Before he became President Trump’s energy secretary, Chris Wright was CEO of Liberty Energy, a natural gas fracking company, and an avid proselytizer for fossil fuels as the foundation of modern lifestyles, prosperity and security in the U.S. and in emerging nations striving for Western standards of living.

Wright’s typical pitch in Liberty YouTube videos links global progress, from fighting poverty to lowering infant mortality rates, to two key factors: the spread of human liberty and democratic government and “the surge in plentiful, affordable energy from oil, gas and coal.”

Wright’s recent efforts to claw back legally obligated federal funding for clean energy projects ─ many in Democratic-led states ─ speak volumes about his commitment to liberty and democratic government.

His arguments for fossil fuels are at least historically accurate: The social, technological and economic advances made possible by the Industrial Revolution in the 19th and 20th centuries were powered by fossil fuels. But, as much as Wright discounts it, the world is in the midst of a major energy transition, from petrotech to electrotech, which the vast majority of countries ─ with the notable exception of the U.S. ─ are pursuing to promote innovation and economic growth and provide a more efficient, affordable and secure future.

This reframing of the energy transition is laid out in The Electrotech Revolution, an extremely detailed, well-documented and provocative report from Ember, a London-based energy think tank.

Rejecting the business-as-usual paradigm of “fossil fuels gradualists” versus “net-zero advocates,” co-authors Daan Walter, Sam Butler-Sloss and Kingsmill Bond stake out electrotech as a third way, focused on “exponential energy technologies revolutionizing how we generate, connect and use electrons … such as solar, wind, batteries and digital solutions.”

This electrotech revolution is “driven by physics, economics and geopolitics,” they write. “After all, the arc of energy history bends toward solutions that are leaner, cheaper and more secure.”

The 112-page report is packed with charts, facts and figures that at every turn demolish Wright’s arguments for grounding U.S. energy abundance and dominance ─ and the welfare of the country’s 342 million citizens ─ in fossil fuels. It depoliticizes the debate and should be required reading for every federal and state policy maker, regulator, electric industry executive and anyone else concerned or just curious about the future of our electric power system.

Chris Wright is a smart, well-informed person, so I am going to presume he knows everything that is in the Ember report but is willfully ignoring and denying the reality of the electrotech transition to advance the political and financial interests of the Trump administration and the U.S. fossil fuel industry.

A handful of charts from the report show why Wright is so wrong. He and Trump may be able to slow the clean energy transition in the U.S, but the electrotech narrative is undeniable and will win out.

Already, China is leading the transition, and emerging economies are leapfrogging over fossil fuels, the report says. What side of history do we want to be on?

The Inefficiency of Fossil Fuels

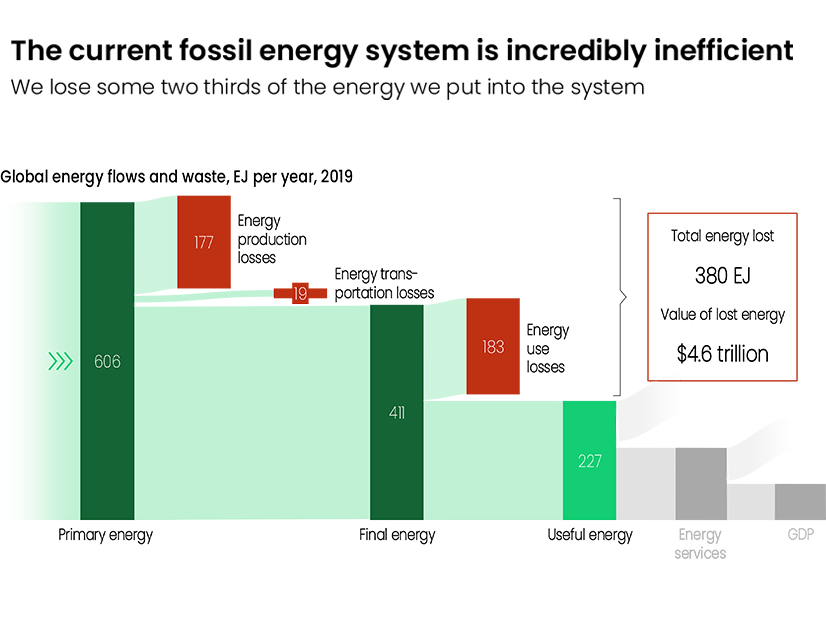

The Ember report starts with some eye-opening basics. First, the physics: Fossil fuels are an incredibly inefficient way to produce electricity.

One exajoule, or EJ, is about 278 terawatt-hours of power, so the amount of energy and money we lose burning fossil fuels is simply ridiculous. The figures here, and throughout the report, are global, unless otherwise noted.

Further, the report shows, what most of us really care about is not the primary energy (basic fuels like coal and gas) or final energy (the gasoline and electricity delivered to consumers). Our day-to-day lives depend on useful energy that produces heat and hot water for our homes, plus steel and other goods (energy services) that create economic value (GDP).

Renewable energy and associated clean technologies ─ like electric vehicles and heat pumps ─ are two to four times more efficient than fossil fuels for generating electricity, powering our transportation and heating our homes.

At a time of rising electric bills, efficiency and cost savings are top priorities for consumers, businesses and the policy makers and regulators besieged by frustrated and increasingly desperate people, facing critical decisions about which bills to pay first.

The question here is simple: Which side of the laws of physics do we want to be on? We should be planning and building out our electric power system accordingly.

Peaking out

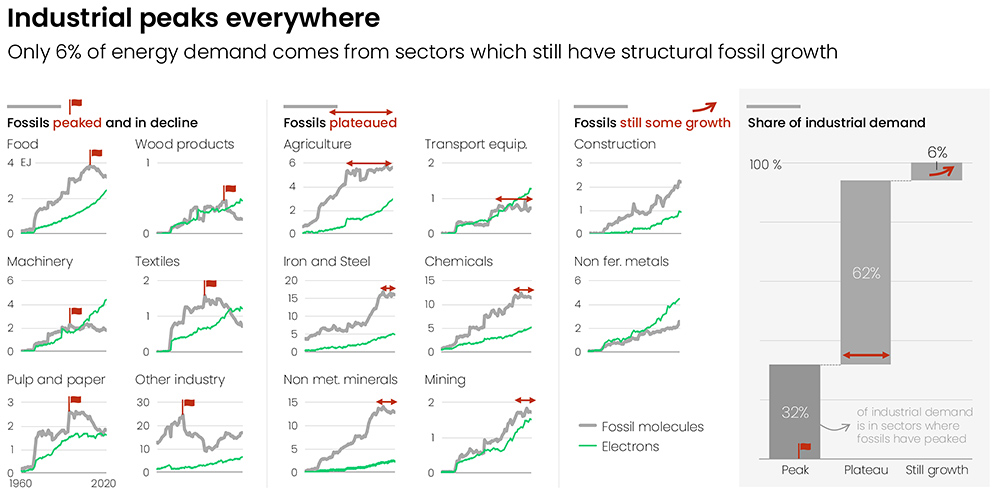

Wright and others often argue that the need for fossil fuels will continue to grow, given the demand for reliable, affordable energy from Europe, China, India and emerging economies.

Wrong again. The Ember report tracks how fossil fuel use has peaked or at least plateaued across various industries worldwide. Pulp and paper and textiles peaked decades ago, while even mining, chemicals and transportation have plateaued. Only construction and non-iron metals, accounting for 6% of industrial demand, are still on a growth curve.

Nearly half of the world is past peak fossil fuel demand for electricity generation, Ember says. China almost single-handedly has been responsible for any growth in global demand for fossil fuels over the past eight years, but even there, Ember finds evidence that the country is moving toward a plateau.

Slashing Fossil Fuel Imports

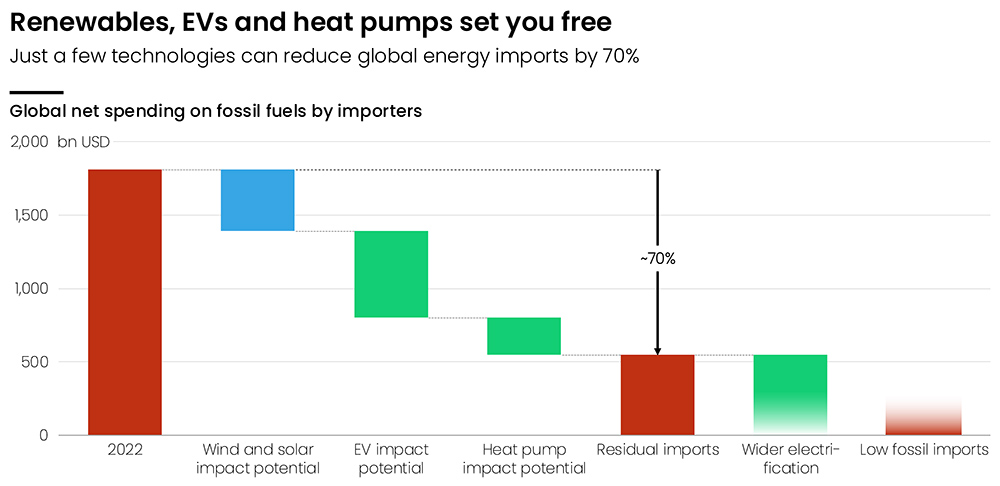

At least one point in Wright’s argument rings true: Many countries remain dependent on imported fossil fuels ─ 50, in fact, where imported oil, gas and coal account for 50% or more of the primary fuels they use to produce electricity and gasoline.

At the same time, the report notes, almost every country in the world has sufficient sources of renewable energy ─ wind, solar, hydro ─ to meet their existing energy demand, in many cases at least 10 times over. A good three-quarters of Africa is classified as “superabundant,” meaning these countries could meet their existing demand 1,000 times over with their renewable resources.

At the same time, the hundreds of billions of dollars spent on importing fossil fuels could be slashed 70% with three existing technologies: renewables in the form of wind and solar, electric vehicles and heat pumps. Wider electrification could shrink fossil fuel imports even further.

While the U.S. is a net exporter of fossil fuels ─ exporting more than we import ─ the country still imports more than 8.4 million barrels of crude oil per day, primarily from Canada. Those imports now come with Trump’s 10% tariff; all the more reason to switch from petro- to electrotech.

Emerging Markets Leapfrog

One of Wright’s more compelling arguments for fossil fuels centers on energy poverty ─ the 666 million people around the world who live without electricity, 85% of whom live in Sub-Saharan Africa, according to a recent report from the World Bank.

At least, he makes it sound compelling, with fossil-fueled electricity bringing modern, Western lifestyles to emerging economies.

But fossil-fueled power plants require extensive supply chains and supporting infrastructure ─ pipelines, transmission systems ─ which means they may not be the best way to provide power to remote villages in Africa, or anywhere else for that matter. The World Bank notes that “new technologies and business models for decentralized renewable energy (DRE) ─ such as solar home systems and solar mini grids ─ offer flexible solutions for these areas.”

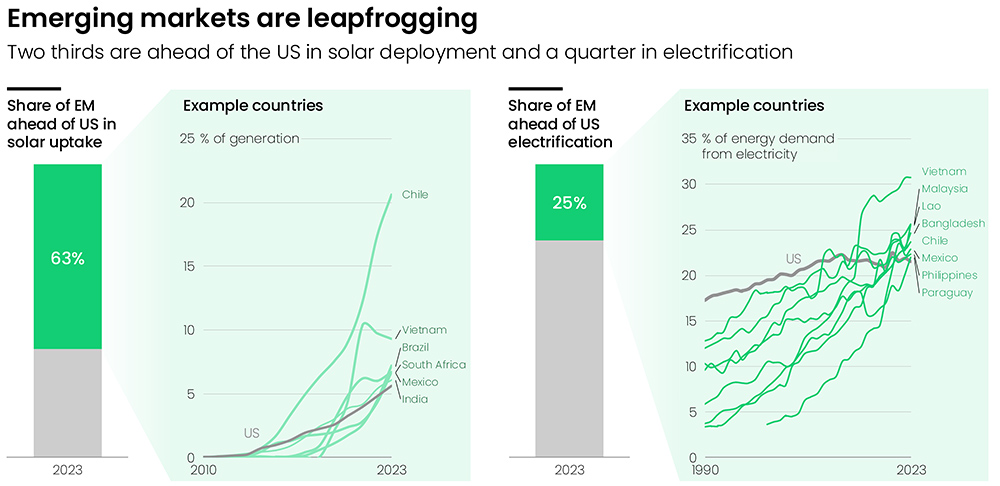

Which may be why, according to the Ember report, many emerging economies in Latin America, Africa and Southeast Asia are adopting solar and electrifying faster than the U.S., leapfrogging fossil fuels to build their economies on clean energy.

As noted in the chart above, 63% of emerging economies ─ from Chile to Vietnam to South Africa ─ are ahead of the U.S. in solar adoption, while 25% ─ including Laos, Malaysia and Bangladesh ─ are ahead in electrification.

Those numbers are, at least in part, being driven by direct cleantech investment from China ─ more than $100 billion in emerging economies since 2023, Ember says. China dominates global markets in solar, storage and electric vehicles, while the U.S. under Trump is increasingly isolated by high tariffs and falling further behind in clean energy manufacturing and deployment.

Bumps Ahead

While the physics and economics for electrotech are pretty convincing, Ember knows the real world is rarely as science- and fact-driven as we would like it to be.

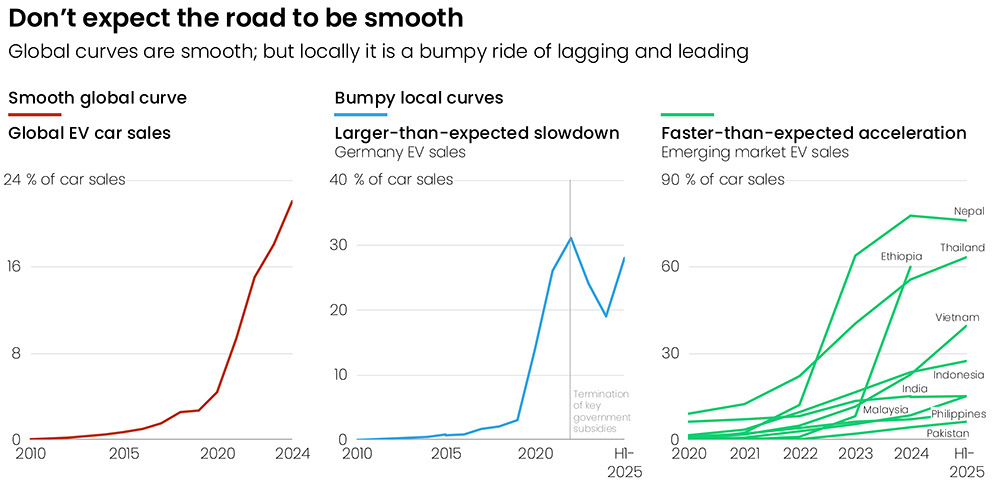

The electrotech transition will be uneven across political and economic landscapes, as seen in Ember’s analysis of EV sales globally, in Germany and emerging economies. Where markets have been dependent on government subsidies ─ in Germany and the U.S. ─ we are going to see some dips and slowdowns, followed by resets and renewed gains.

But such bumps are being offset by faster-than-expected EV adoption in emerging economies, again likely due to China’s high-quality but relatively cheap EVs. You know the ground is shifting when 60% or more of new car sales in Nepal and Ethiopia are electric, driving that steep upward curve in global EV sales.

Certainly, the way forward in the U.S. will be even bumpier with Wright and others in the Trump administration putting as many obstacles as possible in the way of renewables and other clean technologies while setting the country on a path to continuing petrotech dependence and ever-rising electric bills.

One example: On Oct. 16, Wright announced a $1.6 billion loan guarantee to a subsidiary of American Electric Power for transmission upgrades in Indiana, Michigan, Ohio, Oklahoma and West Virginia. According to figures from the Energy Information Administration, all five of these states generate two-thirds or more of their electric power from natural gas and coal. Coal makes up 91% of West Virginia’s generation mix.

Among 321 Department of Energy grants and other awards Wright canceled Oct. 2, 26 were from the Grid Deployment Office.

But one thing neither Trump nor Wright seems to be taking into account ─ all the DOE employees they have let go are now on the ground, starting new businesses and nonprofits, leading corporate, state and local government efforts to decarbonize their power supplies and pushing electrotech innovation and investment forward. They’re ready to ride out the bumps and are not giving up.

Like the Ember report, they know that responding to demand growth in the U.S. and ensuring access to electricity worldwide should not be about politics. Yes, electrotech will cut greenhouse gas emissions, but it is laser-focused on providing the best, cheapest and most dynamic and flexible technology to power our increasingly digital world.

Secretary Wright, come the revolution, what side of history do you want to be on?

Livewire Columnist K Kaufmann has been writing about clean energy for 20 years. She now writes the E/lectrify newsletter.