NEPOOL Markets Committee

ISO-NE presented the initial scope of its work to coordinate resource capacity accreditation improvements with proposed capacity market timing changes at the NEPOOL Markets Committee summer meeting.

NEPGA and CPV offered amendments to ISO-NE’s proposed changes to the financial assurance provisions for the Forward Capacity Market.

ISO-NE’s proposed resource capacity accreditation updates would result in an estimated 11% increase in capacity market revenues, the RTO told the NEPOOL Markets Committee.

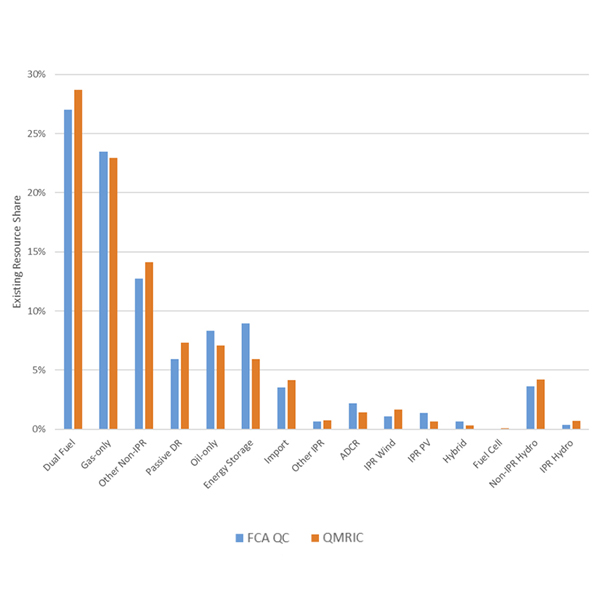

ISO-NE continued work on resource capacity accreditation changes, outlining how changes to the overall resource mix could affect the reliability value of different resource types.

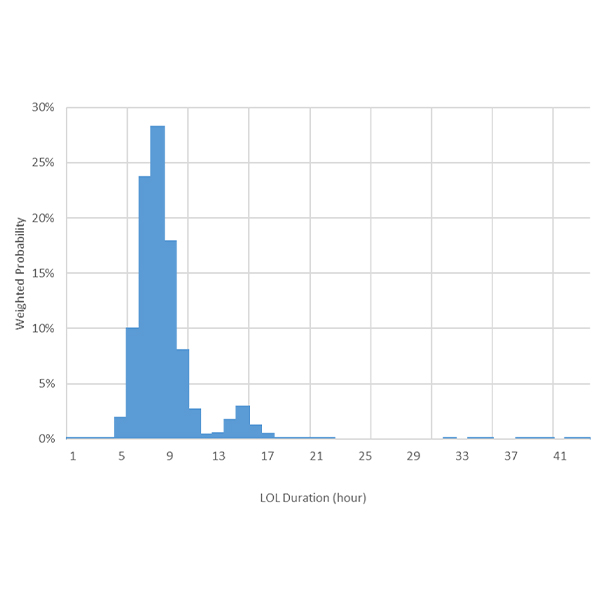

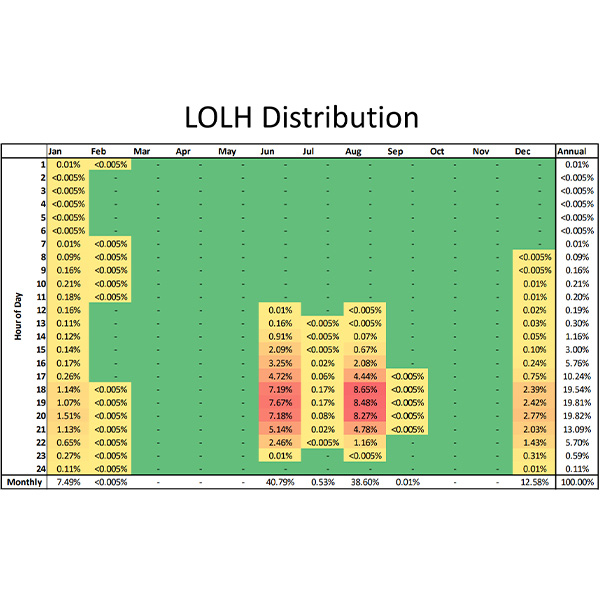

ISO-NE presented the NEPOOL Markets Committee with additional results of the impact analysis for the RTO’s resource capacity accreditation project, which looked at how changes to the resource mix would affect the seasonal distribution of shortfall risks.

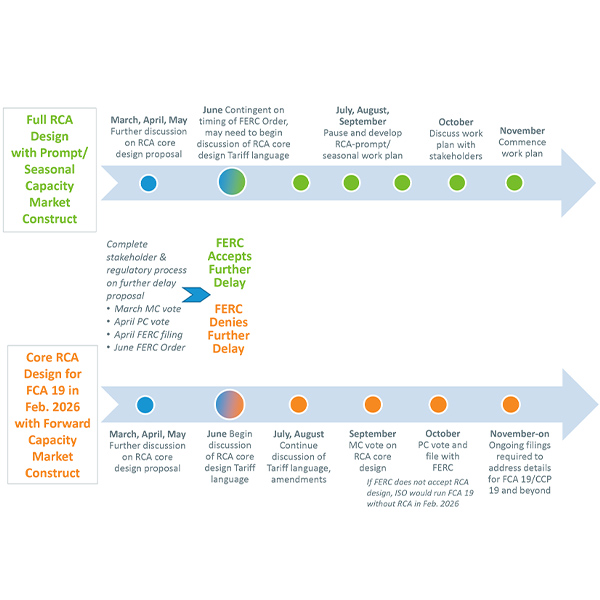

The NEPOOL Markets Committee approved an additional two-year delay of ISO-NE’s Forward Capacity Auction 19 to develop and implement a new seasonal capacity auction.

ISO-NE presented the NEPOOL Markets Committee with the initial results of the RTO’s Resource Capacity Accreditation.

ISO-NE told the NEPOOL Markets Committee that it is proposing a major redesign to its capacity market, moving from a three-years-ahead schedule to a prompt and seasonal design.

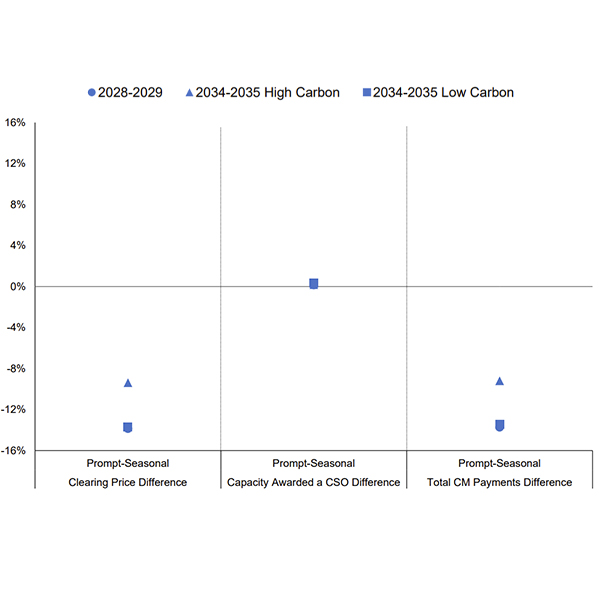

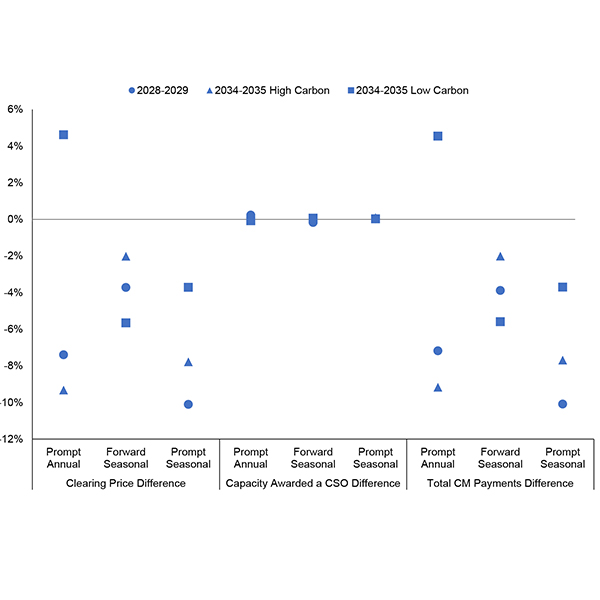

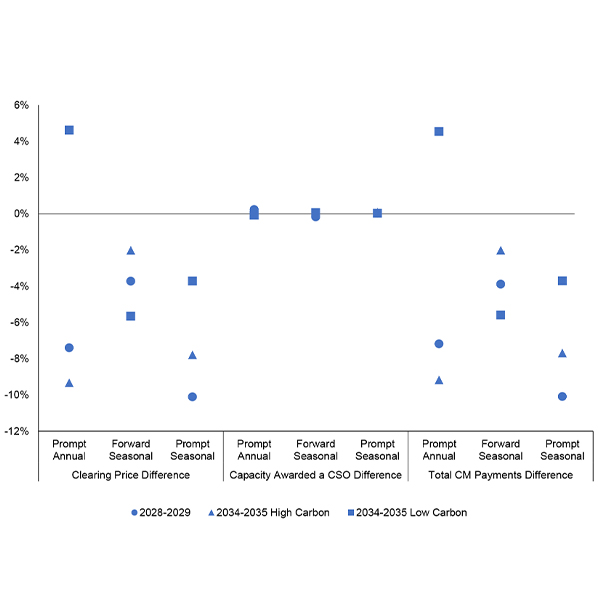

Analysis Group presented its final report on converting ISO-NE's Forward Capacity Market to a prompt, seasonal construct.

ISO-NE should move to a prompt and seasonal capacity market to better accommodate the evolving mix of resources and reliability risks in the region, Analysis Group told stakeholders at the NEPOOL Markets Committee meeting.

Want more? Advanced Search