Markets

MISO will waste no time in 2025 trying to blunt the threat of a shortage that could arrive in the summer months by encouraging new generation and enacting further resource adequacy measures.

CAISO’s launch of the Extended Day-Ahead Market will not spell the end of a Western real-time-only offering from the ISO, according to CEO Elliot Mainzer.

PJM stakeholders have endorsed changes to accounting of demand response in load forecasts, among other actions.

Texas regulators shelved the market design they once favored, agreeing with staff's recommendation that the performance credit mechanism results in “minimal” additional resource adequacy value.

Two initiatives that have bedeviled discussion at NYISO committees in the last few weeks of the year reared their heads again at the final Budget Priorities Working Group meeting of the year.

During its last meeting of the year, the NYISO Management Committee approved two proposals that would institute a new design for the reserve market and alter a calculation used in the regulation service market.

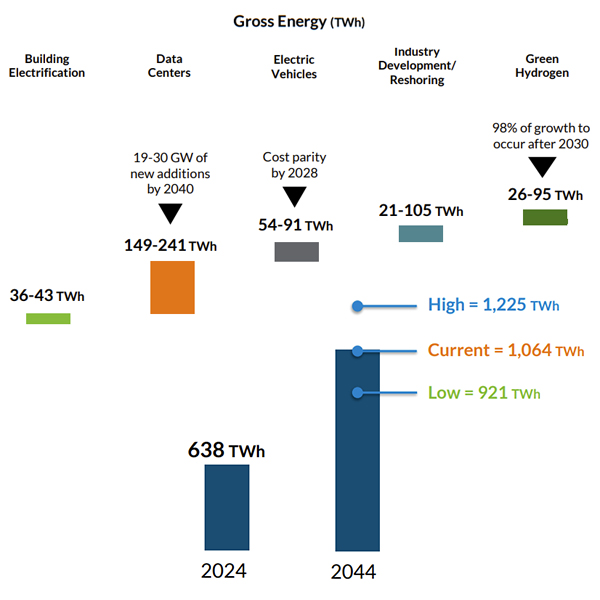

Facing proliferating load additions, MISO has begun developing in-house long-term load forecasts after years of relying on outside help to form load outlooks.

On the surface, CAISO’s Extended Day-Ahead Market and SPP’s Markets+ will take similar approaches to accounting for greenhouse gas emissions — but important differences remain.

MISO said it will finalize an availability-based accreditation for nearly 12 GW of load-modifying resources over the first quarter of 2025 ahead of a filing with FERC.

The Bonneville Power Administration continued to argue that SPP’s Markets+ is preferable to CAISO’s EDAM, stating in a letter to Seattle City Light that potential benefits of a single West-wide market footprint must be viewed with “significant skepticism."

Want more? Advanced Search