NYISO Installed Capacity/Market Issues Working Group (ICAP-MIWG)

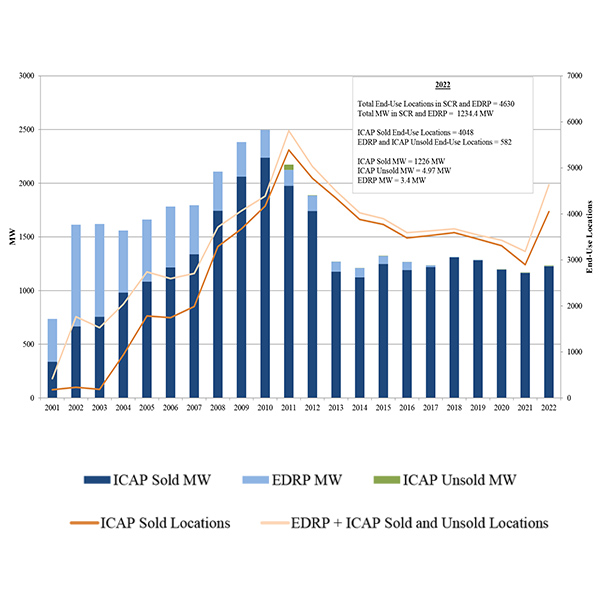

NYISO is proposing to increase the required duration of special-case resources' load curtailment from four hours to six following a survey showing stakeholder support as part of the ISO’s Engaging the Demand Side initiative.

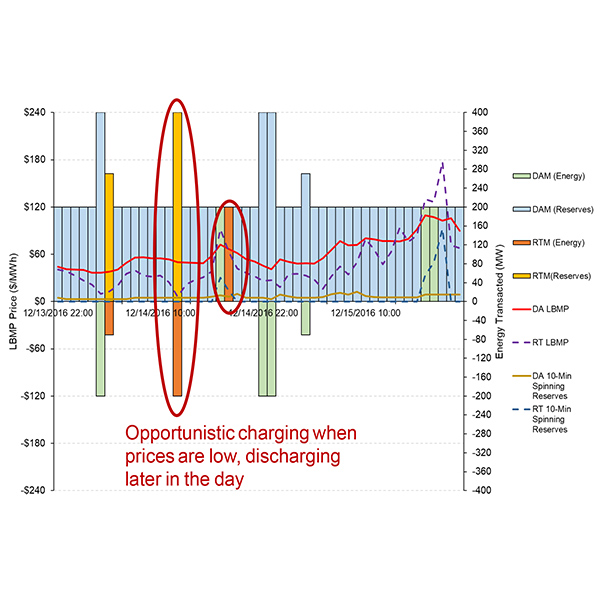

The NYISO Business Issues Committee approved proposed tariff changes to allow energy storage resources co-located with a dispatchable generator behind a single point of interjection to participate in the markets.

NYISO initiated steps toward integrating hydrogen into its market, aiming for technology-agnostic rules to foster clean energy innovation.

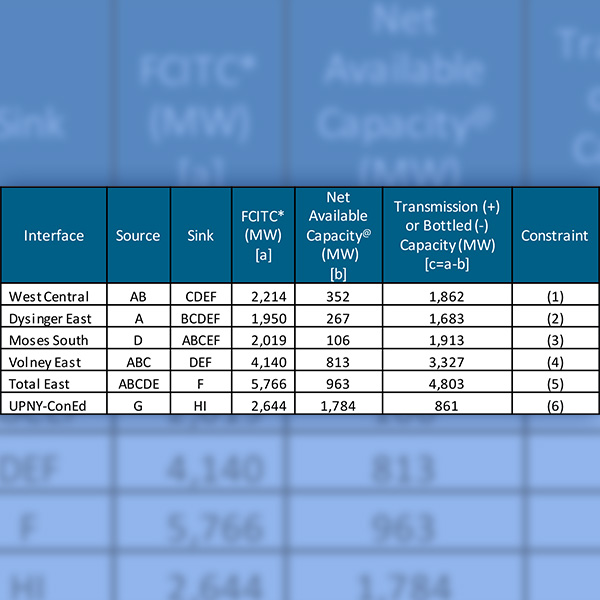

The ISO's New Capacity Zone study indicates that New York's six highway interfaces have sufficient transmission capacity, making establishment of new capacity zones unnecessary.

NYISO stakeholders continued their criticism of the ISO’s effort to improve its demand response programs, saying it has inadequately addressed their concerns.

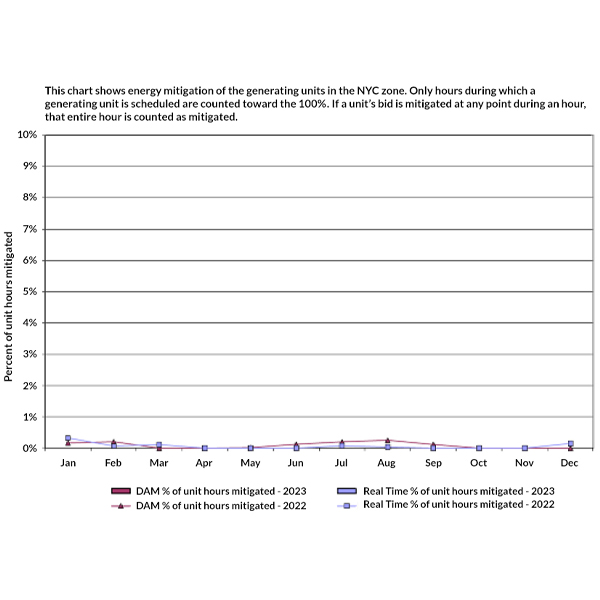

NYISO said a market software problem identified this year in the day-ahead and real-time ancillary services markets had a negligible financial impact and did not result in any market manipulation.

NYISO secured Business Issues Committee approval of the ISO’s proposal to create separate capacity demand curves for summer and winter beginning with the 2025/2026 capability year.

NYISO has begun the process of studying how energy storage resources can be considered as traditional transmission assets.

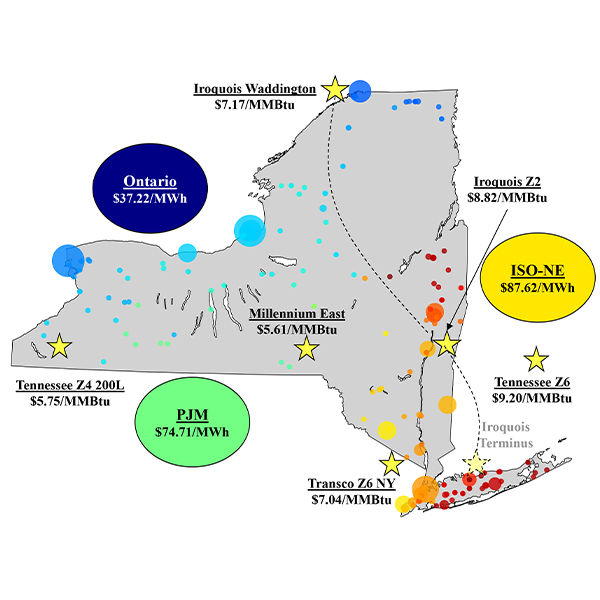

NYISO needs to improve shortage pricing and create smaller capacity zones, the ISO’s market monitoring unit reports in its 2022 State of the Market report.

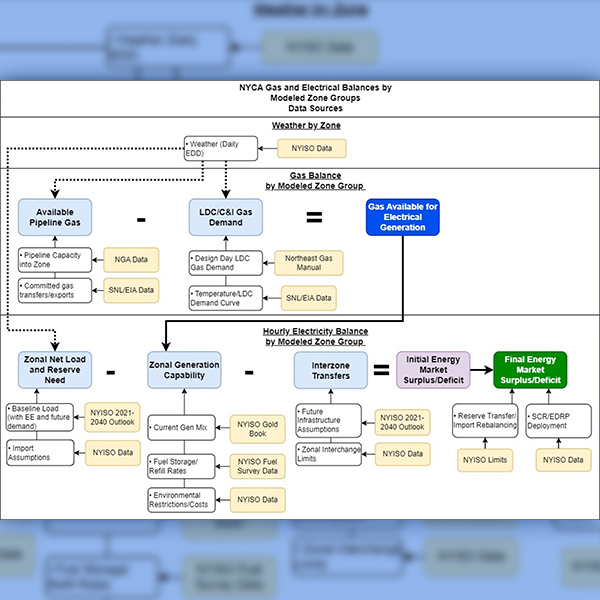

An upcoming fuel and energy security study will examine the combined impacts of electric generation trends and extended cold snaps on NYISO system reliability.

Want more? Advanced Search