Energy Efficiency

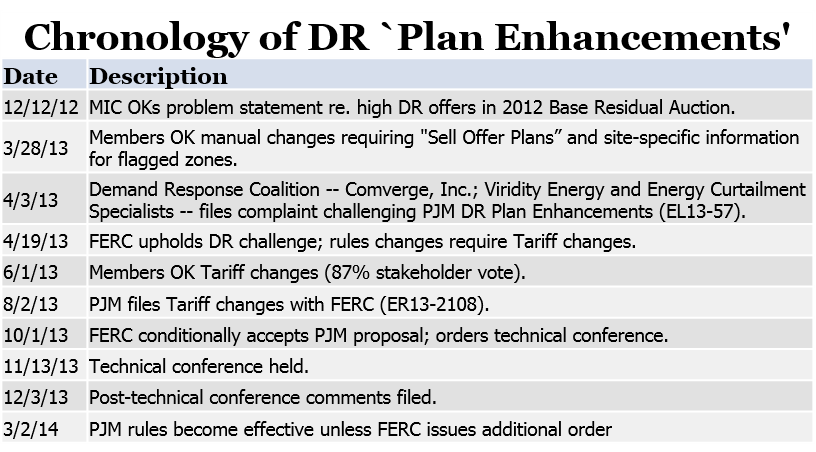

PJM asked FERC to approve changes to the capacity auction - and the way that demand response clears within it - after those changes were rejected by stakeholders.

PJM generators told FERC that it should go beyond PJM’s qualification rules for demand response providers — with some proposing that planned DR resources be banned from the capacity market.

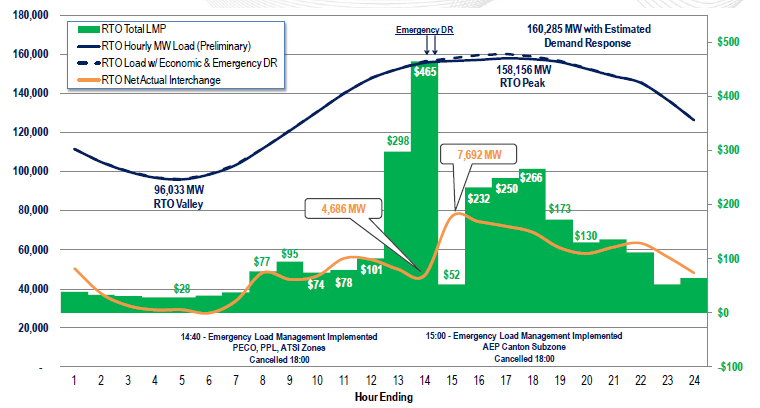

The Market Implementation Committee will consider changes to PJM’s real-time pricing mechanism, which RTO officials say is depressing energy and reserve prices.

The PJM Board of Managers may seek FERC approval for a staff proposal to change the way demand response clears in capacity auctions despite stakeholders’ rejection of the plan.

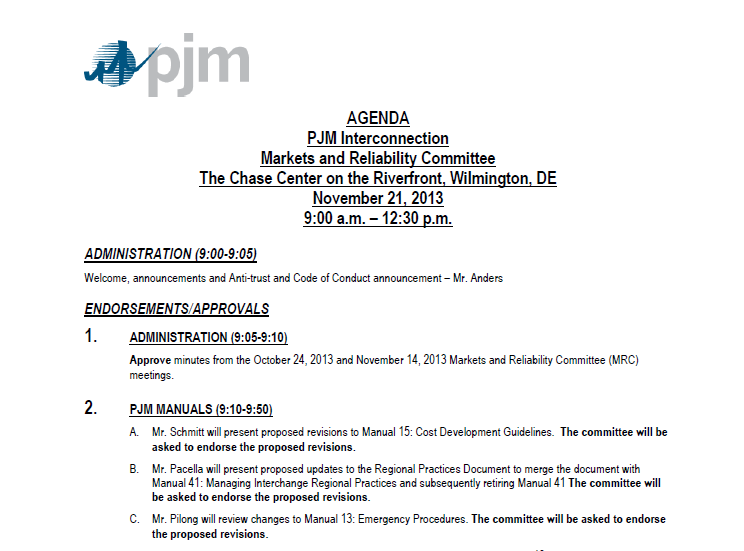

Our summary of the issues scheduled for votes at the PJM MRC and MC on 11/21/13. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage.

Federal Energy Regulatory Commission staff signaled Wednesday that the commission may require PJM to change rules requiring demand response providers to provide “sell offer plans” in order to participate in capacity auctions.

PJM proposed a change in its real-time pricing mechanism, saying the current methodology is depressing energy and reserve prices.

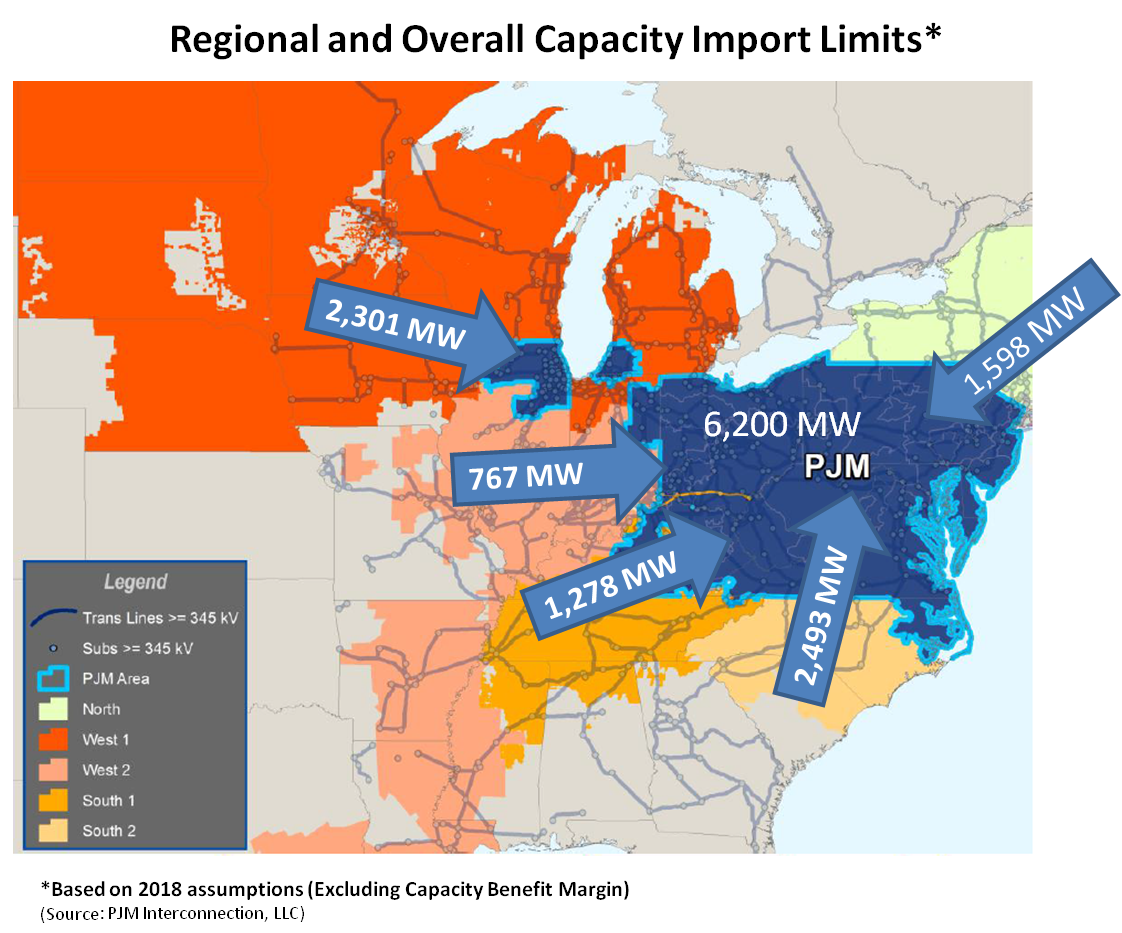

PJM will reduce the volume of imports that clear in next year’s Base Residual Auction – potentially increasing capacity prices – under methodology approved by the Planning Committee yesterday.

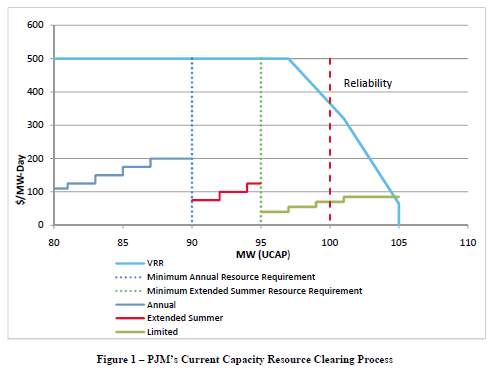

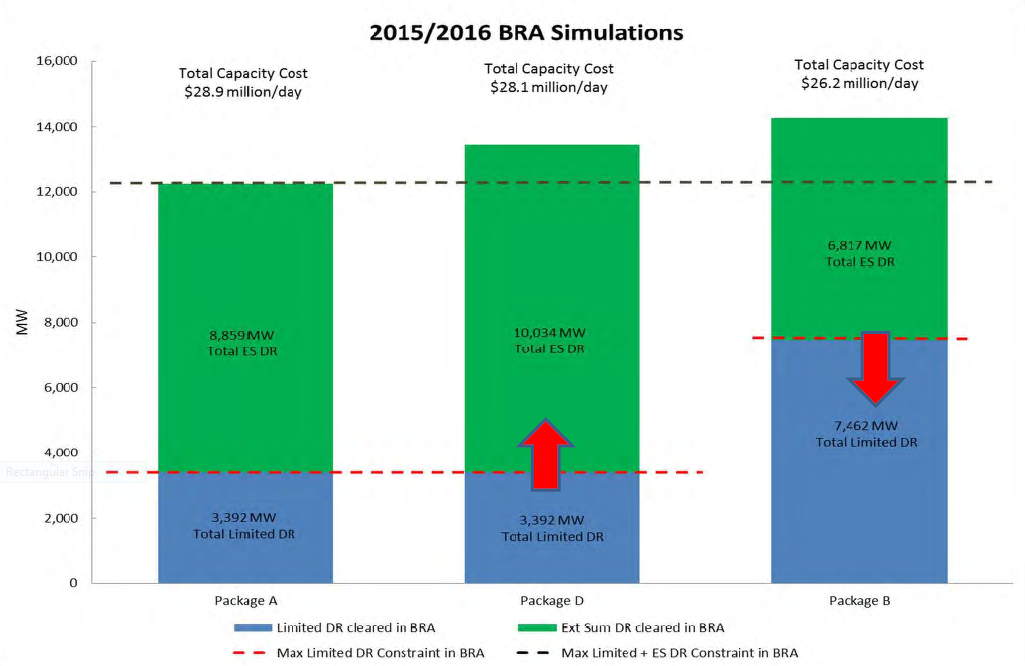

After two marathon committee meetings failed to narrow choices, members will vote beginning today on more than a dozen proposals to make demand response more flexible and eliminate arbitrage opportunities in capacity auctions.

The PJM Markets and Reliability and Members committees approved the following measures with little discussion at their October 24th meeting.

Want more? Advanced Search