synchronized reserves

The PJM Operating Committee has endorsed the winter weekly reserve target values, which are used to coordinate planned outages scheduled during winter.

A Maryland school district is expanding its partnership with Highland Electric Fleets to electrify its buses to use as distributed energy resources in PJM.

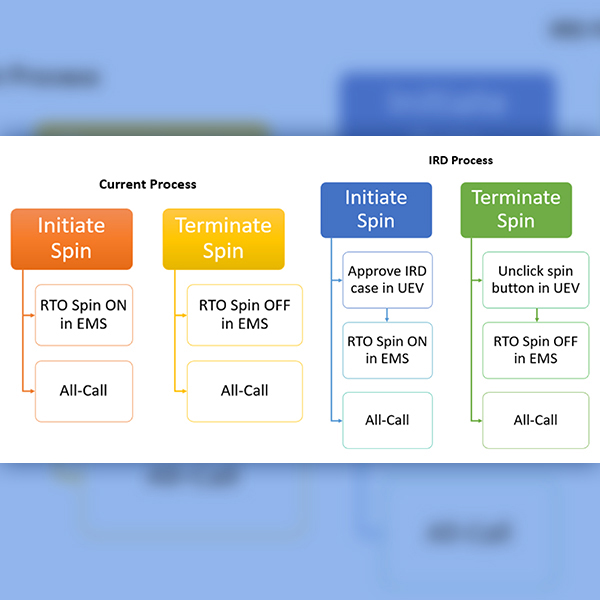

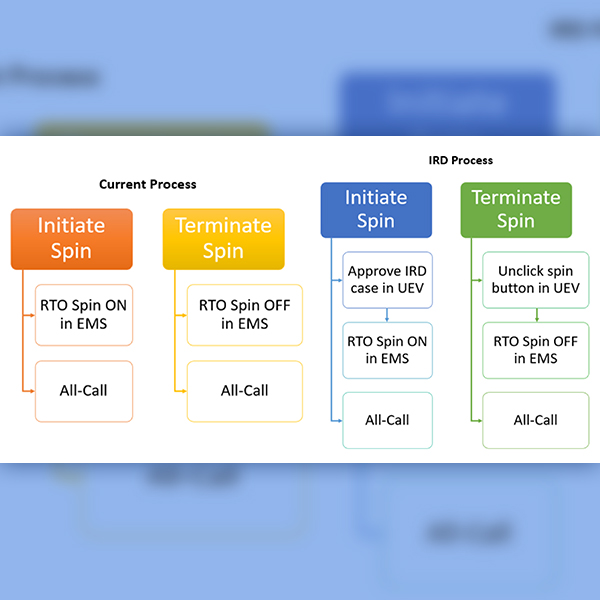

FERC rejected PJM’s plan to change its handling of synchronized reserve events, saying it would likely result in higher prices and over-procurement.

PJM MIC members last week unanimously endorsed a revised proposal from the RTO and its Independent Market Monitor to address start-up cost offer development.

Stakeholders endorsed a PJM proposal at a Markets and Reliability Committee meeting to improve the deployment of synchronized reserves during a spin event.

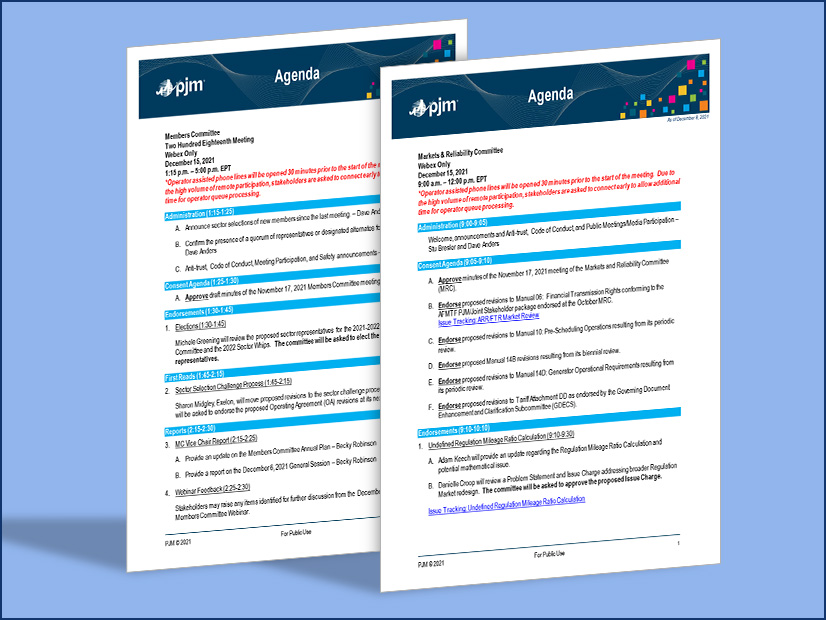

A summary of the issues scheduled to be brought to a vote at the PJM Markets and Reliability Committee and Members Committee meetings on Dec. 15, 2021.

Stakeholders at last week’s Operating Committee meeting endorsed a PJM proposal seeking to improve deployment of synchronized reserves during a spin event.

PJM stakeholders will vote next month on two different proposals seeking to improve the deployment of synchronized reserves during a spin event.

PJM stakeholders unanimously endorsed an issue charge that seeks to improve the deployment of synchronized reserves during a spin event.

PJM is looking to improve the deployment of synchronized reserves during a spin event, but some stakeholders questioned the timing of the issue.

Want more? Advanced Search