data centers

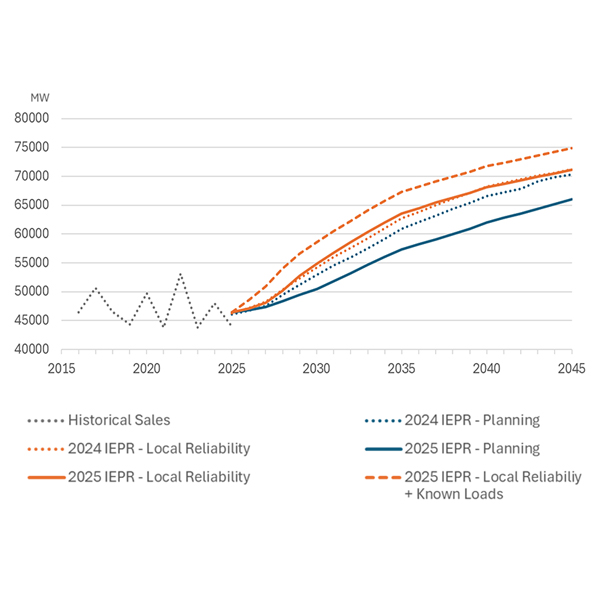

Xcel Energy says that a partnership with NextEra Energy will allow its operating companies to contract up to 6 GW of data center capacity by the end of 2027.

EPRI, InfraPartners, NVIDIA and Prologis will assess ways data centers in the 5- to 20-MW range can be built quickly at or near utility substations that have available capacity.

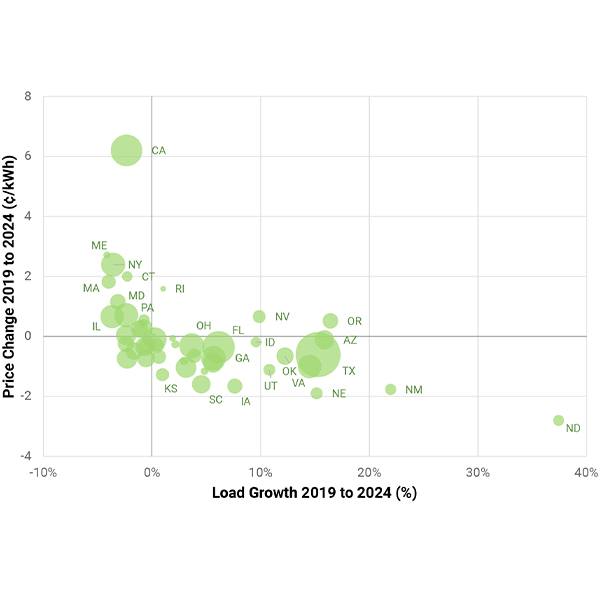

Energy efficiency and load flexibility would be effective and cost far less than the new generation assets many jurisdictions are planning to build to meet anticipated load growth, a new report asserts.

Misguided NIMBYism or corporate welfare either obstructs the building of new data centers or compels taxpayers to subsidize them, writes energy consultant Kenneth W. Costello.

All five FERC commissioners faced questions from the House Energy and Commerce Subcommittee on Energy on how to balance reliability and affordability as demand grows.

If the incremental costs of serving the new loads are below the current average costs, new demand can actually lower average retail rates as the system costs are spread across a wider base, the report concludes.

The Oregon Public Utility Commission questioned Portland General Electric’s proposals concerning grid infrastructure cost allocation for data centers, voicing concern that the utility risked prioritizing data centers over other customers.

NextEra Energy Resources brought 7.2 GW of new generation and storage into operation and added 13.5 GW to its backlog in 2025.

The Electricity Customers Alliance released a paper offering some potential ideas FERC could take up to ensure affordability in a era of major load growth.

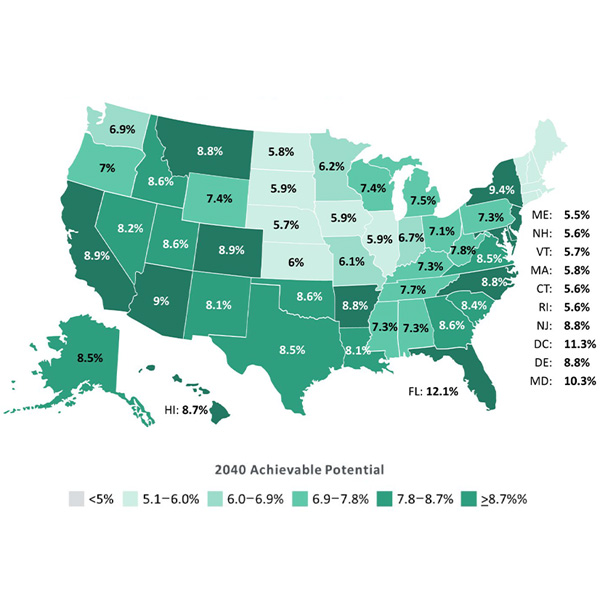

The California Energy Commission signed off on a forecast showing the state's electricity consumption could surge by as much as 61% over the next 20 years, mostly from increased EV adoption.

Want more? Advanced Search