storage projects in the U.S. will face headwinds that could slow the pace of a technology that is fast becoming a global grid staple, warns columnist Dej Knuckey.

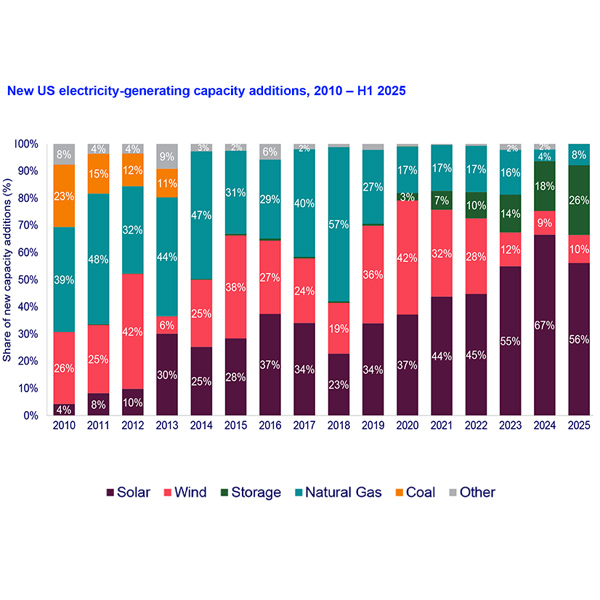

New reports give a picture of a U.S. energy storage sector accelerating at an even faster rate in 2025 despite policy changes but facing a potential slowdown because of those same policy changes.

If the U.S. clean energy industry had to lose the federal incentives, it could not have happened at a better time, says columnist K Kaufmann.

A new report quantifies the buildout of solar power generation in 2025 and forecasts the slowdown expected to result from federal policy changes.

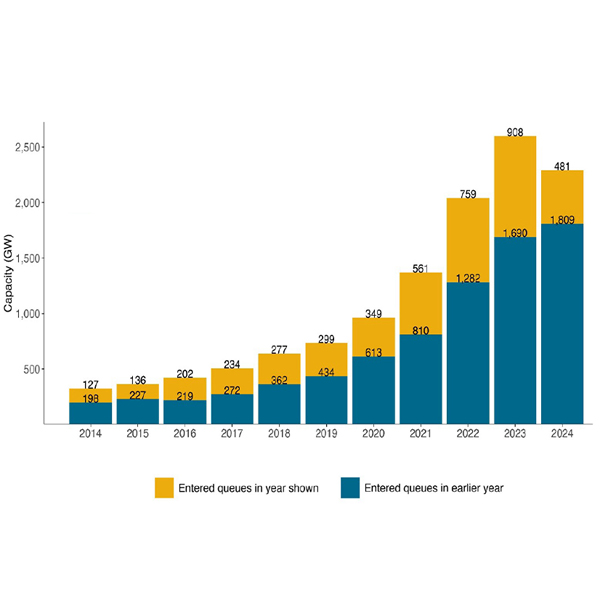

Two new data sets show the industry has started to cut back on record high interconnection queue levels from last year as reforms have started to take hold.

Growing power demand from data centers dominated conversations at the NARUC Summer Policy Summit, where industry members and Trump administration officials advocated for the rapid addition of fossil fuel resources and infrastructure to meet load growth.

Announced cancellations, closures and cutbacks in new manufacturing and clean energy projects in the first half of 2025 were valued at $22.1 billion by the business policy group E2.

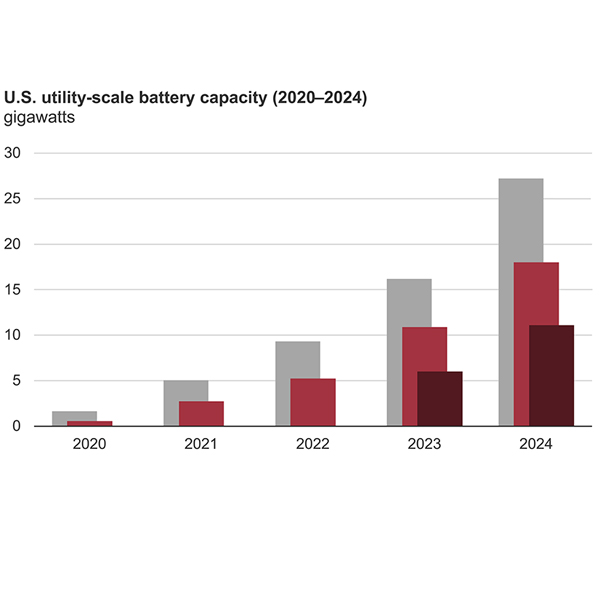

Storage set a new record of installations in 2024, but the forecasts for the rest of the decade are cloudy because of uncertainty around the future of tax credits and additional tariffs from President Trump.

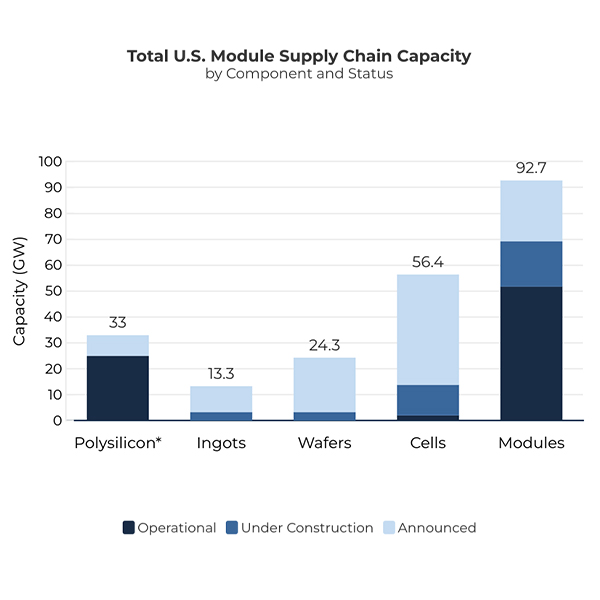

The U.S. has enough solar panel manufacturing capacity to produce more than 51 GW of panels per year, with another 17.5 GW under construction and 23.5 GW of additional capacity announced.

President-elect Trump said he would halt offshore wind power development, but how big of an impact he will have on the industry remains to be seen.

Want more? Advanced Search