CAISO Extended Day-Ahead Market (EDAM)

The CREPC-WIRAB spring meeting focused on regional markets and transmission planning in the West, including FERC's recent transmission planning NOPR.

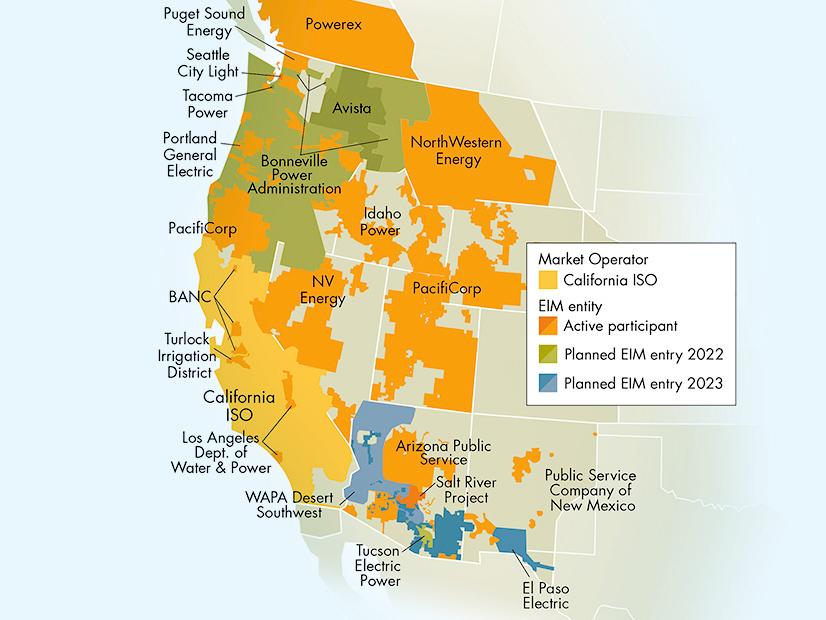

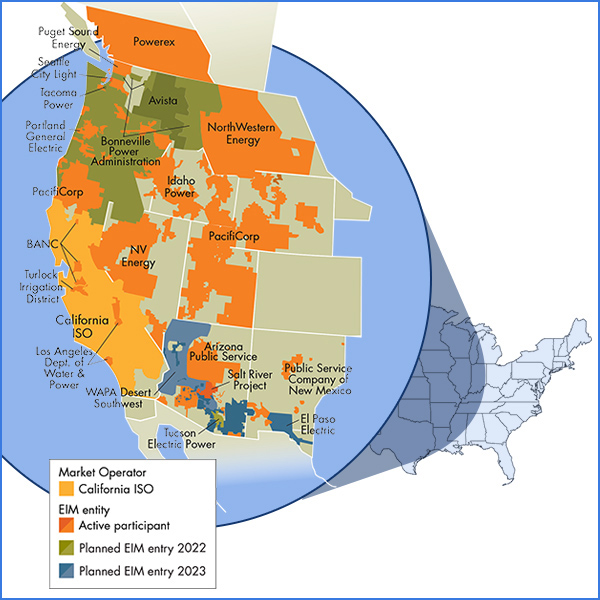

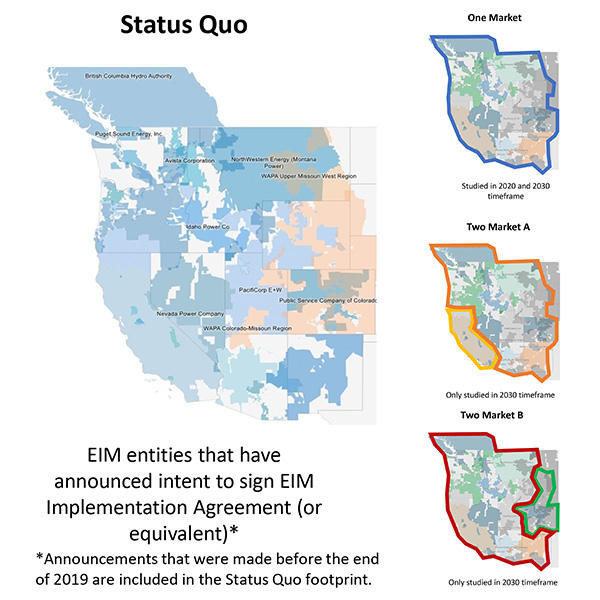

CAISO issued a straw proposal for its extended day-ahead offering in the Western Energy Imbalance Market, a renewed effort at greater Western regionalization.

A group of Western utilities plans to help SPP develop its Markets+ program in the West and to examine the benefits of joining it or CAISO's day-ahead market.

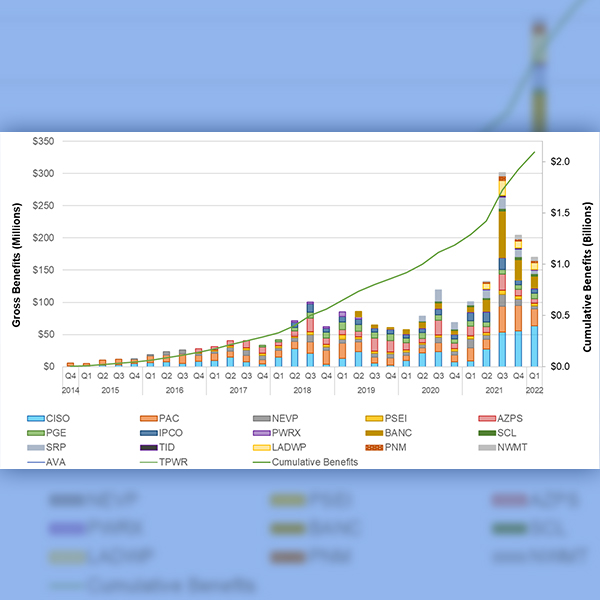

CAISO's Western Energy Imbalance Market surpassed $2 billion in total member benefits only 20 months after hitting the $1 billion mark in 2020.

CAISO, SPP and the Western Power Pool are all maneuvering to organize the Western electricity sector, and conditions finally seem ripe for change.

CAISO's Board of Governors extended controversial wheel-through restrictions for two more years as the ISO works on a long-term fix to transmission constraints.

Three stakeholder working groups charged with designing key elements of CAISO’s proposed extended day-ahead market for the Western EIM began meeting this week.

CAISO intends in 2022 to focus on long-term transmission planning, interconnecting storage and extending the real-time Western EIM to a day-ahead market.

CAISO restarted the stakeholder process to expand its Western Energy Imbalance Market from a real-time to a day-ahead interstate market after a 14-month break.

FERC commissioners told an audience of Western stakeholders and regulators that they back the formation of a Western RTO; California can't go it alone.

Want more? Advanced Search