Midcontinent Independent System Operator (MISO)

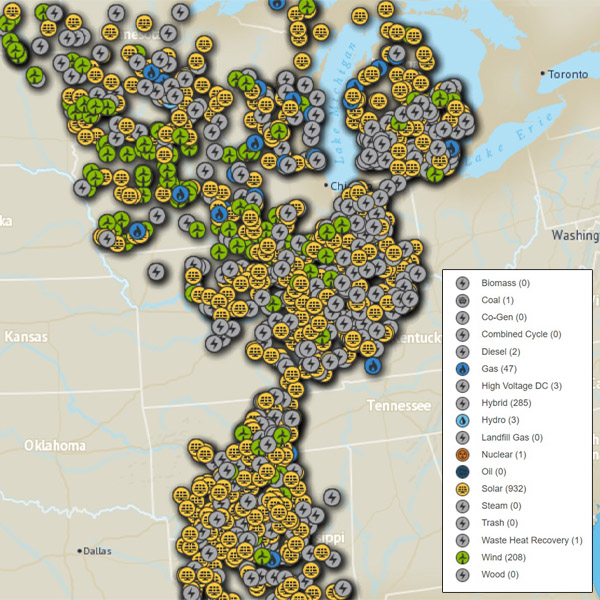

MISO plans to pursue a more straightforward, 50% peak load megawatt cap to limit the number of generator interconnection requests it will accept annually.

Coal plants in the Central U.S. are elbowing out lower-cost, cleaner generation and have collected more than $1 billion in uneconomic payments over a three-year span, the Natural Resources Defense Council said in a new report.

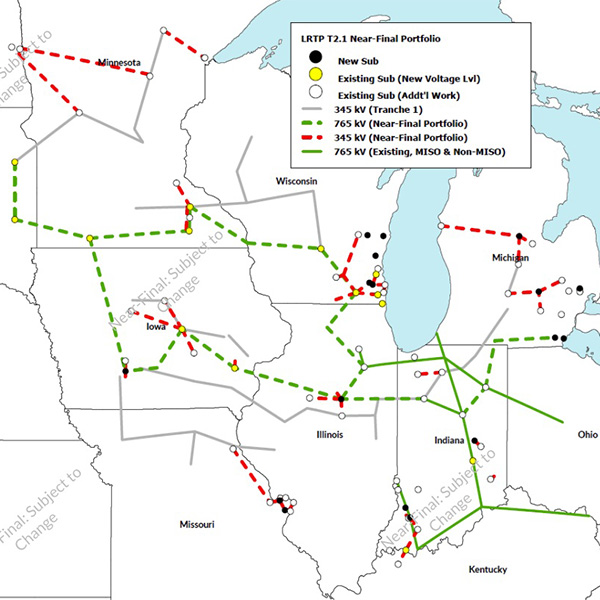

MISO’s $25 billion, mostly 765-kV long-range transmission package for the Midwest region is nearing finalization, while the Independent Market Monitor continues to doubt the necessity of the projects.

A band of Michigan utilities wants the option to decline MISO’s affected system-style studies on distributed energy resources.

MISO has announced that its longtime second in command will retire at the end of the year.

A group of utilities have filed for rehearing of a show cause order FERC issued in June that could change the practice of who pays for interconnection lines at four ISO/RTOs.

Clean energy nonprofits continued to try to persuade Entergy and MISO South state commissioners to embrace a broader view of cost allocation for an upcoming long-range transmission portfolio the RTO intends for the subregion.

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

MISO said stakeholders have convinced it to design an off switch on its proposed $10,000/MWh value of lost load to use during extended load-shedding events.

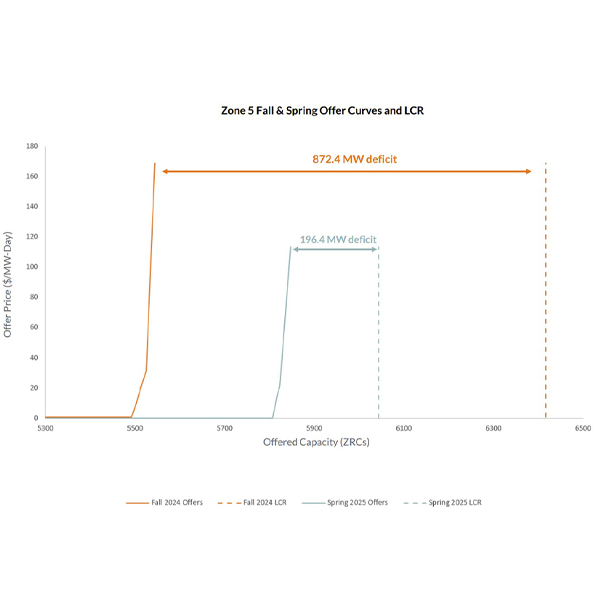

As it gears up to run its first auctions using sloped demand curves, MISO said prices and procurement would have risen had it used them in this year’s auctions.

Want more? Advanced Search