Bonneville Power Administration (BPA)

The senators representing Oregon and Washington urged the agency to delay its decision to join a Western day-ahead electricity market until developments play out further around SPP’s Markets+ and CAISO’s EDAM.

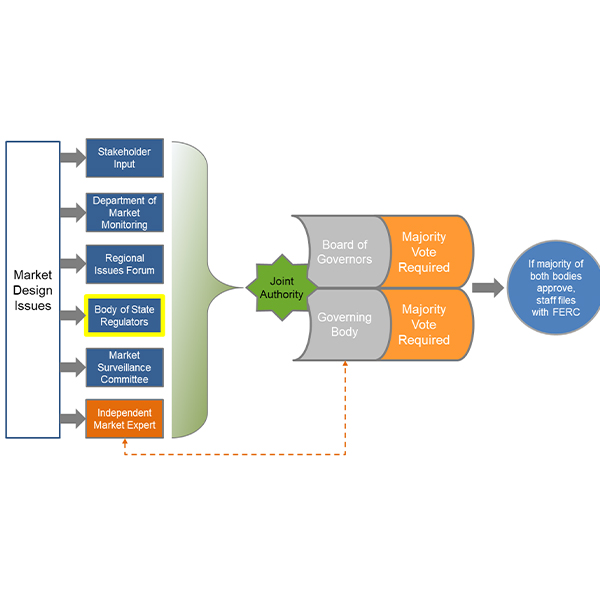

CAISO will recommend its board approve a proposal to eventually give the WEM Governing Body increased authority over both the Western EIM and EDAM.

The Bonneville Power Administration is ramping up its engagement with the West-Wide Governance Pathways Initiative, an executive with the federal power agency said.

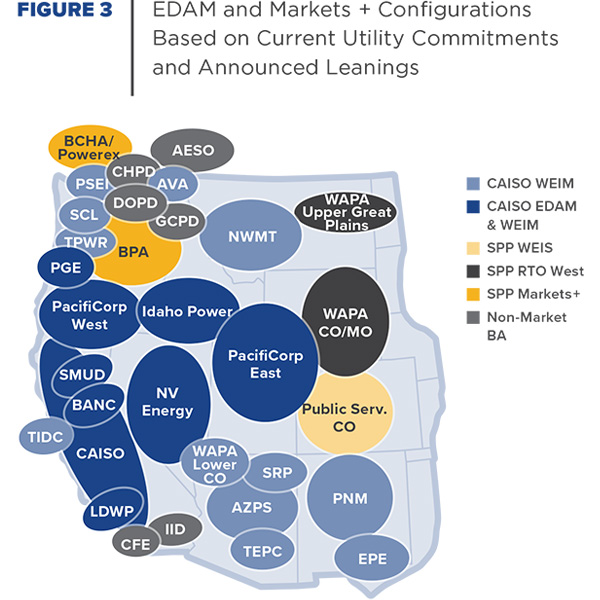

A new study commissioned by Renewable Northwest says Powerex is poised to benefit if the West ends up divided between CAISO’s EDAM and SPP’s Markets+.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

FERC rejected PacifiCorp’s request to include in its Open Access Transmission Tariff the interest it pays when refunding advance payments such as interconnection study deposits.

BPA’s choice of a day-ahead market will not be driven by concerns about the impact of the seams that would divide the two markets proposed for the West, an agency official made clear.

Utility staff charged with managing real-time operations will be equipped to deal with the seams between two Western day-ahead markets, but the situation will be far from ideal, Western state energy officials heard at the CREPC-WIRAB spring conference.

More than two dozen Western electricity sector entities sent a letter to SPP expressing support for the continued development of the RTO’s Markets+, which is competing for participants with CAISO’s Extended Day-Ahead Market.

The Bonneville Power Administration released a much anticipated staff report that tentatively recommends the agency choose SPP’s Markets+ over CAISO’s Extended Day-Ahead Market.

Want more? Advanced Search