PJM Market Implementation Committee

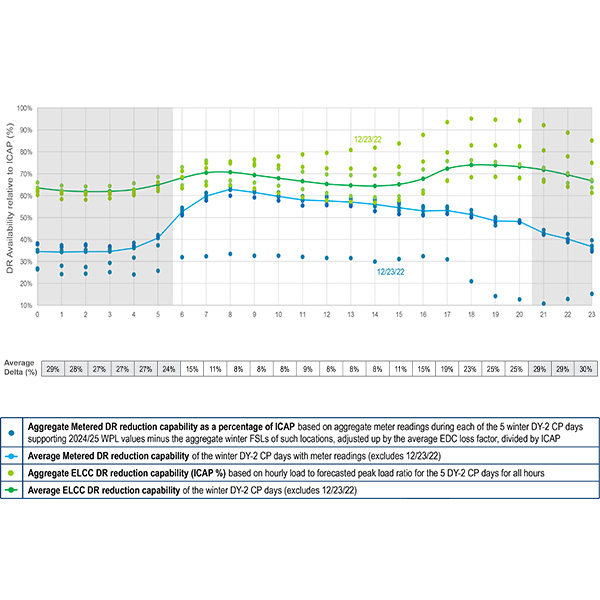

PJM has proposed changes to the demand response availability window, which determines when the curtailment capability is evaluated as accredited capacity and expected to be online for dispatch.

A PJM discussion on expanding the demand response winter availability window to include a wider range of hours branched off into a broader conversation on how the resource class participates in the RTO's capacity market.

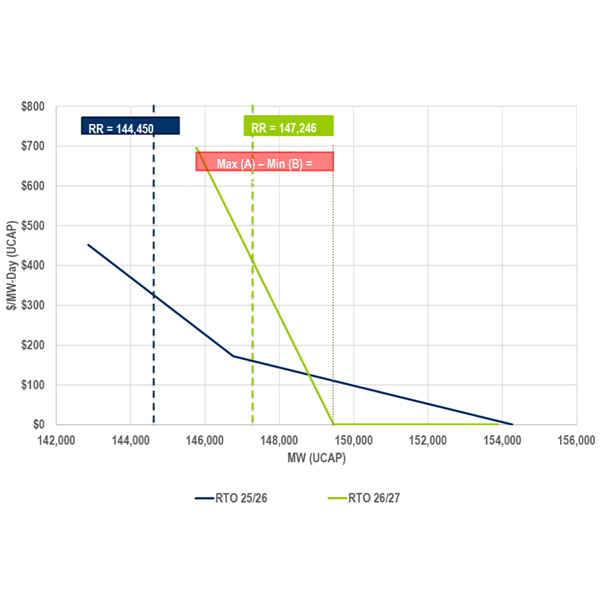

PJM presented how the planning parameters for the 2026/27 Base Residual Auction affected the variable resource rate curve, which intersects with supply and demand to determine auction clearing prices.

The PJM Markets and Reliability Committee voted to eliminate energy efficiency from the capacity construct, adopting a proposal from the Monitor.

PJM has decided not to refile several components of its proposed capacity market redesign that was rejected by FERC in February.

PJM’s Market Implementation Committee endorsed by acclamation a proposal to revise two financial inputs to the quadrennial review to reflect changing market conditions, particularly increased interest rates.

PJM’s Market Implementation Committee endorsed by acclamation a proposal to add two energy market parameters for economic demand response.

The PJM Market Implementation Committee endorsed by acclamation a rewrite of Manual 18 to implement market redesigns drafted through the critical issue fast path process.

The Market Implementation Committee voted to endorse a package to revise how capacity obligations associated with forecast large load additions are assigned to electric distribution companies.

PJM proposed changes to how it measures and verifies the capacity contribution of energy efficiency resources, drawing concerns the RTO is moving too fast to implement changes ahead of the next capacity auction.

Want more? Advanced Search