Midcontinent Independent System Operator (MISO)

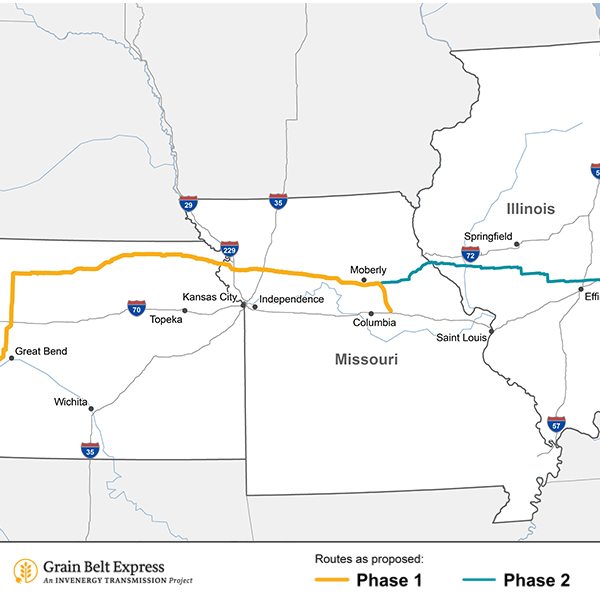

DOE has terminated its $4.9 billion conditional loan commitment for the long-delayed Grain Belt Express project, saying it is “not critical” for the federal government to support the project.

FERC approved a controversial MISO proposal to create a fast lane for certain reliability-related projects in the RTO’s interconnection queue — just two months after rebuffing an earlier version of the plan.

FERC sided with MISO IMM David Patton, denying a petition from MISO that would have prevented the RTO from reimbursing the Monitor for reviewing the market impact of transmission planning.

MISO has filed with FERC to impose more exacting testing on its demand response resources in an effort to deflect fraud.

MISO is free to keep working toward its 2030 goal of fully incorporating aggregators of distributed energy resources into its markets without an interim participation option.

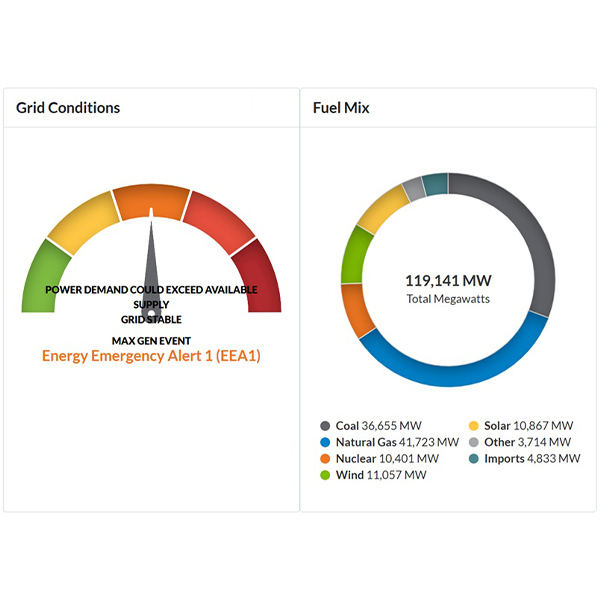

MISO stakeholders are skeptical of the RTO’s proposed new approach to divvying up reliability obligations among load-serving entities based on evolving system risk.

The Southern Renewable Energy Association appeared before Entergy’s state regulators to urge them to think twice before considering leaving MISO for the Southeast Energy Exchange Market.

MISO’s Independent Market Monitor has expressed lingering dissatisfaction with NERC’s Long-Term Reliability Assessment, even with potentially corrected values.

MISO’s Independent Market Monitor has released four new market improvement recommendations concerning transmission congestion, the Midwest-South transmission link, market-to-market coordination and price settlements after grid devastation.

MISO debuted a code of conduct for its stakeholder meetings that forbids rude or callous language, deliberate meeting disruptions or disregarding committee chairs’ instructions.

Want more? Advanced Search