New Mexico Public Regulation Commission (NM PRC)

El Paso Electric again is seeking regulatory approval for its New Mexico renewable energy plan after resolving tariff-related cost uncertainty of a solar-plus-storage procurement proposed in the plan.

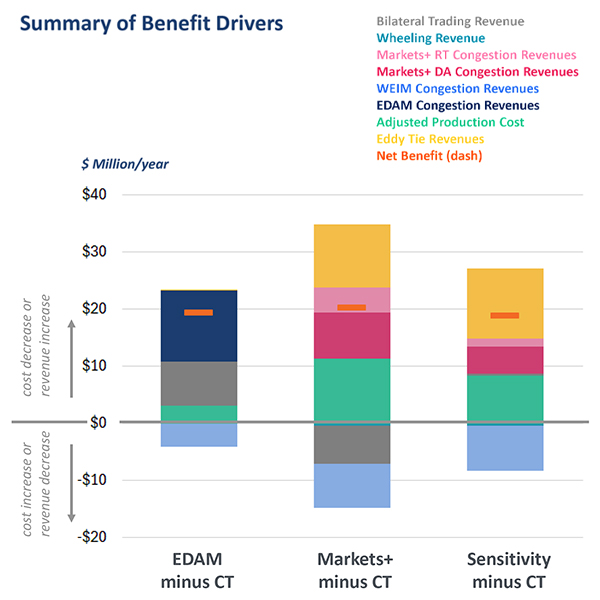

State regulators approved an accounting order for Public Service Company of New Mexico’s participation in CAISO’s Extended Day-Ahead Market, in a case that rekindled the debate over which day-ahead market PNM should choose.

California lawmakers have passed a landmark bill that will allow CAISO to transition the governance of its markets to the independent “regional organization” envisioned by the West-Wide Governance Pathways Initiative.

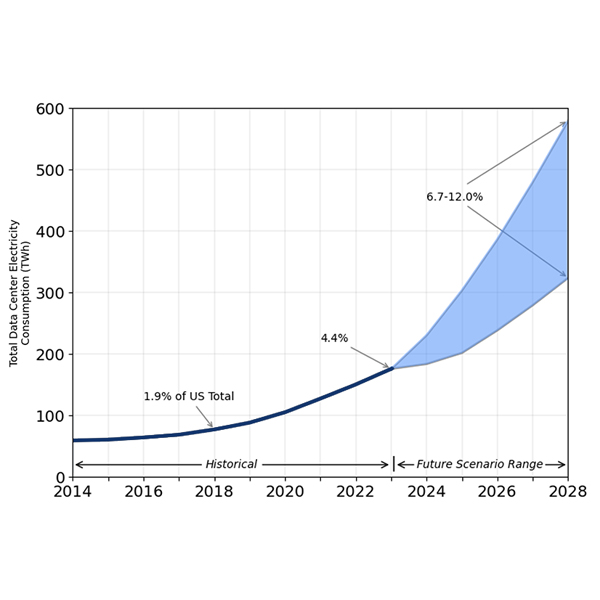

As regulators grapple with rate design for large customers such as data centers, some experts are pointing out the transparency benefits of tariffs compared to special contracts between the utility and customer.

PNM will provide $175 million in benefits to customers and New Mexico as part of Blackstone Infrastructure’s acquisition of its parent company, TXNM Energy.

CREPC TC, in collaboration with Energy Strategies, issued its first transmission cost allocation study to provide the Western electricity industry with guidelines on how to tackle the thorny issue.

Public Service Company of New Mexico made it official: The utility signed an implementation agreement to begin participating in CAISO’s Extended Day-Ahead Market in fall 2027.

With winter storms, load sheds and tight operating conditions, 2025 has turned out to be “quite a challenging year” for SPP.

The New Mexico Legislature passed a handful of energy-related bills, including one that would boost advanced grid technologies, which are seen as a way to make the grid more efficient and potentially reduce the need to build new transmission lines.

A recent study that contributed to El Paso Electric’s decision to join SPP’s Markets+ rather than CAISO’s Extended Day-Ahead Market has raised questions among New Mexico regulators.

Want more? Advanced Search