PJM Market Implementation Committee

PJM’s Market Implementation Committee passed by acclamation a PJM issue charge seeking to more thoroughly define how storage resources participate in the energy and ancillary service markets.

PJM, Voltus and the RTO’s Independent Market Monitor presented proposals to establish penalties for demand response and price-responsive demand resources that fail to perform during a pre-emergency load management event.

The PJM Market Implementation Committee endorsed an issue charge to evaluate whether manual revisions are warranted, among other business conducted in the committee's most recent meeting.

Among other issues, PJM presented a quick fix proposal to address instances in which offline generators are committed as secondary reserves and granted lost opportunity cost credits.

The PJM Market Implementation Committee endorsed manual revisions that define how distributed energy resources will participate in the 2028/29 capacity auction.

The PJM Market Implementation Committee endorsed a package of revisions to Manual 18.

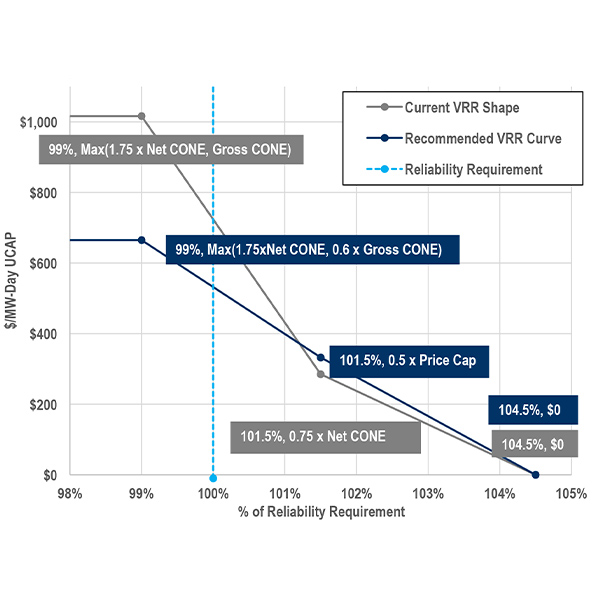

The PJM Market Implementation Committee voted to endorse two packages of revisions to key parameters of the capacity market out of six offered by PJM and stakeholders that resulted from the Quadrennial Review.

The Market Implementation Committee endorsed a proposal to allow demand response resources with behind-the-meter storage to participate in the regulation market when there is the capability for energy injections.

Key challenges in the review are tightening supply and demand, the uncertain cost of new capacity and accounting for changes PJM has made to how it identifies reliability risks and determines the capacity value for different resource types.

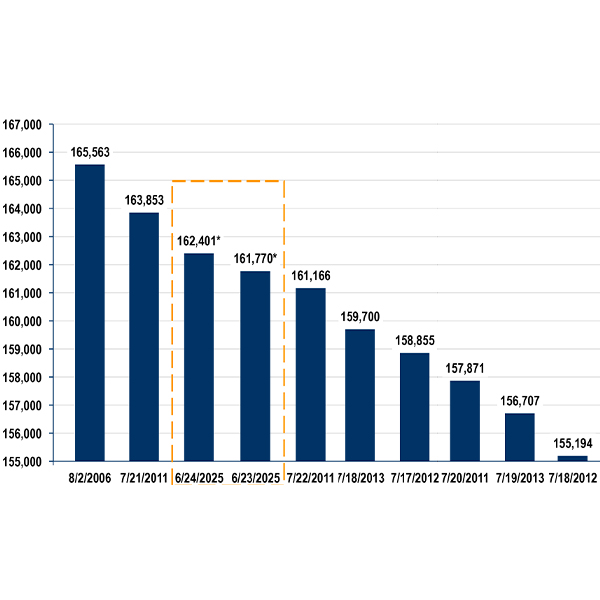

PJM saw its highest peak loads in over a decade during a heat wave that stressed the Mid-Atlantic region from June 22 to 26.

Want more? Advanced Search