Offshore Wind Power

Updates on energy development efforts off the New York coastline did not gloss over President Donald Trump’s war on wind turbines but did not focus on it, either.

The Maine PUC granted the request of Pine Tree Offshore Wind to suspend talks on a contract to support construction of a research project with up to 12 turbines with a capacity of up to 144 MW.

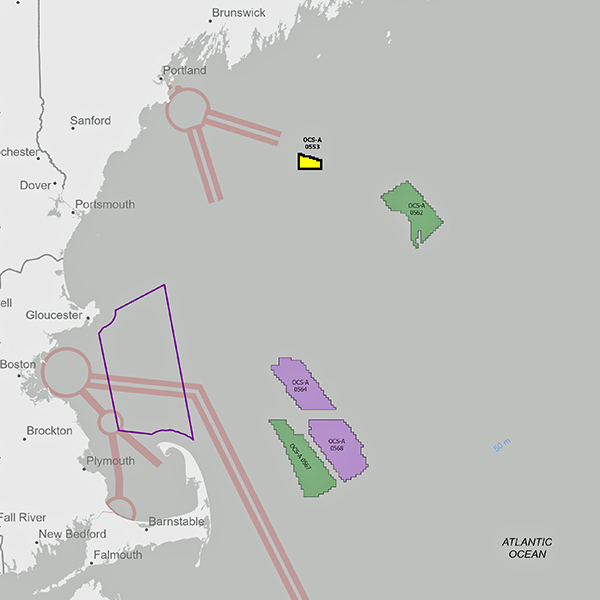

A new analysis by ISO-NE shows about 9,600 MW of offshore wind may be able to connect to the New England transmission system without triggering the need for upgrades.

Christine Guhl-Sadovy, president of the New Jersey Board of Public Utilities, has a lot to do and little time to do it in.

A longstanding project to build a wind tower manufacturing center in the Port of Albany has become uncertain under the Trump administration.

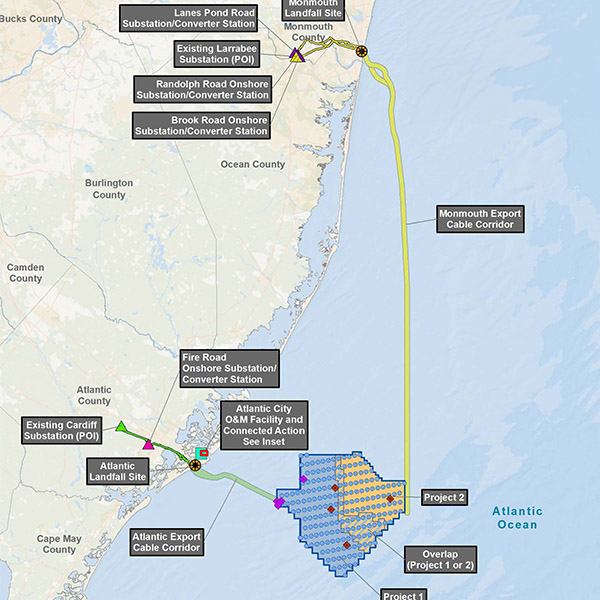

The EPA’s Environmental Appeals Board has granted the agency’s motion for a “voluntary remand” on the air quality permit for the project, essentially returning it to EPA for re-evaluation in light of President Donald Trump’s Jan. 20 executive order on offshore wind.

Commercial fishing advocates are asking the nation’s highest court to rule that federal regulators improperly authorized construction of Vineyard Wind 1 off the Massachusetts coast.

FERC approved a guarantee for National Grid to recoup all prudently incurred costs for the company’s portion of the Power Up New England transmission project if the project is terminated due to factors outside the company’s control.

Uncertainty around federal funding, permitting approvals and tariffs is creating major challenges for clean energy development in the Northeast, industry representatives said at NECA’s annual Renewable Energy Conference.

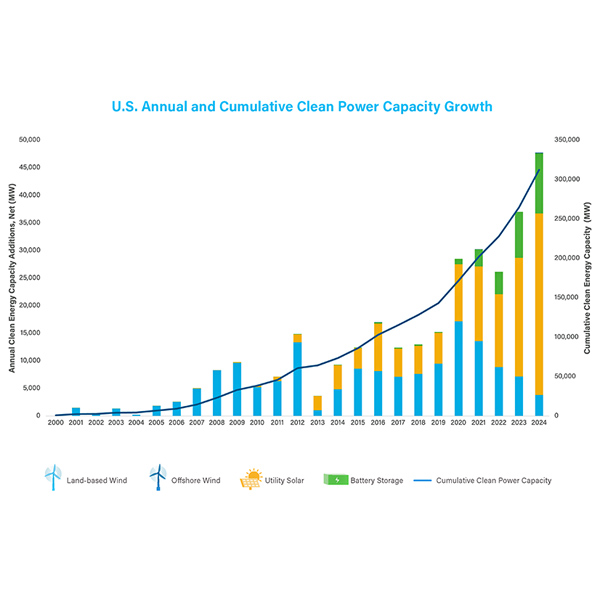

A record 49 GW of clean energy generation came online in 2024 in the U.S., nearly 33% more than in 2023, the American Clean Power Association reported.

Want more? Advanced Search