investment tax credit (ITC)

Colorado regulators approved 3.2 GW of new resources requested by Public Service Company of Colorado under an expedited approval process designed to take advantage of soon-expiring federal tax credits.

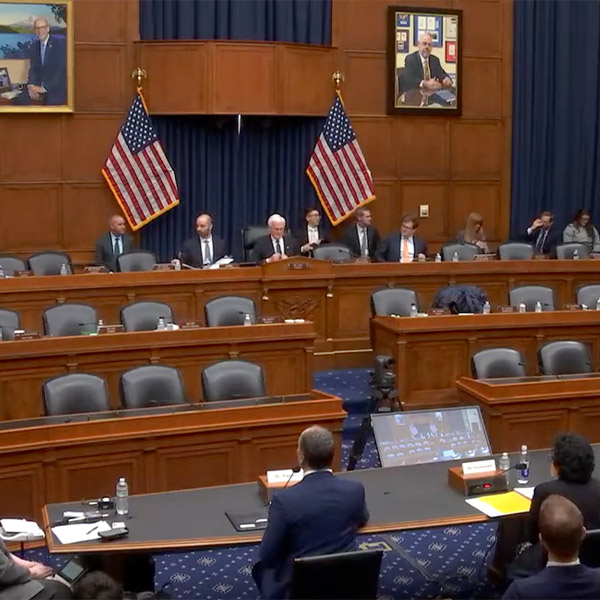

At an oversight hearing on new nuclear capacity, the two parties touted recent bipartisan legislation as helping move things forward, but Democrats said Trump administration cuts and moves to curb the NRC's independence creates crosswinds.

A California PUC judge has proposed the commission order an additional 6 GW of capacity for the state between 2029 and 2032 to get ahead of disappearing federal tax credits and loans for renewable energy resources.

The California PUC is recommending the state build an additional 68.5 GW of new solar generation resources by 2045, despite new tariffs on imports and the planned elimination of federal tax credits.

New York launched a renewable energy solicitation enlisting multiple agencies to expedite the process and get as many projects as possible approved while they still can qualify for federal tax credits.

As solar development companies race to meet the deadlines by which they can secure federal investment tax credits before the program expires, developers see a better-than-expected short-term outlook but a grim long term.

The Trump administration is tightening the rules on qualifying for tax credits on new wind and solar construction, but not as much as some feared it would.

American Electric Power and Xcel Energy say clean energy projects are still a part of their plans, despite the hurdles placed in front of them by the federal government’s budget reconciliation bill.

The expedited phaseout of federal tax incentives for renewables threatens projects and jobs across the clean energy industry in New England.

The U.S. Senate met through the weekend and overnight June 30 to work on Republicans’ budget reconciliation bill, passing it 51-50 with Vice President JD Vance casting the tiebreaking vote.

Want more? Advanced Search