El Paso Electric (EPE)

ERCOT told Texas regulators its initial reliability study of the Permian Basin indicates “substantial amounts” of transmission projects will be needed to meet its projected load by 2038.

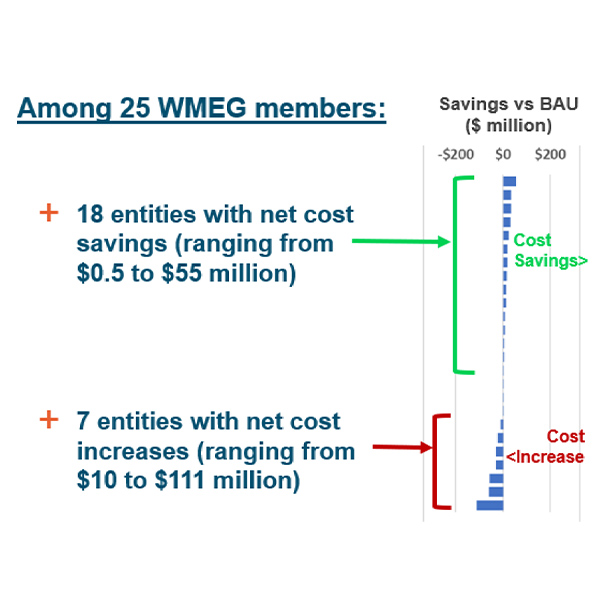

Despite the recent release of results from a study on the two competing day-ahead markets in the West, two New Mexico utilities said they need to conduct more analysis before they make a choice.

The New Mexico Public Regulation Commission will dive into a report on the financial implications of a Western day-ahead electricity market.

FERC issued an order that J.P. Morgan Investment Management qualified as an affiliate of Mankato Companies and IIF US Holding 2, through which it is tied to other firms including El Paso Electric.

State regulators have launched a process to develop “guiding principles” regarding participation in a regional day-ahead market or RTO.

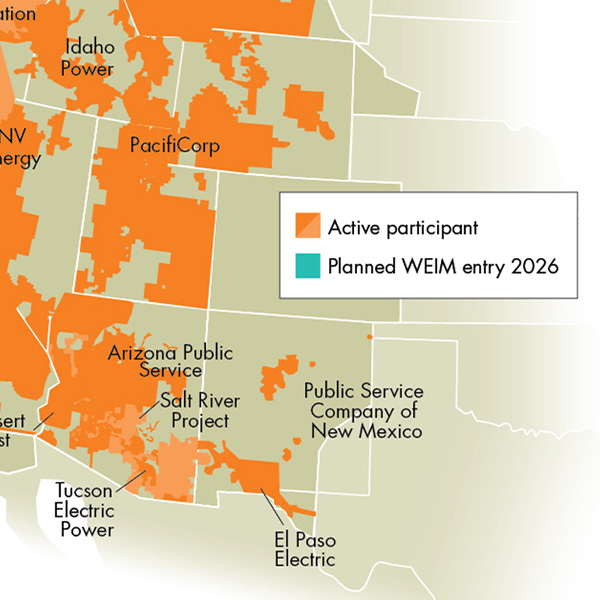

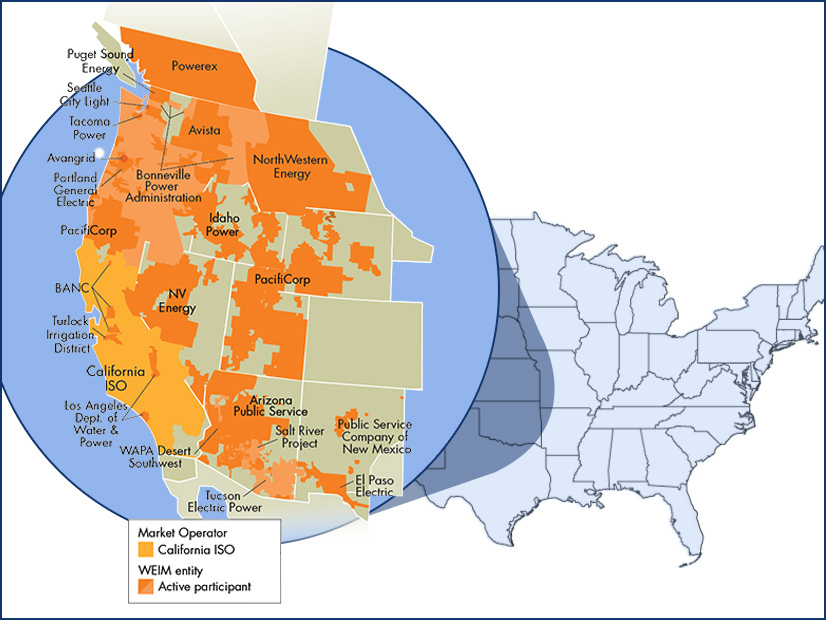

Three new entities joined CAISO's Western Energy Imbalance Market, including El Paso Electric, which expanded the market into Texas for the first time.

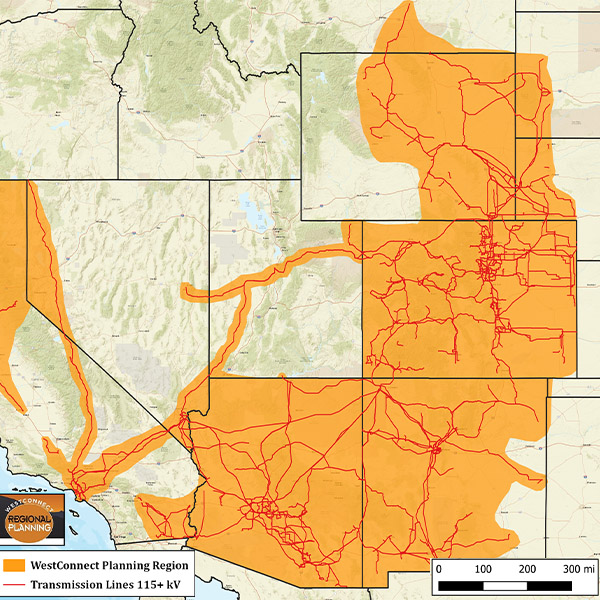

FERC rejected a proposed settlement intended to resolve a longstanding dispute over how to implement Order 1000 in the WestConnect planning region.

NERC hasn't yet issued its annual Winter Reliability Assessment, but it's clear that it is concerned about the electric industry’s readiness for severe weather.

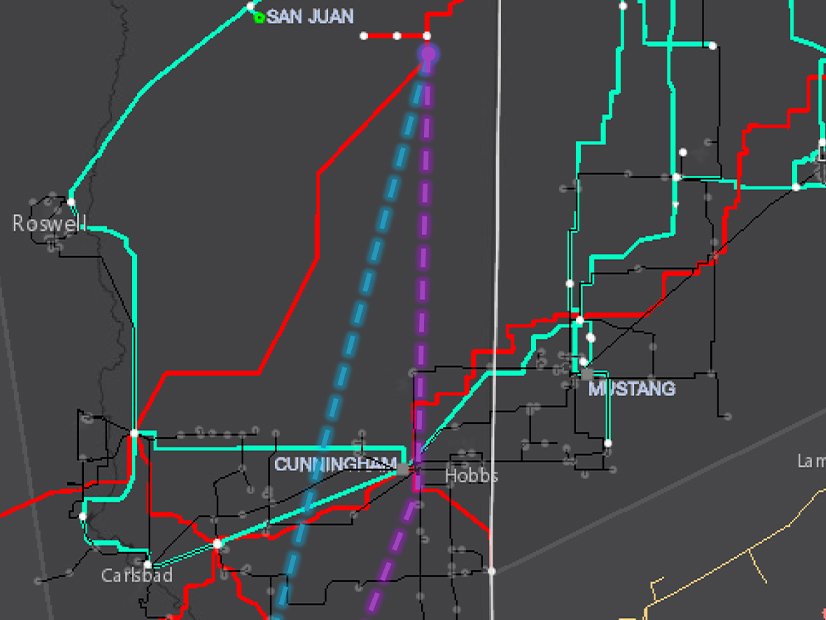

SPP’s Board of Directors approved stakeholders’ recommendation to issue a notification to construct a 345-kV double-circuit transmission project in New Mexico.

FERC and NERC continue to gather information from utilities, generators and grid operators on maintaining electric reliability during severe cold weather.

Want more? Advanced Search