Demand Response

PJM operators dispatched demand response this morning after cutting voltages and calling on spinning reserves last night as frigid temperatures stressed generators and created record loads across the RTO.

The MD PSC worked with PJM to ensure new rules on demand response would not ruin the state’s “mass market” DR: EmPOWER Maryland, part of an initiative to reduce energy consumption by 15% below 2007 levels.

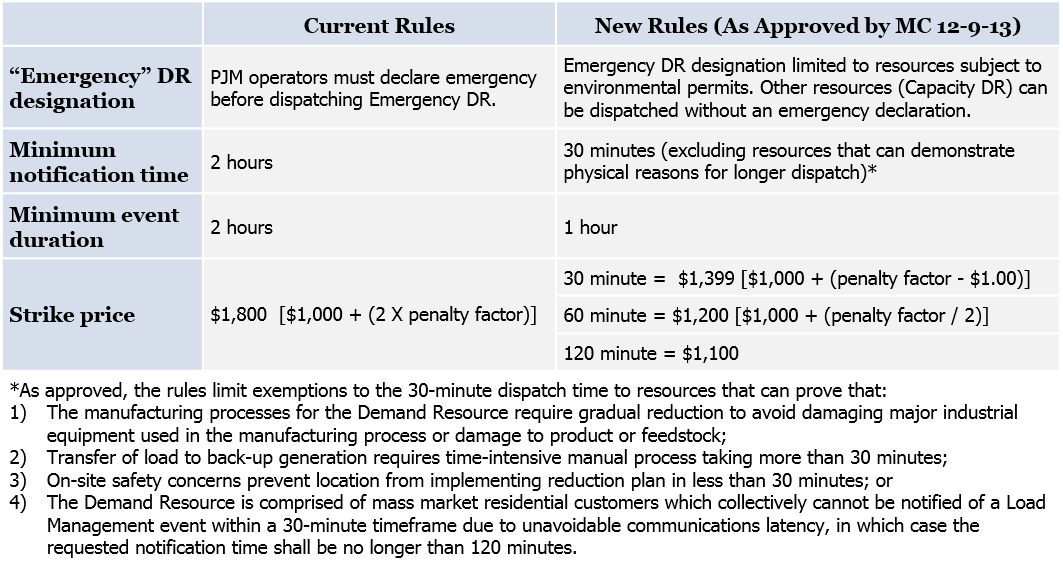

It took three tries Dec. 9 before the Members Committee reached consensus on Tariff changes that will allow PJM operators more flexibility in dispatching demand response.

Members agreed to develop rules for demand response providers requesting maintenance outages.

The volume and magnitude of changes PJM is attempting to impose on demand response raise the question of whether the high-flying sector is still a growth business or one in retreat.

Members approved a proposal giving PJM more flexibility in the way it dispatches demand response, clearing the way for a FERC filing.

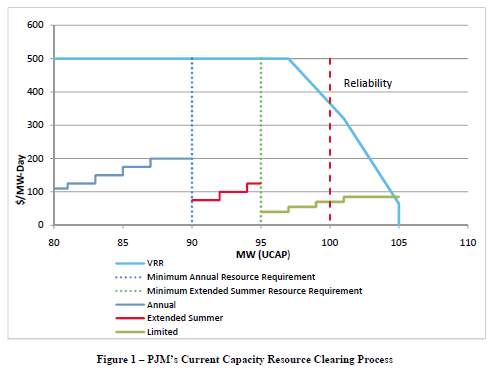

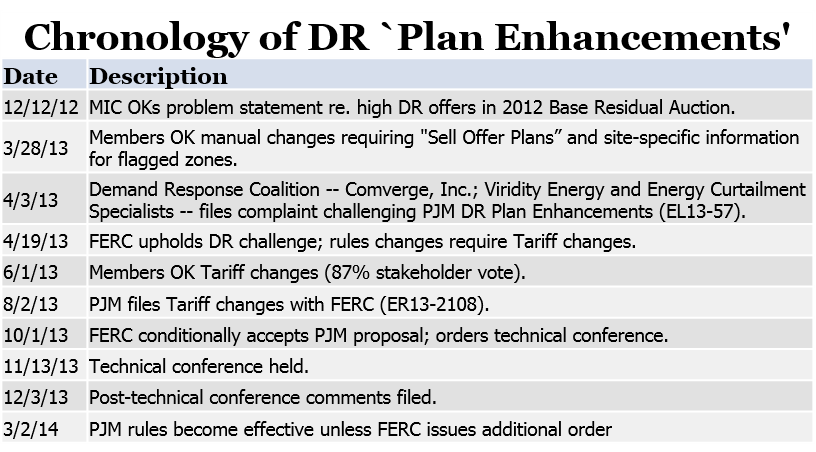

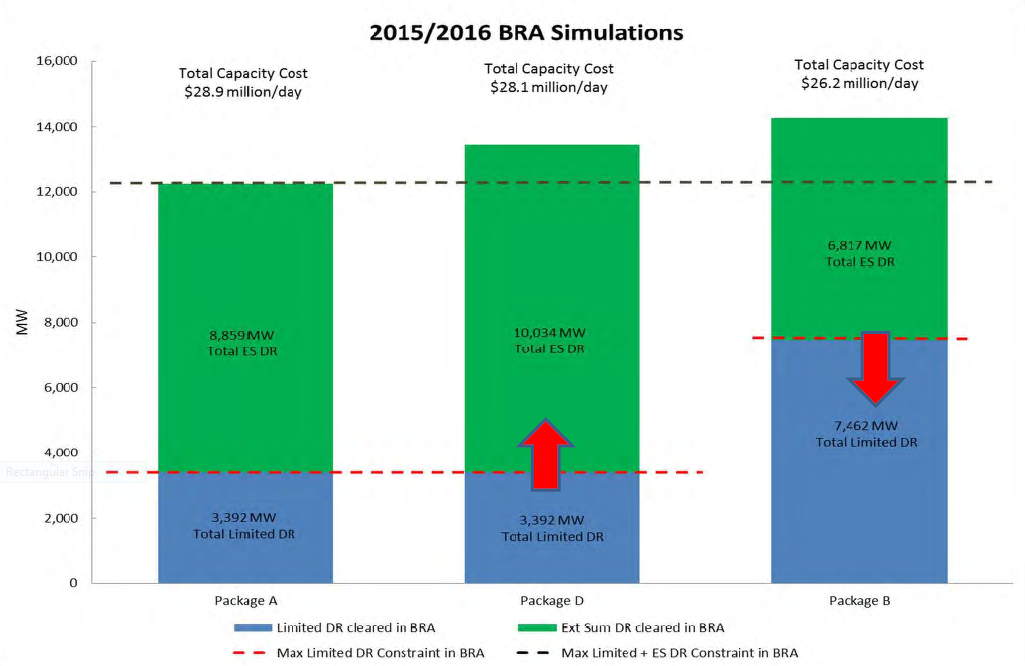

PJM asked FERC to approve changes to the capacity auction - and the way that demand response clears within it - after those changes were rejected by stakeholders.

PJM generators told FERC that it should go beyond PJM’s qualification rules for demand response providers — with some proposing that planned DR resources be banned from the capacity market.

The Market Implementation Committee will consider changes to PJM’s real-time pricing mechanism, which RTO officials say is depressing energy and reserve prices.

The PJM Board of Managers may seek FERC approval for a staff proposal to change the way demand response clears in capacity auctions despite stakeholders’ rejection of the plan.

Want more? Advanced Search