MISO Board of Directors

MISO’s $25 billion, mostly 765-kV long-range transmission package for the Midwest region is nearing finalization, while the Independent Market Monitor continues to doubt the necessity of the projects.

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

MISO said its cost of doing business is set to escalate within the next four years, spawning bigger operating budgets and heftier member dues.

MISO’s system is at the mercy of faster interconnections of new resources and retirement delays, executives said in a quarterly address to the board and stakeholders.

MISO and its board are scrutinizing the steps they can take to preserve institutional knowledge on the board of directors as they confront half of board members reaching term limits this year and next.

Members of MISO’s Advisory Committee emphasized that all players in the footprint need to act swiftly to position themselves for “hyperscale” load growth and the EPA’s new carbon rule.

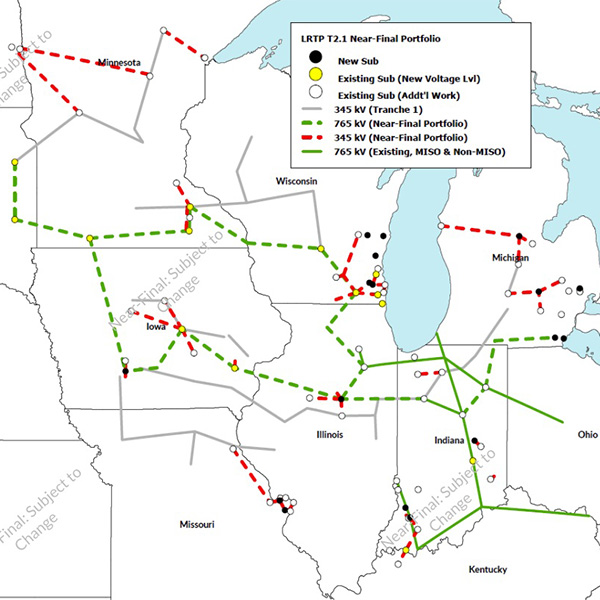

MISO reaffirmed its commitment to its second, $25 billion long-range transmission portfolio while stakeholders asked the RTO to be mindful of river crossings and whether it may reassign developers for the first LRTP portfolio’s projects in Iowa.

MISO’s imminent filing for a new capacity accreditation is a crucial first step to get ready for a more complex and challenging future, executives told attendees during March Board Week.

MISO’s Independent Market Monitor told the board the RTO must crack down on confirmations to prevent more phony demand response from infiltrating its markets.

MISO’s conceptual, $20 billion, 765-kV transmission suggestion took top billing at Board Week, with some members asserting MISO has even more transmission to plan if it wants to meet the future confidently.

Want more? Advanced Search