CAISO Department of Market Monitoring (DMM)

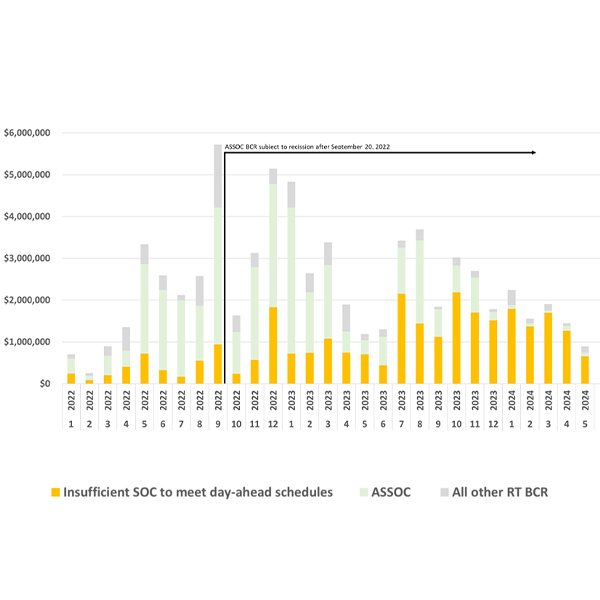

Batteries may be receiving excessive or inefficient bid cost recovery payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

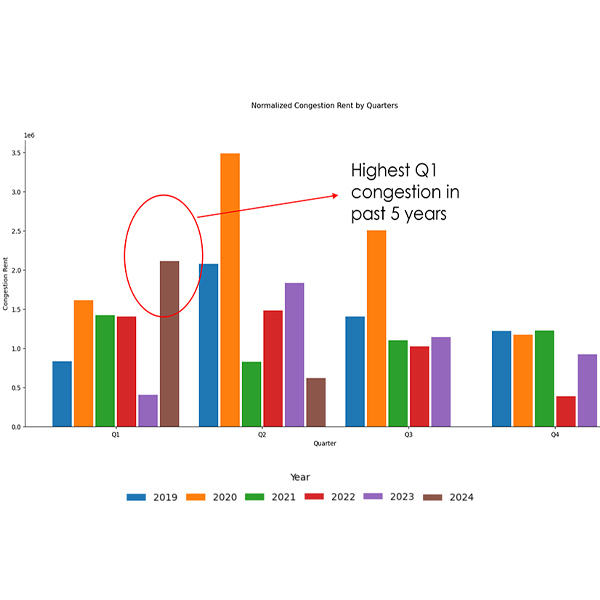

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

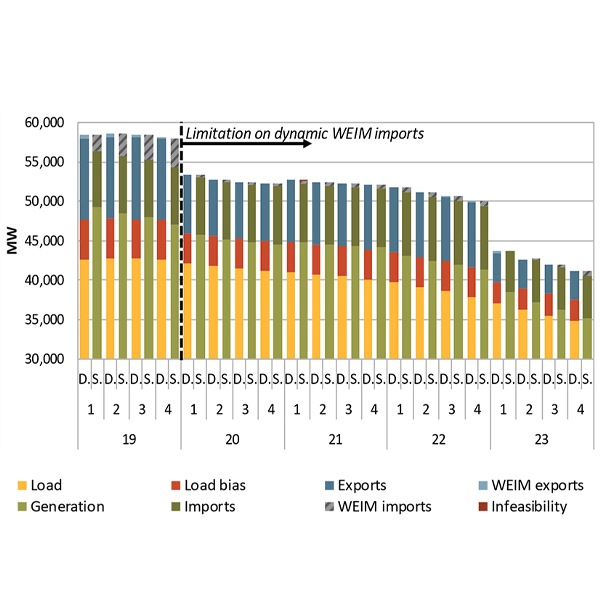

CAISO's Department of Market Monitoring found that limits on WEIM imports last year led to increased transmission congestion in the ISO's markets.

CAISO's Department of Market Monitoring explained that self-scheduled exports to support stressful conditions led to the declaration of emergency alerts in July.

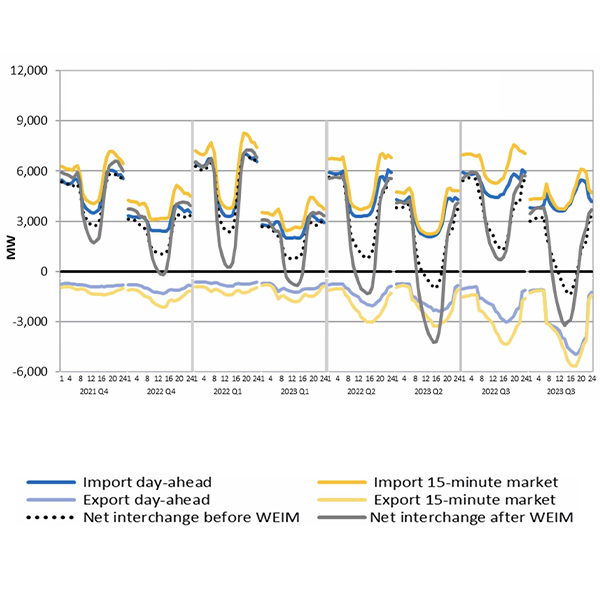

CAISO’s net energy exports have increased sharply this year, with imports being displaced by increased output from California’s hydroelectric and natural gas resources.

FERC fined independent power producer AES $6 million for failing to fulfill RA obligations related to eight of the company’s 12 generating units operating in Southern California.

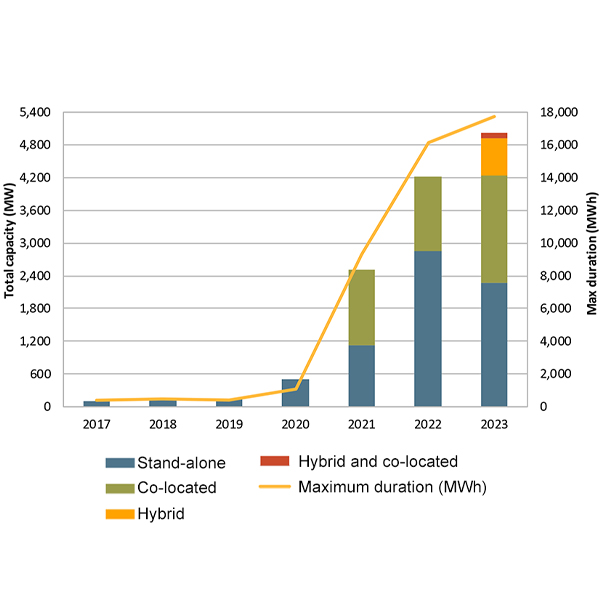

The more than 5,000 MW of batteries connected to the CAISO grid are playing in increasing role in maintaining reliability, a report from the ISO's Market Monitor shows.

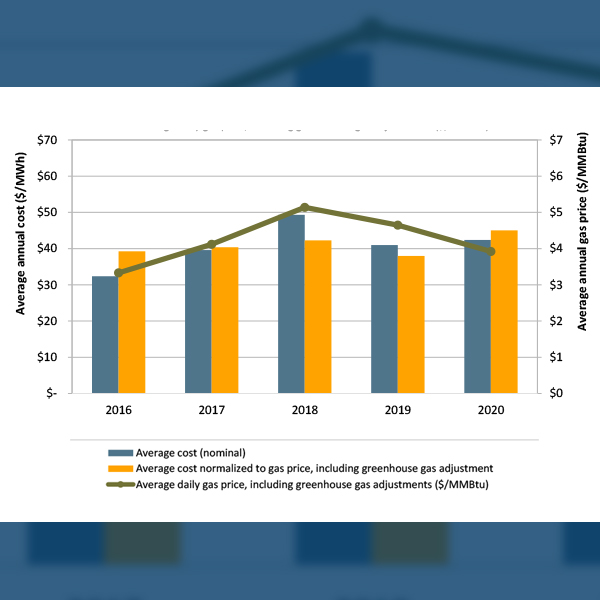

Low hydro output, a summer heat wave and high prices during evening ramps helped boost CAISO’s load-serving costs by 3% last year despite lower gas prices.

CAISO’s Market Monitor found no evidence of market manipulation or strategic outages during the rolling blackouts of mid-August.

CAISO won FERC approval for its second effort to allow generators to recover the costs of higher natural gas prices.

Want more? Advanced Search