Arizona Public Service (APS)

Arizona regulators are moving toward a repeal of a renewable energy standard for utilities, saying the mandate has cost ratepayers billions of dollars since it was adopted in 2006.

The development of SPP's Markets+ has picked up the pace with stakeholders agreeing on an interim governance structure and representation on the working groups that will handle much of the effort ahead.

CAISO’s Western Energy Imbalance Market provided participants with $422.44 million in economic benefits during the second quarter of 2025, up 15% compared with the same period year earlier despite no change in membership.

With data centers contributing to surging load growth, a new report suggests that more Western utilities should adopt clean transition tariffs or even make the tariffs mandatory for certain large customers.

SPP secured $150 million in financing and entered the second phase of development for its day-ahead market Markets+, the grid operator announced.

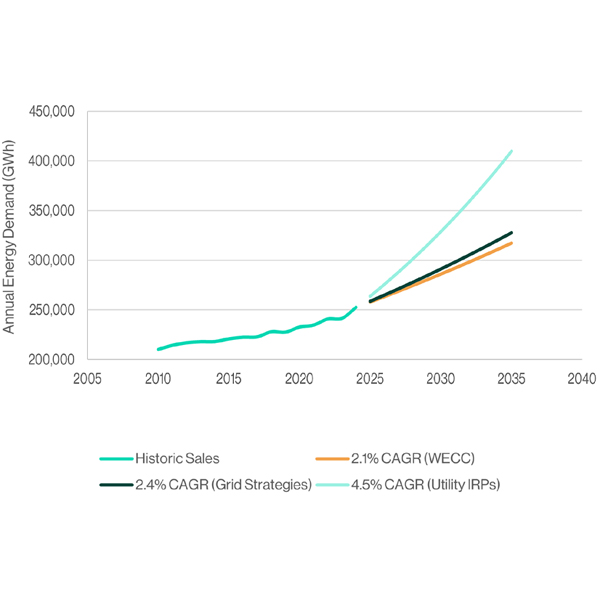

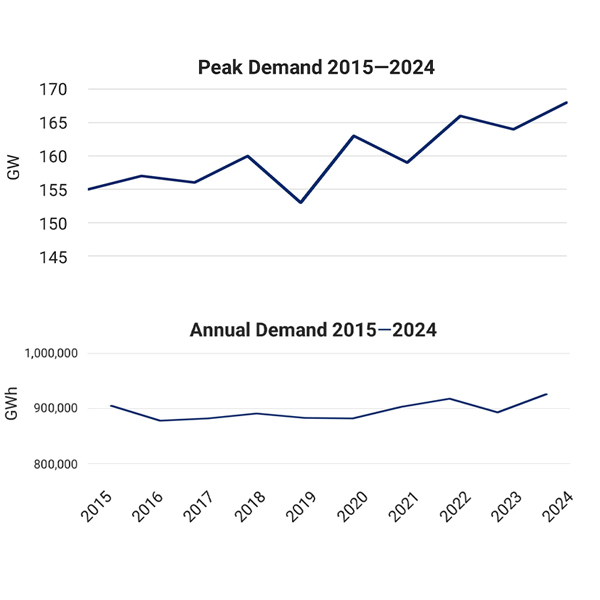

Peak demand in the Western Interconnection hit a record high of 168.2 GW in 2024, reflecting “early effects” of the growth in large loads such as data centers, according to a new WECC report.

Arizona utilities are seeking U.S. Department of Energy funding to help plan for additional nuclear power facilities in the state.

Bonneville's final record of decision will come as little surprise to those who’ve been following market developments in the West.

APS officials said they are looking to a non-coal future for the recently closed Cholla coal-fired power plant, despite President Donald Trump’s calls to keep the facility running.

FERC’s approval of SPP’s Markets+ funding agreement and its recovery mechanism came as backers of the Western centralized day-ahead market were meeting with the snow-capped Rockies as a backdrop.

Want more? Advanced Search