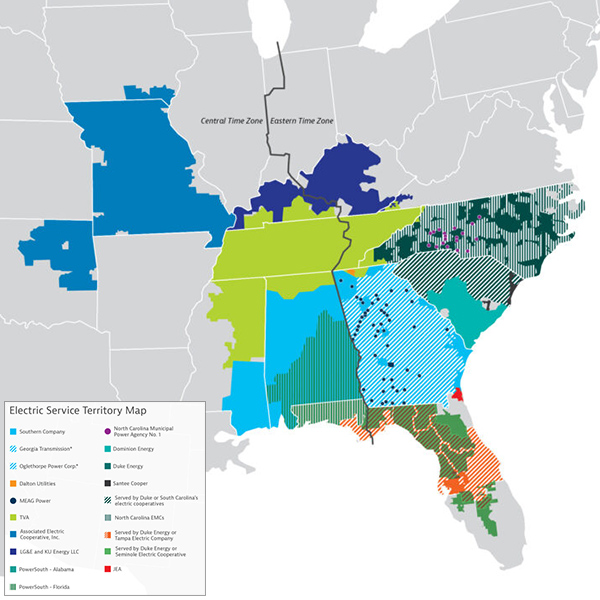

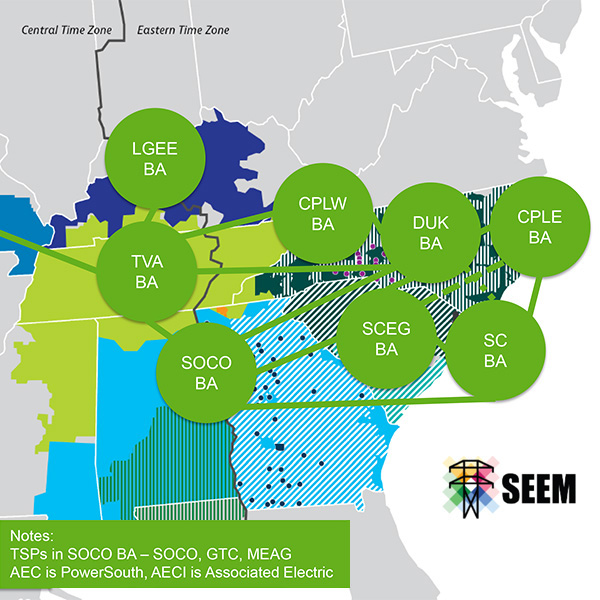

Southeast Energy Exchange Market (SEEM)

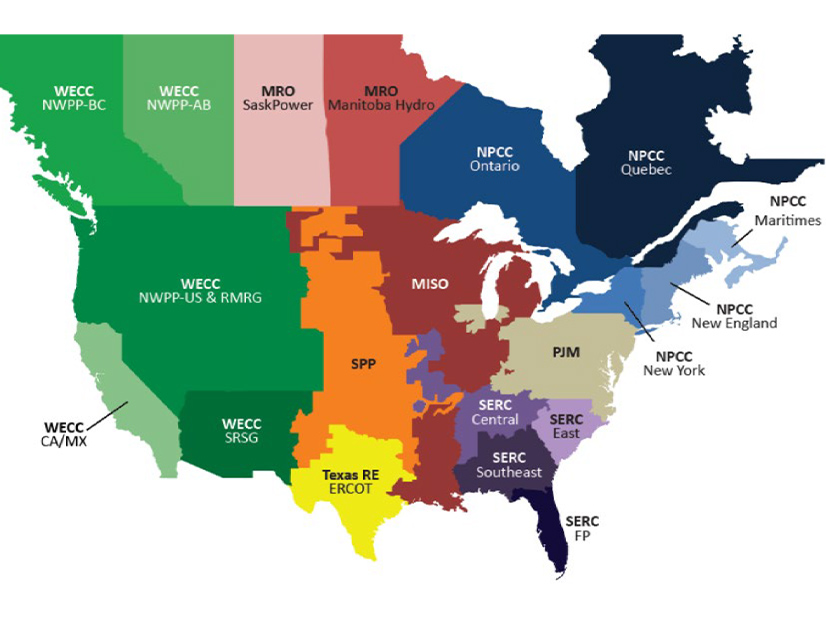

FERC requested stakeholder arguments on whether SEEM should be considered a loose power pool under Order 888.

Opponents of the Southeast Energy Exchange Market want the federal courts to examine FERC's approval of the market.

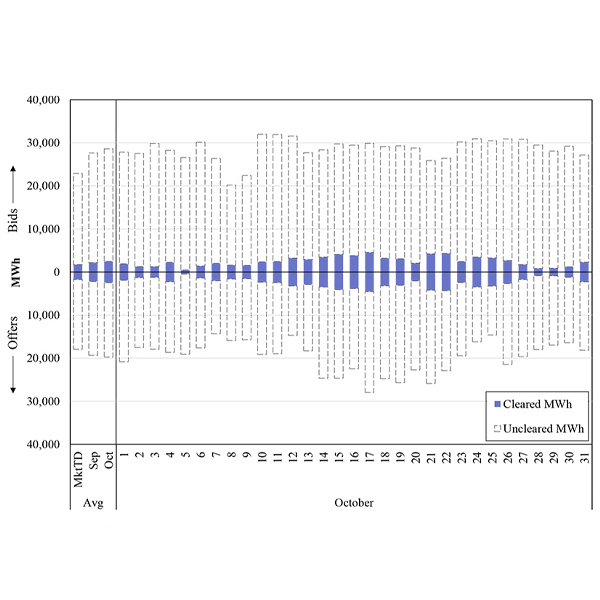

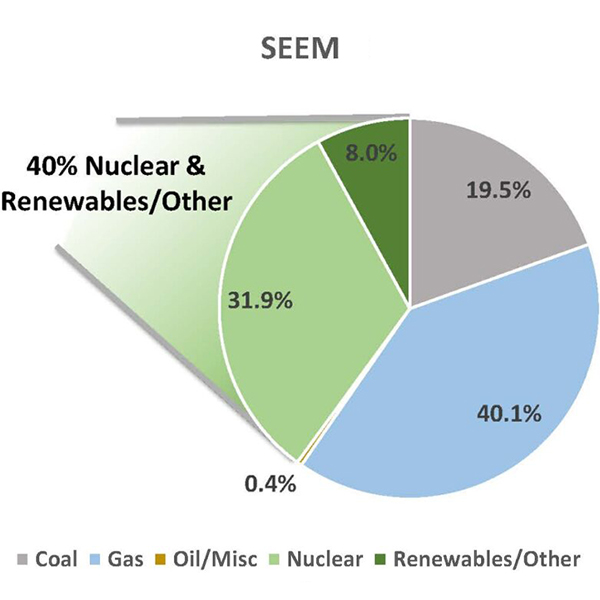

Critics of the Southeast Energy Exchange Market say after a year of operations, it has failed to meet many of the promises of its sponsors.

North Carolina regulators approved the combination of Duke Energy's "carbon plans" to implement state law requiring net zero emissions by midcentury with its standard integrated resource plans for the sake of regulatory efficiency.

The D.C. Circuit Court of Appeals remanded FERC’s approval of the Southeast Energy Exchange Market back to the commission for additional proceedings.

North Carolina businesses called for a study of wholesale market competition, including a possible RTO, citing a lack of “cost-competitive, clean energy.”

FERC must look beyond reliability standards to boost electric industry winter readiness, says R Street Institute's Michael Giberson.

Oral arguments Wednesday on the appeal of FERC’s approval by operation of law of the Southeast Energy Exchange Market focused on the issue of deadlines.

Southern Co. announced that CEO Tom Fanning is set to step down from most of his roles, and Georgia Power CEO Chris Womack has been tapped as his successor.

The Southeast Energy Exchange Market is set to begin operations on Nov. 9 despite an ongoing legal challenge from environmental groups.

Want more? Advanced Search