Capacity Market

The PJM Markets and Reliability Committee will consider proposed revisions to Manual 12 and Manual 13, along with several other agenda items.

PJM’s Market Implementation Committee endorsed by acclamation a proposal to revise two financial inputs to the quadrennial review to reflect changing market conditions, particularly increased interest rates.

PJM stakeholders presented several proposals to revise how energy efficiency resources are measured and verified to the Market Implementation Committee.

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

As it gears up to run its first auctions using sloped demand curves, MISO said prices and procurement would have risen had it used them in this year’s auctions.

A renewable energy trade group asked MISO to put more thought into how HVDC transmission’s ability to infuse the footprint with more external capacity could influence MISO’s capacity auctions.

MISO said it will likely split load-modifying resource participation into two options in an effort to line up their true contributions with accreditation.

Talen Energy’s deal to carve out capacity from its Susquehanna Nuclear Plant to serve a growing data center on its site drew protests at FERC from other parties who argued the deal and others like it could shift costs and threaten reliability.

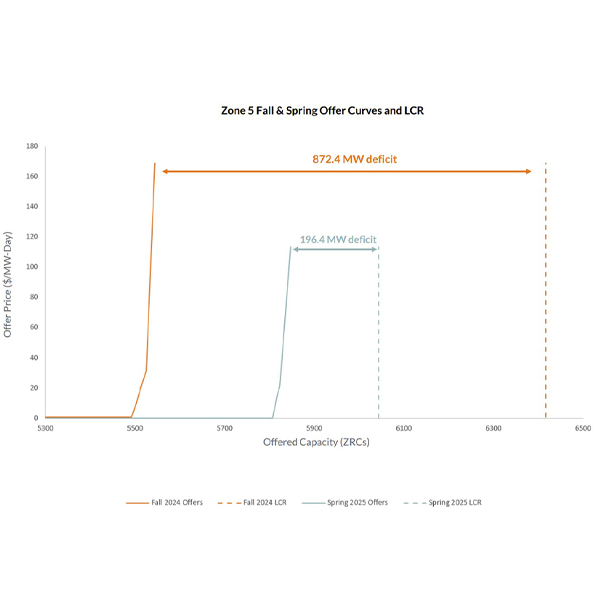

New York City saw a 221% increase in capacity costs in the first quarter due to the retirement of 600 MW in peaker plants and the increase of more than 300 MW in the local installed capacity requirement.

Want more? Advanced Search