NREL: US Will Need 2,100 American-made OSW Turbines by 2030

Report Finds Only 1 U.S. Port Currently Capable of Supporting Offshore Construction

Mar 30, 2022

|

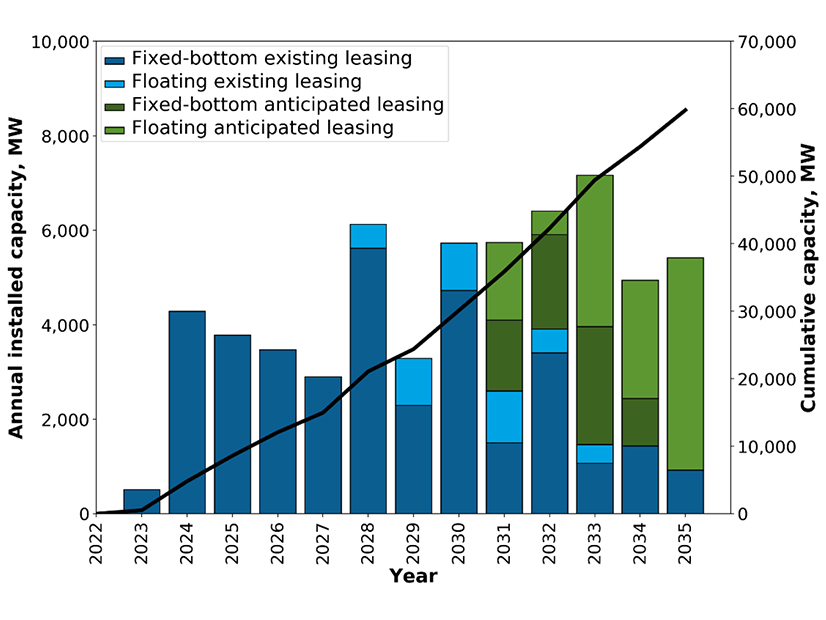

Reaching the goal of constructing 30 GW of offshore wind by 2030 will require a supply chain capable of producing more than 2,100 wind turbines, a report says.