fixed resource requirement (FRR)

FERC granted a complaint from Dominion Energy to allow planned capacity resources to shift their participation from the Fixed Resource Requirement alternative to the Reliability Pricing Model capacity market.

Dominion expects to start installing monopiles for the Coastal Virginia Offshore Wind project between May 6 and 8, CEO Robert Blue told analysts during the company’s first-quarter earnings call.

FERC has rejected a PJM proposal to rework the role of performance penalties in its capacity market and how the associated risks can be reflected in seller offers.

FERC granted American Electric Power waivers to alter the capacity obligation calculation for four of its vertically integrated utilities in PJM to not include load growth outside their territories.

FERC approved PJM's proposal to rework several areas of its capacity market centered around aligning how resources’ capacity contributions match up to system risk analysis.

PJM completed its delivery of a sprawling presentation outlining its envisioned overhaul of the capacity market, followed by stakeholder presentations from Calpine, Daymark Energy Advisors and the East Kentucky Power Cooperative.

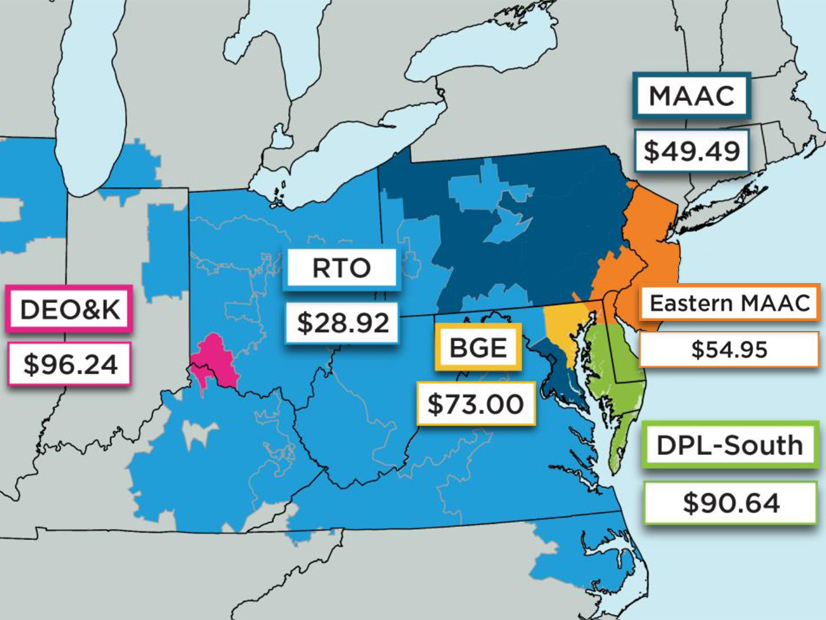

PJM capacity prices dropped in much of the RTO for delivery year 2024/25, but ratepayers in five regions will face increases due to locational constraints.

PJM’s Board of Managers is opening an accelerated stakeholder process to address rising reliability concerns about the RTO’s capacity market.

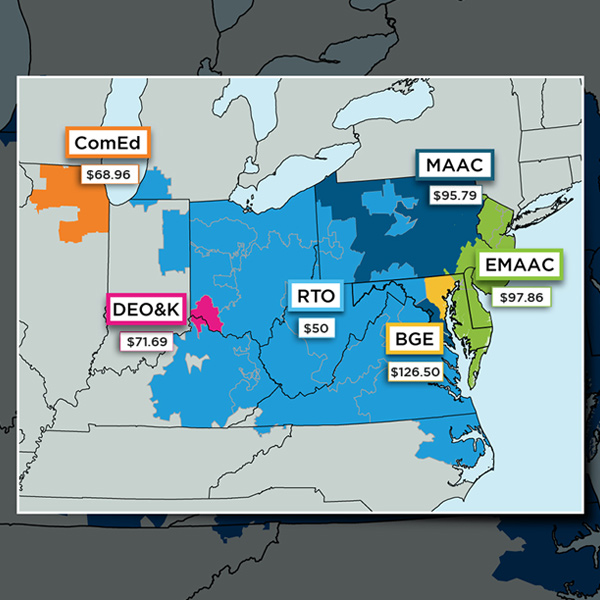

The results of PJM’s 2022/23 Base Residual Auction were not competitive, according to a report released last week by the RTO’s Independent Market Monitor.

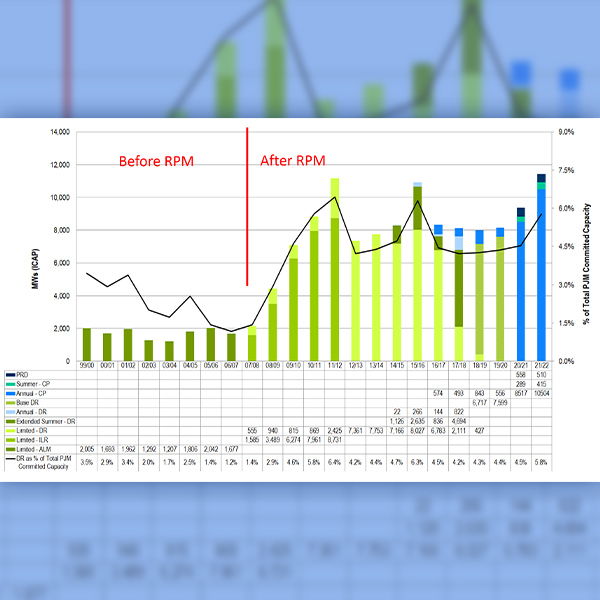

The PJM MRC approved an updated issue charge for the Resource Adequacy Senior Task Force after debating its out-of-scope items, including demand response.

Want more? Advanced Search