Financial Transmission Rights (FTR)

MISO’s Independent Market Monitor debuted six new market recommendations this year as part of his annual State of the Market report.

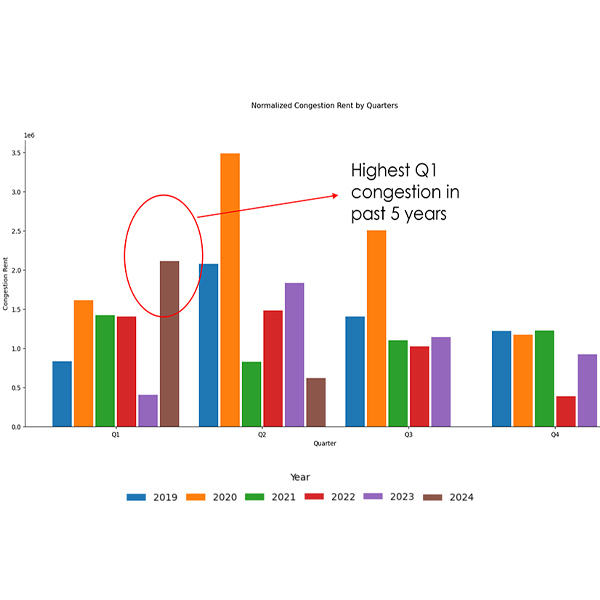

Congestion revenue rights auctions averaged $62 million in losses between 2019 and 2023, down nearly $50 million since changes were implemented in 2019 but “still very high,” said CAISO’s Department of Market Monitoring.

Average load-weighted electricity prices in PJM fell by around half in 2023, the Independent Market Monitor said in its annual State of the Market Report.

Columnist Steve Huntoon says a recent Moody’s report uses misleading data to make its case for investing in transmission to solve reliability problems.

FERC remained dissatisfied with PJM’s and SPP’s FTR credit policies, while ending inquiries into those of CAISO, ISO-NE and NYISO.

The United States Court of Appeals for the District of Columbia Circuit sided with FERC, upholding its decision to suspend PJM's transmission penalty factor when it was driving up prices in Virginia.

The D.C. Circuit upheld FERC’s decision to OK PJM’s FTR forfeiture rule without ordering refunds under previous rules implemented without commission approval.

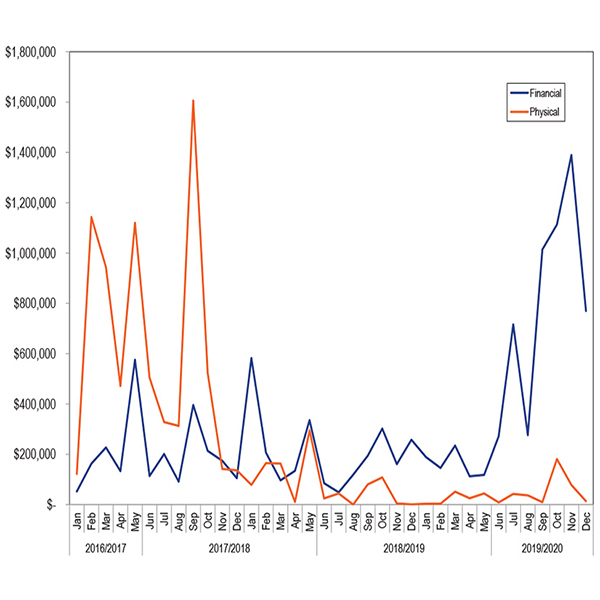

MISO’s Independent Market Monitor reported that the RTO’s financial transmission rights market came up short by more than $60 million this spring.

FERC granted PJM’s request to terminate the membership of Hill Energy Resource & Services following the company’s failure to pay invoices on time in 2022.

The PJM Markets and Reliability Committee endorsed an RTO proposal to increase the maximum number of bids a single corporate entity can enter into FTR auctions.

Want more? Advanced Search