PJM Interconnection LLC (PJM)

FERC approved a settlement between PJM and 81 parties to reduce the $1.8 billion in penalties assessed against generators that underperformed during Winter Storm Elliott.

FERC Commissioner Mark Christie used orders on two transmission projects to blast the commission’s “ridiculously generous” incentives.

The PJM Markets and Reliability Committee will consider endorsement of two competing proposals to implement multi-schedule modeling, while the Members Committee will endorse representatives for the Finance Committee.

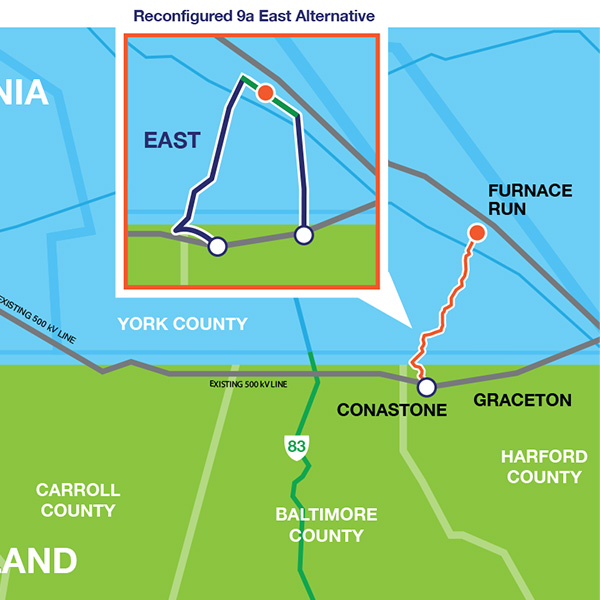

A federal court overturned Pennsylvania regulators’ rejection of the Independence Energy Connection, but the project’s fate depends on a PJM benefit-cost analysis.

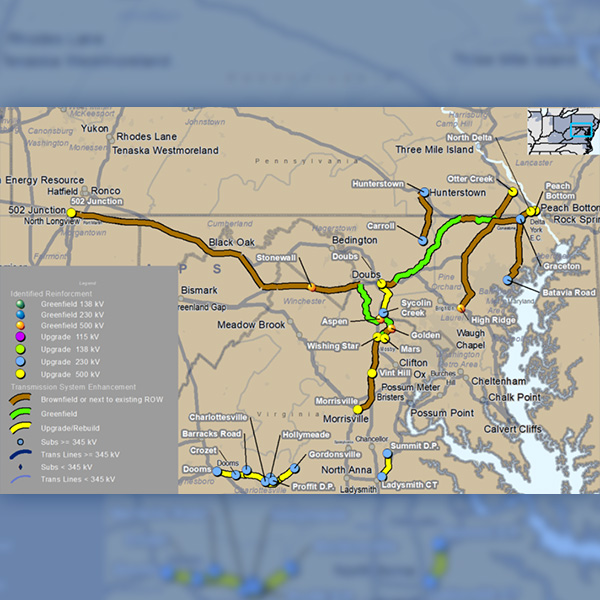

The PJM Board of Managers approved staff's recommended projects for the third window of the 2022 Regional Transmission Expansion Plan.

PJM’s MIC heard updates on capacity market proposals pending before FERC and began a review of how energy efficiency resources participate in the market.

PJM reviewed changes in preparation for the winter season and urged generators to participate in Systems Operations Subcommittee calls ahead of storms.

PJM’s preliminary load forecast for 2024 sees higher growth for both summer and winter, driven by EVs, data centers and state incentivizes for heat pumps.

The Organization of PJM States urged the PJM Board of Managers to work closer with member states to find holistic solutions to reliability challenges posed by rising load and generation retirements.

The 3rd U.S. Circuit Court of Appeals upheld FERC's 2021 approval of PJM's tightened minimum offer price rule, which removed a requirement that resources receiving state subsidies be mitigated to their cost-based offer.

Want more? Advanced Search