FERC Office of Enforcement

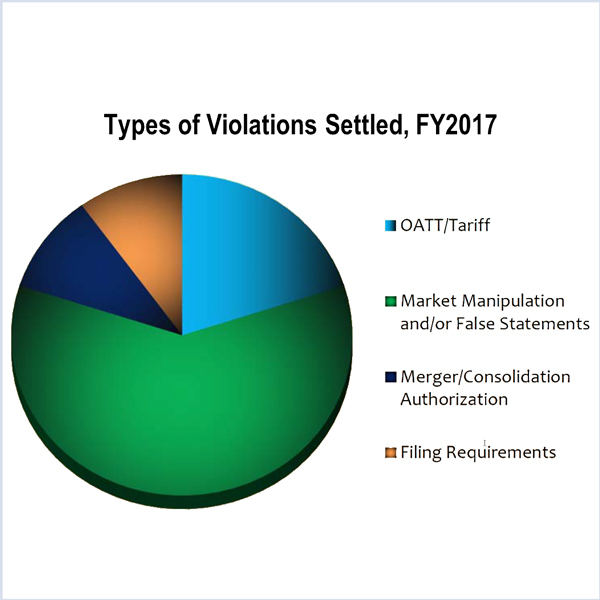

The FERC Office of Enforcement opened 27 investigations in fiscal year 2017, 10 more than the year before, according to its 11th annual report.

FERC agreed to sharply reduce the penalty Barclays Bank must pay to settle claims that it manipulated Western electricity markets a decade ago.

ATC agreed to pay a fine and undergo a year of monitoring after failing to report more than 60 agreements and transactions to FERC over the past 16 years.

Westar will pay a penalty of $180K for submitting inaccurate mitigated energy offer curves to SPP under a settlement with FERC’s Office of Enforcement.

K. Stephen Tsingas and his City Power Marketing agreed to a $11.7 million settlement with FERC's Office of Enforcement over market manipulation allegations.

Maxim Power has closed a deal to sell its U.S. subsidiary and its five plants, concluding a two-year effort to stave off threats to the company’s survival.

In a settlement approved by FERC's Office of Enforcement, GDF SUEZ will will pay almost $82 million to PJM to settle market manipulation charges.

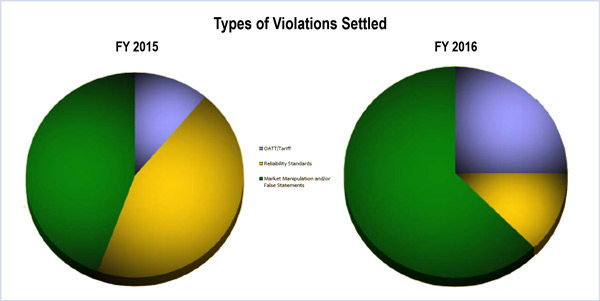

Market manipulation cases dominated FERC enforcement efforts in fiscal 2016, according to the Office of Enforcement’s 10th annual report.

FERC has been ordered to pay attorney’s fees for stonewalling the STS Energy Partners request for documents under the Freedom of Information Act (FOIA).

Maxim Power will pay $8 million to settle a FERC complaint that it manipulated the New England power market in a fuel-switching scheme.

Want more? Advanced Search